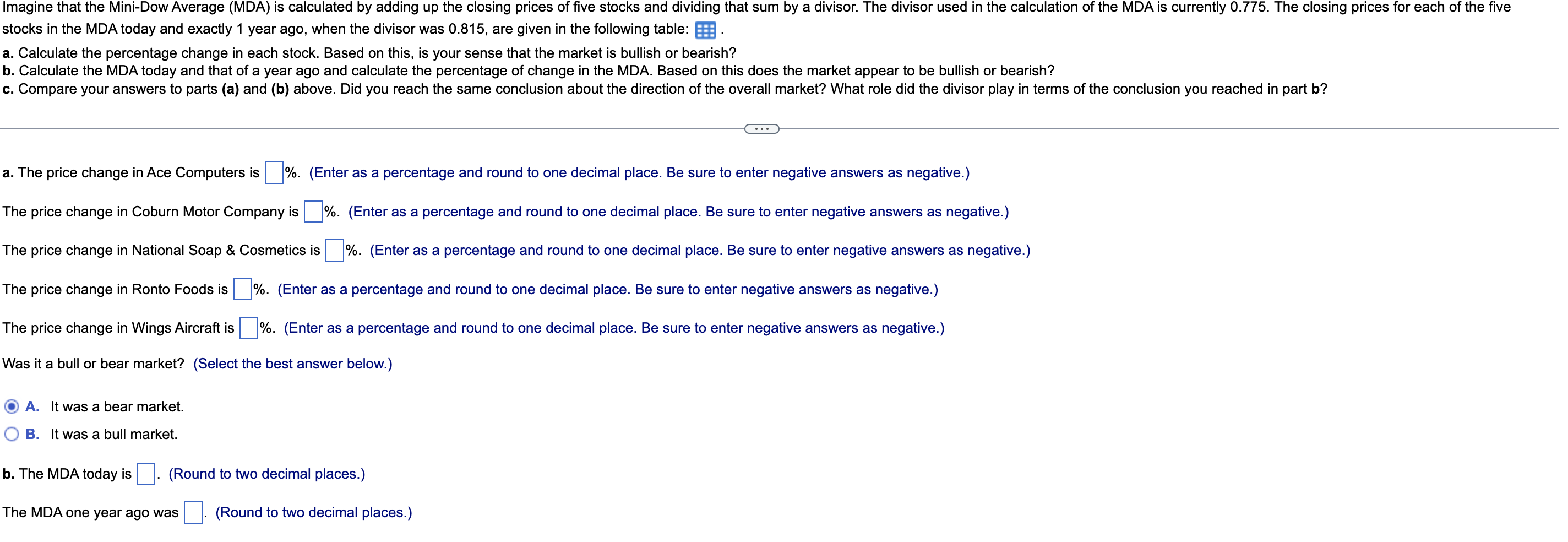

Imagine that the Mini-Dow Average (MDA) is calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The divisor used in the calculation of the MDA is currently 0.775. The closing prices for each of the five stocks in the MDA today and exactly 1 year ago, when the divisor was 0.815, are given in the following table:. a. Calculate the percentage change in each stock. Based on this, is your sense that the market is bullish or bearish? b. Calculate the MDA today and that of a year ago and calculate the percentage of change in the MDA. Based on this does the market appear to be bullish or bearish? c. Compare your answers to parts (a) and (b) above. Did you reach the same conclusion about the direction of the overall market? What role did the divisor play in terms of the conclusion you reached in part b? a. The price change in Ace Computers is%. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in Coburn Motor Company is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in National Soap & Cosmetics is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in Ronto Foods is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in Wings Aircraft is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) Was it a bull or bear market? (Select the best answer below.) A. It was a bear market. B. It was a bull market. (Round to two decimal places.) b. The MDA today is The MDA one year ago was (Round to two decimal places.) Was it a bull or bear market? (Select the best answer below.) OA. It was a bear market. OB. It was a bull market. C. Compare your answers to parts (a) and (b) above. Did you reach the same conclusion about the direction of the overall market? What role did the divisor play in terms of the conclusion you reached in part b? (Select the best answer below.) OA. The conclusions agree. The reason is that the divisor fell to a greater extent than the stock prices did, so the index level increased on net. The divisor could fall for a number of reasons, for example if one or more companies conducted a stock split or a spinoff. OB. The conclusions do not agree. The reason is that the divisor fell to a lesser extent than the stock prices did, so the index level decreased on net. The divisor could fall for a number of reasons, for example if one or more companies conducted a stock split or a spinoff. OC. The conclusions do not agree. The reason is that the divisor rose to a greater extent than the stock prices did, so the index level increased on net. The divisor could rise for a number of reasons, for example if one or more companies conducted a stock split or a spinoff. O D. The conclusions do not agree. The reason is that the divisor fell to a greater extent than the stock prices did, so the index level increased on net. The divisor could fall for a number of reasons, for example if one or more companies conducted a stock split or a spinoff. Imagine that the Mini-Dow Average (MDA) is calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The divisor used in the calculation of the MDA is currently 0.775. The closing prices for each of the five stocks in the MDA today and exactly 1 year ago, when the divisor was 0.815, are given in the following table:. a. Calculate the percentage change in each stock. Based on this, is your sense that the market is bullish or bearish? b. Calculate the MDA today and that of a year ago and calculate the percentage of change in the MDA. Based on this does the market appear to be bullish or bearish? c. Compare your answers to parts (a) and (b) above. Did you reach the same conclusion about the direction of the overall market? What role did the divisor play in terms of the conclusion you reached in part b? a. The price change in Ace Computers is%. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in Coburn Motor Company is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in National Soap & Cosmetics is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in Ronto Foods is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) The price change in Wings Aircraft is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) Was it a bull or bear market? (Select the best answer below.) A. It was a bear market. B. It was a bull market. (Round to two decimal places.) b. The MDA today is The MDA one year ago was (Round to two decimal places.) Was it a bull or bear market? (Select the best answer below.) OA. It was a bear market. OB. It was a bull market. C. Compare your answers to parts (a) and (b) above. Did you reach the same conclusion about the direction of the overall market? What role did the divisor play in terms of the conclusion you reached in part b? (Select the best answer below.) OA. The conclusions agree. The reason is that the divisor fell to a greater extent than the stock prices did, so the index level increased on net. The divisor could fall for a number of reasons, for example if one or more companies conducted a stock split or a spinoff. OB. The conclusions do not agree. The reason is that the divisor fell to a lesser extent than the stock prices did, so the index level decreased on net. The divisor could fall for a number of reasons, for example if one or more companies conducted a stock split or a spinoff. OC. The conclusions do not agree. The reason is that the divisor rose to a greater extent than the stock prices did, so the index level increased on net. The divisor could rise for a number of reasons, for example if one or more companies conducted a stock split or a spinoff. O D. The conclusions do not agree. The reason is that the divisor fell to a greater extent than the stock prices did, so the index level increased on net. The divisor could fall for a number of reasons, for example if one or more companies conducted a stock split or a spinoff