Answered step by step

Verified Expert Solution

Question

1 Approved Answer

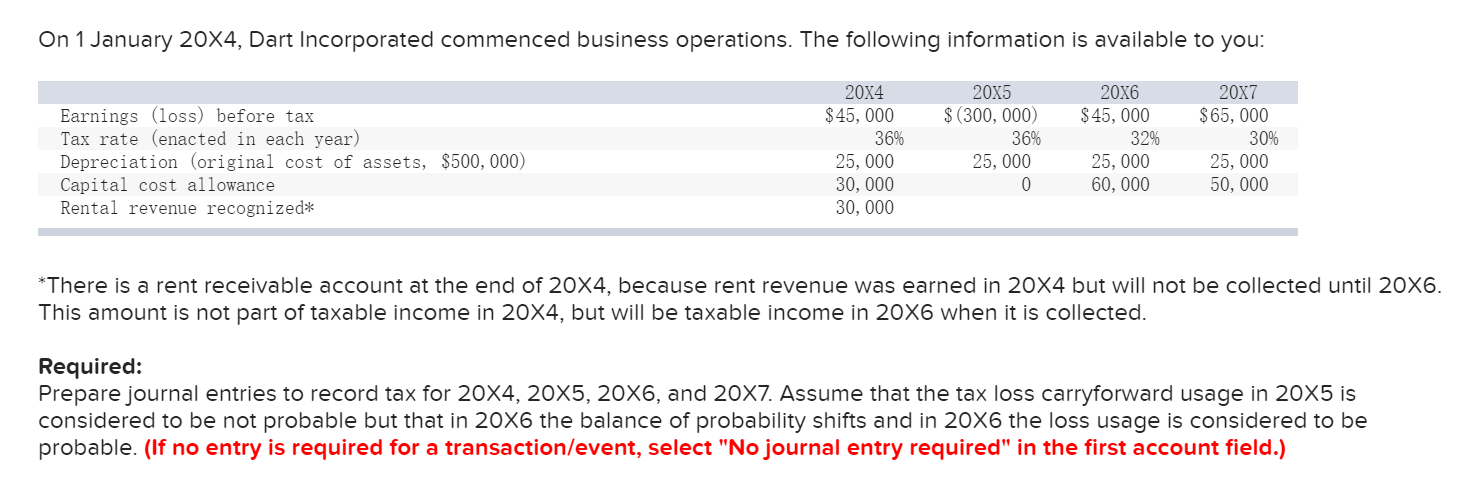

On 1 January 20X4, Dart Incorporated commenced business operations. The following information is available to you: 20X6 $45, 000 20X4 20X5 20X7 $ (300,

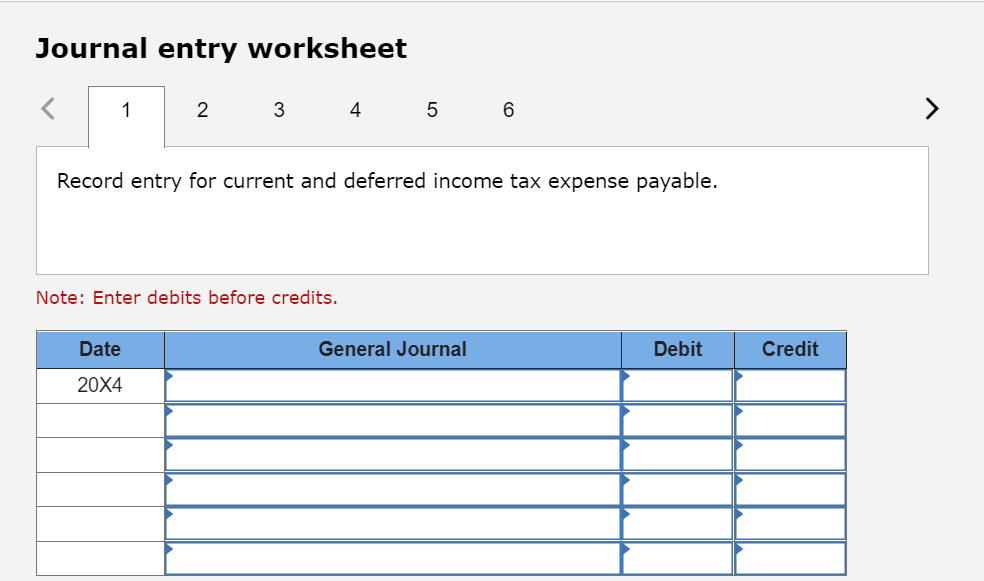

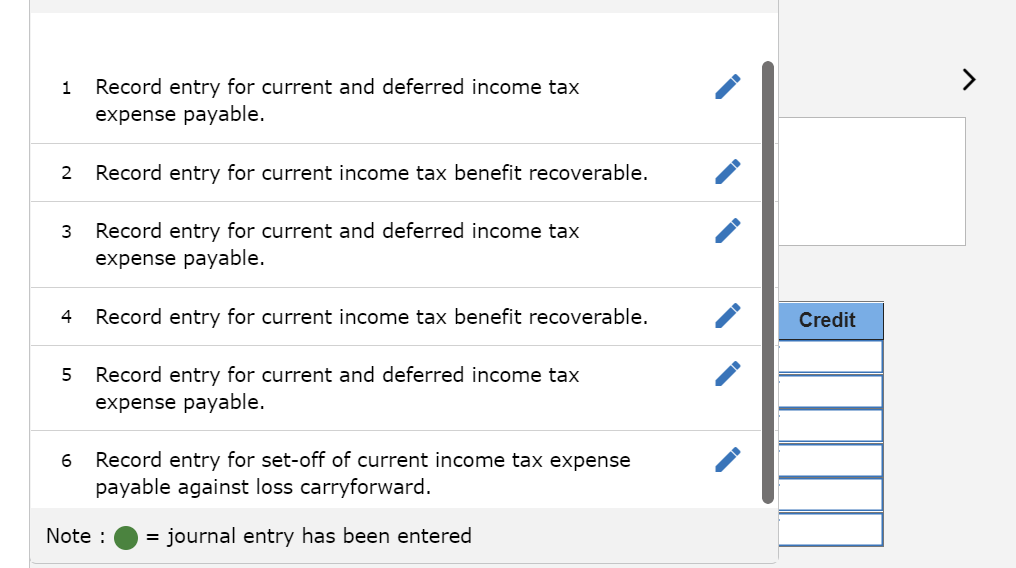

On 1 January 20X4, Dart Incorporated commenced business operations. The following information is available to you: 20X6 $45, 000 20X4 20X5 20X7 $ (300, 000) Earnings (loss) before tax Tax rate (enacted in each year) Depreciation (original cost of assets, $500, 000) Capital cost allowance Rental revenue recognized* $45, 000 $65, 000 36% 36% 32% 30% 25, 000 30, 000 30, 000 25, 000 60, 000 25, 000 25, 000 50, 000 *There is a rent receivable account at the end of 20X4, because rent revenue was earned in 20X4 but will not be collected until 20X6. This amount is not part of taxable income in 20X4, but will be taxable income in 20X6 when it is collected. Required: Prepare journal entries to record tax for 20X4, 20X5, 20X6, and 20X7. Assume that the tax loss carryforward usage in 20X5 is considered to be not probable but that in 20X6 the balance of probability shifts and in 20X6 the loss usage is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 2 4 5 > Record entry for current and deferred income tax expense payable. Note: Enter debits before credits. Date General Journal Debit Credit 20X4 1 Record entry for current and deferred income tax expense payable. 2 Record entry for current income tax benefit recoverable. 3 Record entry for current and deferred income tax expense payable. 4 Record entry for current income tax benefit recoverable. Credit 5 Record entry for current and deferred income tax expense payable. 6 Record entry for set-off of current income tax expense payable against loss carryforward. Note : = journal entry has been entered

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

20X4 1 Debit Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started