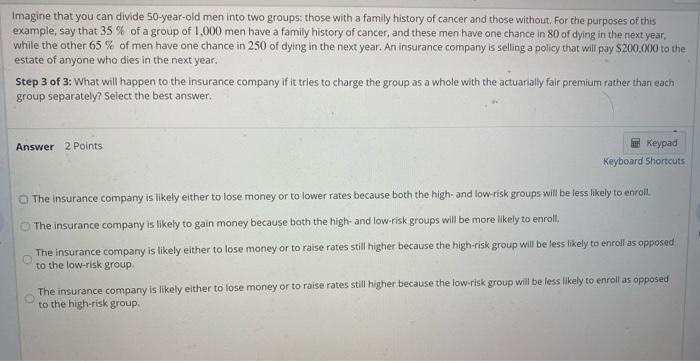

Imagine that you can divide 50-year-old men into two groups: those with a family history of cancer and those without. For the purposes of this example, say that 35% of a group of 1.000 men have a family history of cancer, and these men have one chance in 80 of dying in the next year, while the other 65 % of men have one chance in 250 of dying in the next year. An insurance company is selling a policy that will pay $200,000 to the estate of anyone who dies in the next year, Step 1 of 3: If the insurance company was selling life insurance separately to each group, what would be the actuarially fair premium for each group? if necessary, do not round any intermediate calculations, and round your final answer to the nearest whole number. Answer 2 Points Keypad Keyboard Shortcuts For the high-risk group: av For the low-risk group: Question 10 - of 14 Step 2 of 3 00:36:53 Imagine that you can divide 50-year-old men into two groups: those with a family history of cancer and those without. For the purposes of this example, say that 35% of a group of 1,000 men have a family history of cancer, and these men have one chance in 80 of dying in the next year, while the other 65 % of men have one chance in 250 of dying in the next year. An insurance company is selling a policy that will pay $200,000 to the estate of anyone who dies in the next year. Step 2 of 3: If the insurance company was offering life insurance to the entire group but could not find out family medical history, what would be the actuarially fair premium for the group as a whole? Enter your answer in the box below, and round to the nearest whole number if necessary. Do not round any intermediate calculations. Answer 2 Points Keypad Keyboard Shortcuts Imagine that you can divide 50-year-old men into two groups: those with a family history of cancer and those without. For the purposes of this example, say that 35% of a group of 1,000 men have a family history of cancer, and these men have one chance in 80 of dying in the next year, while the other 65 % of men have one chance in 250 of dying in the next year. An insurance company is selling a policy that will pay $200,000 to the estate of anyone who dies in the next year. Step 3 of 3: What will happen to the insurance company if it tries to charge the group as a whole with the actuarially fair premium rather than each group separately? Select the best answer. Answer 2 Points Keypad Keyboard Shortcuts The insurance company is likely either to lose money or to lower rates because both the high- and low-risk groups will be less likely to enroll. The insurance company is likely to gain money because both the high- and low-risk groups will be more likely to enroll. The insurance company is likely either to lose money or to raise rates still higher because the high-risk group will be less likely to enroll as opposed to the low-risk group The insurance company is likely either to lose money or to raise rates still higher because the low.risk group will be less likely to enroll as opposed to the high-risk group