Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you are the new CFO for a furniture manufacturer named American Furniture Company (AFC) that has only been in business for a few

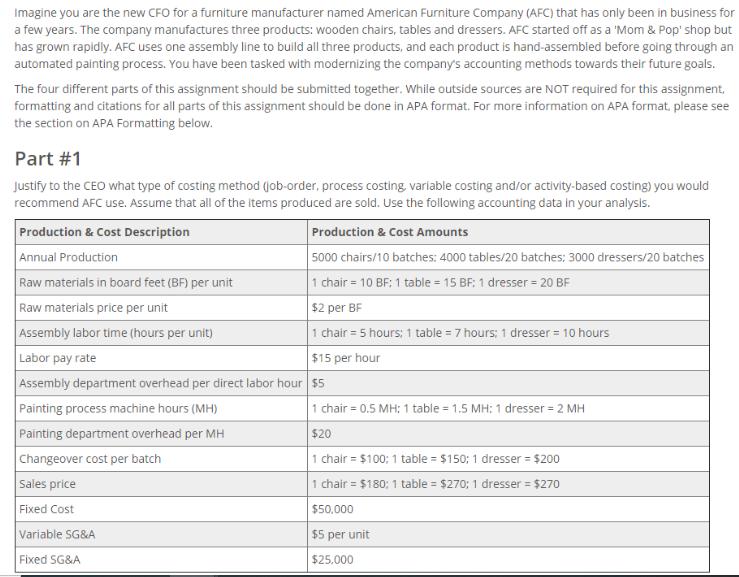

Imagine you are the new CFO for a furniture manufacturer named American Furniture Company (AFC) that has only been in business for a few years. The company manufactures three products: wooden chairs, tables and dressers. AFC started off as a 'Mom & Pop' shop but has grown rapidly. AFC uses one assembly line to build all three products, and each product is hand-assembled before going through an automated painting process. You have been tasked with modernizing the company's accounting methods towards their future goals. The four different parts of this assignment should be submitted together. While outside sources are NOT required for this assignment, formatting and citations for all parts of this assignment should be done in APA format. For more information on APA format, please see the section on APA Formatting below. Part #1 Justify to the CEO what type of costing method (job-order, process costing, variable costing and/or activity-based costing) you would recommend AFC use. Assume that all of the items produced are sold. Use the following accounting data in your analysis. Production & Cost Description Annual Production Raw materials in board feet (BF) per unit Raw materials price per unit Assembly labor time (hours per unit) Labor pay rate Production & Cost Amounts 5000 chairs/10 batches: 4000 tables/20 batches: 3000 dressers/20 batches 1 chair 10 BF: 1 table = 15 BF: 1 dresser = 20 BF $2 per BF 1 chair = 5 hours: 1 table = 7 hours; 1 dresser = 10 hours $15 per hour Assembly department overhead per direct labor hour $5 Painting process machine hours (MH) Painting department overhead per MH Changeover cost per batch Sales price Fixed Cost Variable SG&A Fixed SG&A 1 chair = 0.5 MH: 1 table = 1.5 MH: 1 dresser = 2 MH $20 1 chair $100; 1 table = $150; 1 dresser = $200 1 chair $180; 1 table = $270; 1 dresser = $270 $50,000 $5 per unit $25,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started