Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine we are in the business of manufacturing pizza. Whenever a pizza oven wears out, we have to replace it with a new one

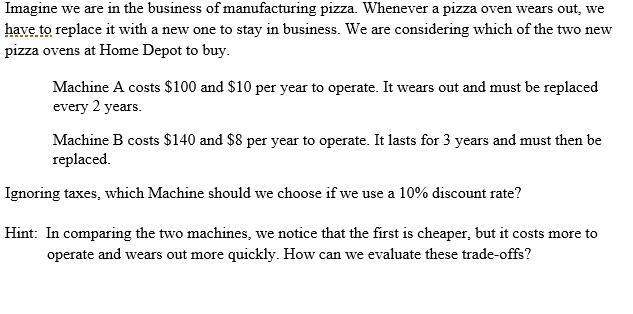

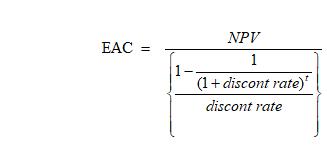

Imagine we are in the business of manufacturing pizza. Whenever a pizza oven wears out, we have to replace it with a new one to stay in business. We are considering which of the two new pizza ovens at Home Depot to buy. Machine A costs $100 and $10 per year to operate. It wears out and must be replaced every 2 years. Machine B costs $140 and $8 per year to operate. It lasts for 3 years and must then be replaced. Ignoring taxes, which Machine should we choose if we use a 10% discount rate? Hint: In comparing the two machines, we notice that the first is cheaper, but it costs more to operate and wears out more quickly. How can we evaluate these trade-offs? EAC 1 NPV 1 (1 + discont rate) discont rate

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The best option to choose between the two pizza ovens is Machine B as it has a lower upfront cost an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started