Question

Imagine you are a portfolio manager who believes that value stocks would gain more than the S&P 500 Index, but you are concerned that both

Imagine you are a portfolio manager who believes that value stocks would gain more than the S&P 500 Index, but you are concerned that both value stocks and the S&P 500 Index would lose during the next few weeks, such that you’ll lose money even if value stocks lose less than the S&P 500 Index.

Imagine that today’s date is June 22nd. Vanguard Value Index fund shares are available at $39.57 per share.

S&P 500 Index Mini futures expiring in September are available at 3,091, multiplied by $50, so the value of the contract is $154,550

Create a strategy combining one S&P 500 Index Mini futures contract with Vanguard Value Index fund shares that would benefit you if your belief is ultimately correct.

Time has passed, and the date is August 10th. The S&P 500 Index Mini futures are now available at 3,184 and Vanguard Value Index fund shares are available at $41.55 per share.

Questions:

- Explain the rationale for your strategy.

- Did your strategy do what it was expected to do?

- How much money did your strategy make or lose?

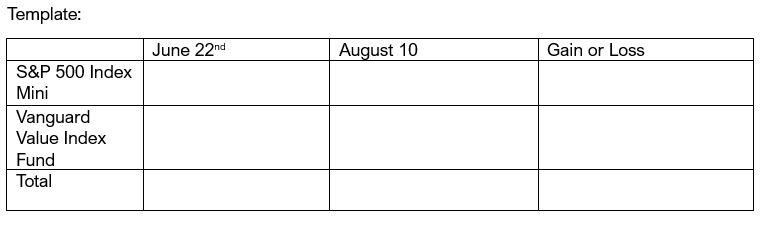

Template: S&P 500 Index Mini Vanguard Value Index Fund Total June 22nd August 10 Gain or Loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The rationale for the strategy combining one SP 500 Index Mini futures contract with Vanguard Value Index fund shares is as follows 1 Belief in Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started