Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your mother invested $66,900 in a taxable account 32 years ago. Your mother's marginal tax rate on interest income is 51.7%. Her marginal tax

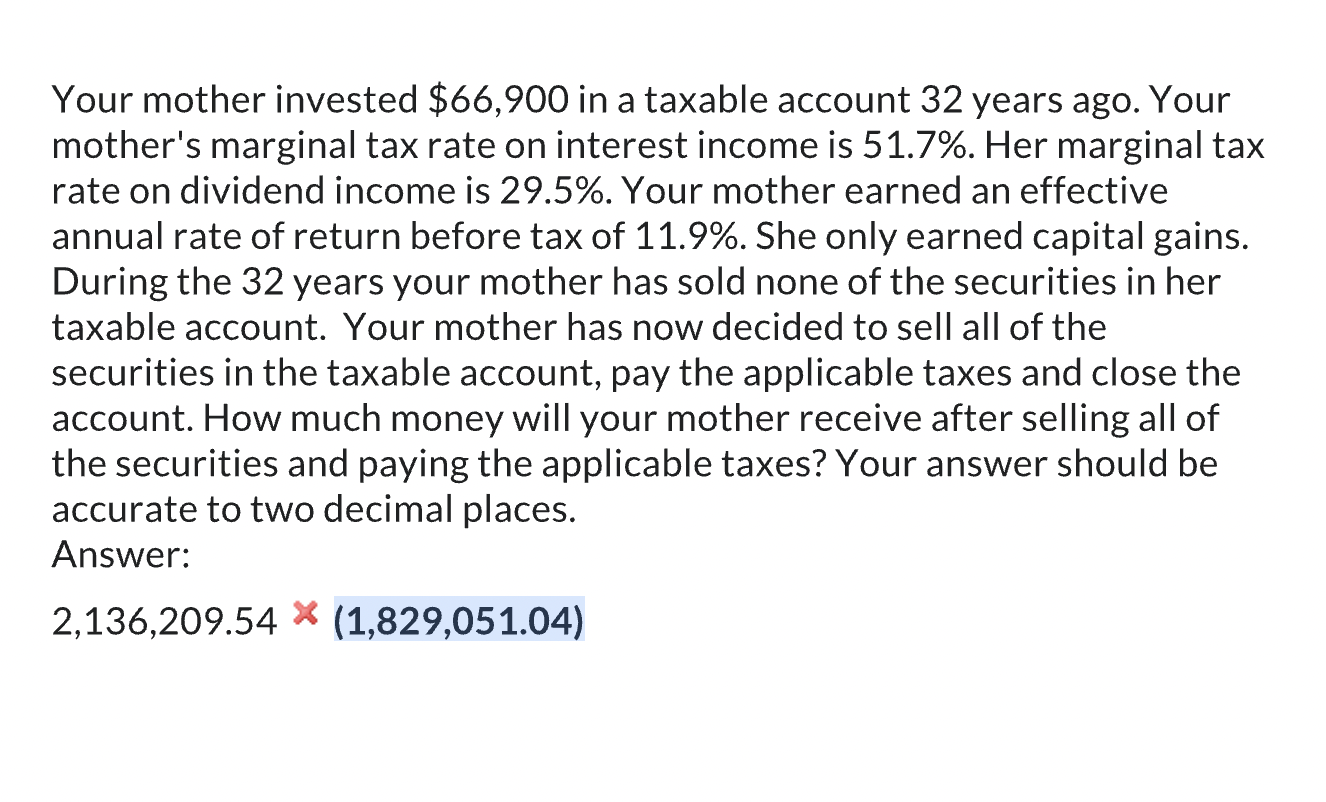

Your mother invested $66,900 in a taxable account 32 years ago. Your mother's marginal tax rate on interest income is 51.7%. Her marginal tax rate on dividend income is 29.5%. Your mother earned an effective annual rate of return before tax of 11.9%. She only earned capital gains. During the 32 years your mother has sold none of the securities in her taxable account. Your mother has now decided to sell all of the securities in the taxable account, pay the applicable taxes and close the account. How much money will your mother receive after selling all of the securities and paying the applicable taxes? Your answer should be accurate to two decimal places. Answer: 2,136,209.54 (1,829,051.04)

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the total value of the investment after 32 years the capi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started