Imagine to be working on the fixed income desk of a hedge fund or investment bank. You have two monitors in front of you:

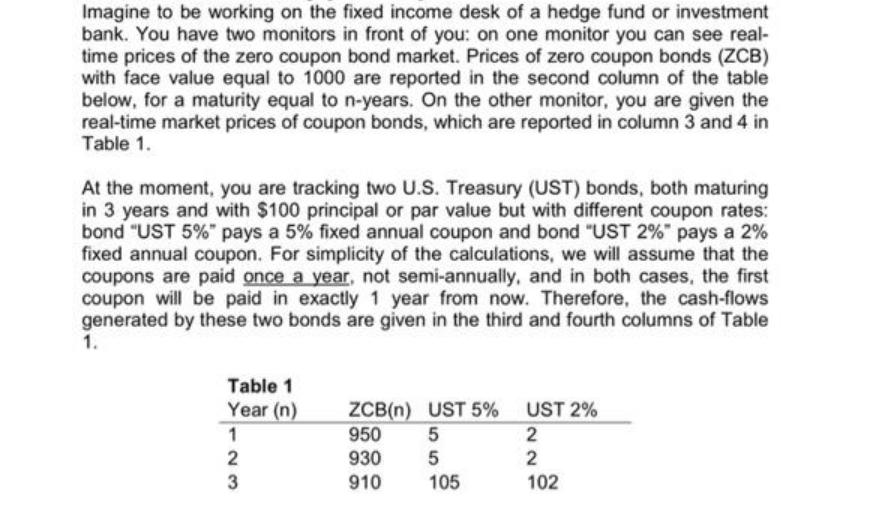

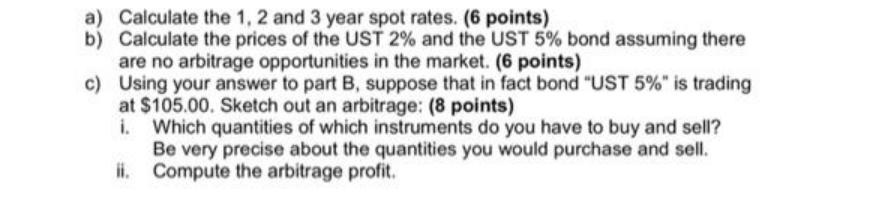

Imagine to be working on the fixed income desk of a hedge fund or investment bank. You have two monitors in front of you: on one monitor you can see real- time prices of the zero coupon bond market. Prices of zero coupon bonds (ZCB) with face value equal to 1000 are reported in the second column of the table below, for a maturity equal to n-years. On the other monitor, you are given the real-time market prices of coupon bonds, which are reported in column 3 and 4 in Table 1. At the moment, you are tracking two U.S. Treasury (UST) bonds, both maturing in 3 years and with $100 principal or par value but with different coupon rates: bond "UST 5%" pays a 5% fixed annual coupon and bond "UST 2%" pays a 2% fixed annual coupon. For simplicity of the calculations, we will assume that the coupons are paid once a year, not semi-annually, and in both cases, the first coupon will be paid in exactly 1 year from now. Therefore, the cash-flows generated by these two bonds are given in the third and fourth columns of Table 1. Table 1 Year (n) 1 2 23 3 ZCB(n) UST 5% UST 2% 950 5 2 930 5 2 910 105 102 a) Calculate the 1, 2 and 3 year spot rates. (6 points) b) Calculate the prices of the UST 2% and the UST 5% bond assuming there are no arbitrage opportunities in the market. (6 points) c) Using your answer to part B, suppose that in fact bond "UST 5%" is trading at $105.00. Sketch out an arbitrage: (8 points) i. Which quantities of which instruments do you have to buy and sell? Be very precise about the quantities you would purchase and sell. Compute the arbitrage profit. ii.

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each part of the question step by step To begin with a Calculate the 1 2 and 3 year spot rates The spot rate for a zerocoupon bond is simply the yield to maturity of the bond We can calcu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started