Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine that you are purchasing a house for $150,000. You have saved some money and would like to obtain an 80% loan to value

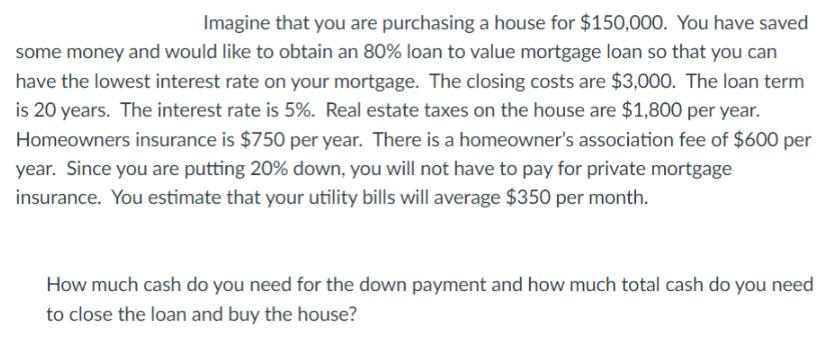

Imagine that you are purchasing a house for $150,000. You have saved some money and would like to obtain an 80% loan to value mortgage loan so that you can have the lowest interest rate on your mortgage. The closing costs are $3,000. The loan term is 20 years. The interest rate is 5%. Real estate taxes on the house are $1,800 per year. Homeowners insurance is $750 per year. There is a homeowner's association fee of $600 per year. Since you are putting 20% down, you will not have to pay for private mortgage insurance. You estimate that your utility bills will average $350 per month. How much cash do you need for the down payment and how much total cash do you need to close the loan and buy the house?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the down payment and the total cash needed to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started