Question

Imagine you are the manager of a business. After calculating the payback period of two different potential investment opportunities, you find the payback periods

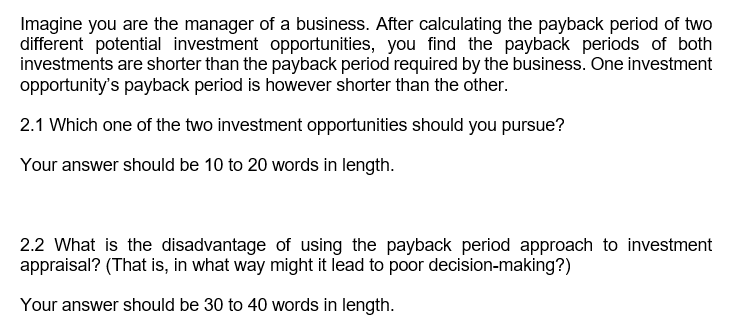

Imagine you are the manager of a business. After calculating the payback period of two different potential investment opportunities, you find the payback periods of both investments are shorter than the payback period required by the business. One investment opportunity's payback period is however shorter than the other. 2.1 Which one of the two investment opportunities should you pursue? Your answer should be 10 to 20 words in length. 2.2 What is the disadvantage of using the payback period approach to investment appraisal? (That is, in what way might it lead to poor decision-making?) Your answer should be 30 to 40 words in length.

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

21 Investment opportunities with the shortest payback should be considered Reason ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Core Concepts of Accounting

Authors: Cecily A. Raiborn

2nd edition

470499478, 978-0470499474

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App