Answered step by step

Verified Expert Solution

Question

1 Approved Answer

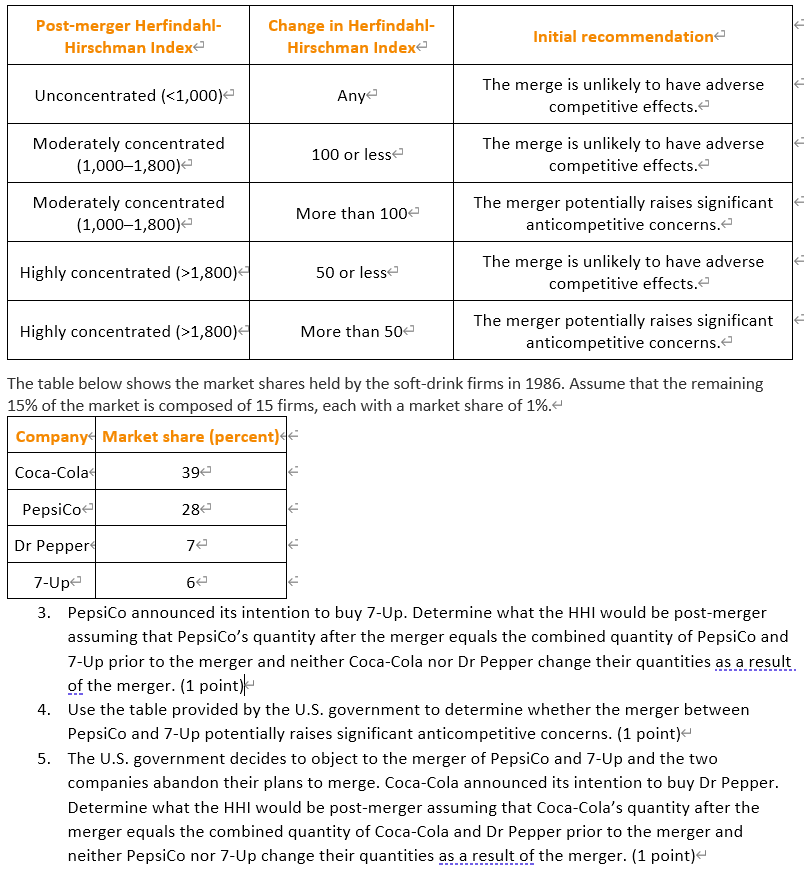

Imagine the U.S. government has hired you to conduct an initial analysis of proposed mergers. The U.S. government has provided you with the following table

Imagine the U.S. government has hired you to conduct an initial analysis of proposed mergers. The U.S. government has provided you with the following table to use for conducting an initial analysis. When calculating the post-merger HHI, assume that the quantity of the merged firm equals the sum of the quantities of the merging firms prior to the merger and no other firm changes its quantity as a result of the merger.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started