Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you are responsible for designing swaps at an investment bank. You find that L'Oreal SA can borrow over a 3 year period (in

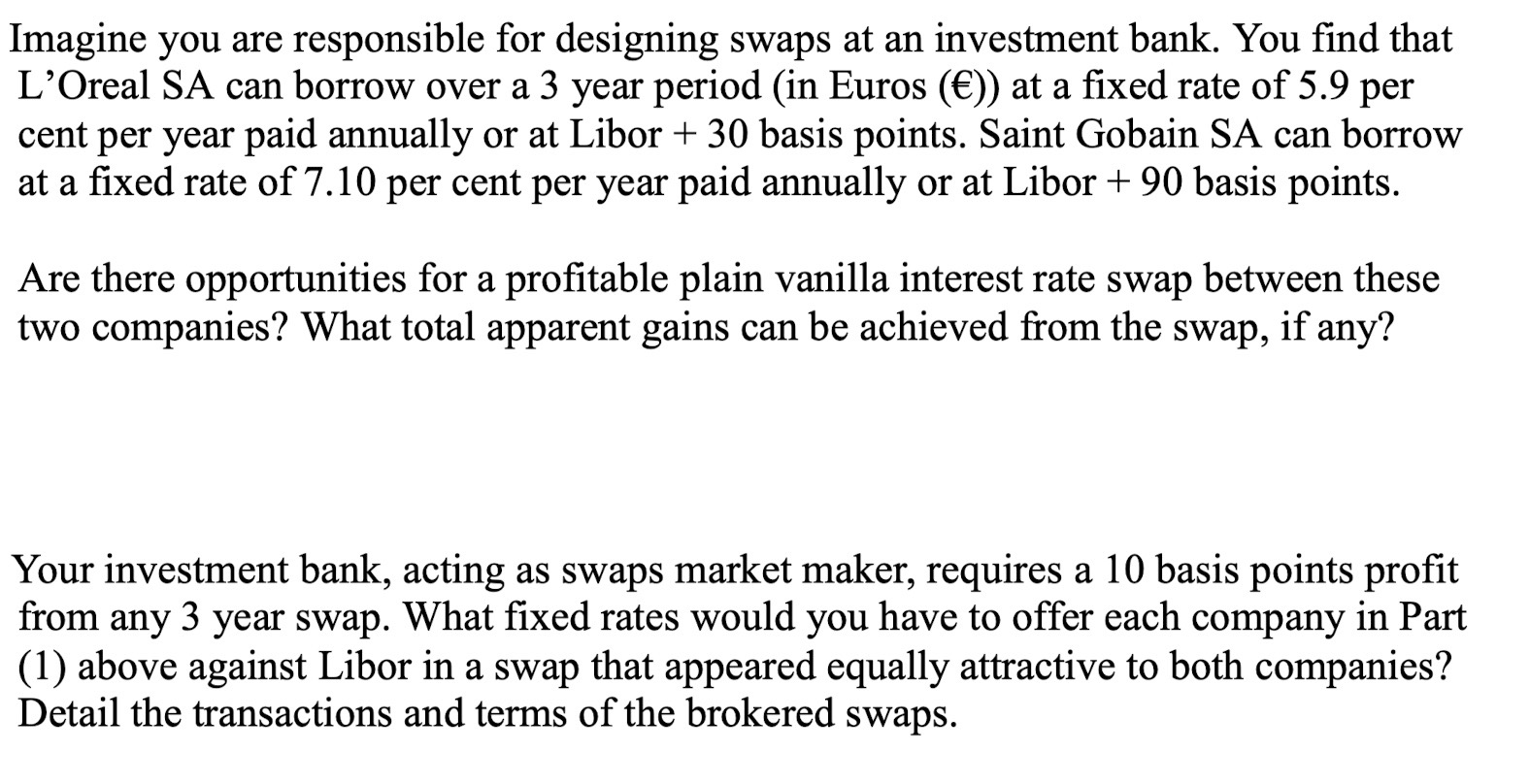

Imagine you are responsible for designing swaps at an investment bank. You find that L'Oreal SA can borrow over a 3 year period (in Euros ()) at a fixed rate of 5.9 per cent per year paid annually or at Libor + 30 basis points. Saint Gobain SA can borrow at a fixed rate of 7.10 per cent per year paid annually or at Libor + 90 basis points. Are there opportunities for a profitable plain vanilla interest rate swap between these two companies? What total apparent gains can be achieved from the swap, if any? Your investment bank, acting as swaps market maker, requires a 10 basis points profit from any 3 year swap. What fixed rates would you have to offer each company in Part (1) above against Libor in a swap that appeared equally attractive to both companies? Detail the transactions and terms of the brokered swaps.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Potential for Profitable Swaps and Brokered Transactions 1 Analyzing Swap Opportunities LOreal SA Borrowing cost at fixed rate59 annually Borrowing co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started