Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you are working as a graduate tax accountant at the local tax firm in Perth, Western Australia. You are assisting the senior tax practitioner,

Imagine you are working as a graduate tax accountant at the local tax firm in Perth, Western Australia. You are assisting the senior tax practitioner, Abigail, with a business client's GST compliance.

Twenty Questions & Co is a business registered for GST located in regional New South Wales. The business has records for the quarter ending 31 March 2022 as follows:

| Cash Receipts | $ |

| Gross proceeds from sale of stock to Australian clientele | 220,000 |

| Gross proceeds from sale of manufacturing equipment | 66,000 |

| Income tax refund from the 2020/2021 income year | 15,000 |

| Gross proceeds from sale of gift vouchers | 1,100 |

| Export sales | 33,000 |

| Interest income from term deposit | 220 |

| Cash Payments | $ |

| Purchase of printer | 3,300 |

| Payment of private health insurance premiums for employees | 8,800 |

| Purchase of stock from manufacturer (GST registered) relating to sales to Australian clientele | 110,000 |

| Parking fines arising in respect to one of its employees business-related travel (specifically denied by s26-5 of ITAA97) | 660 |

| Rent on commercial premises | 11,000 |

Additional information:

- Where applicable, figures are GST inclusive.

- Valid tax invoices are held for all relevant payments.

- All payments relate to the carrying on of the business.

- The business accounts for GST on a cash basis and lodges quarterly business activity statements.

- Unless stated, sales are connected with Australia.

- Gift vouchers are sold with a stated monetary value and entitlement to the holder to buy goods up to the stated monetary value.

- Export sales relate to sales to Japanese clientele and were exported within 60 days of receiving consideration.

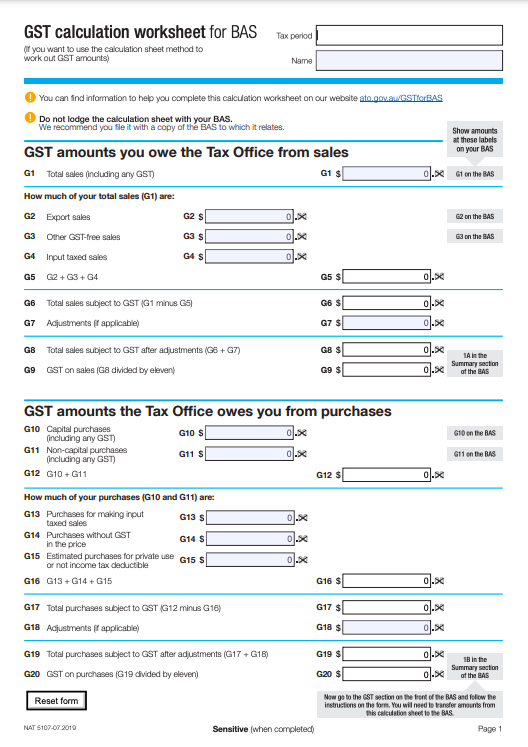

Complete the GST calculation worksheet for BAS available below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started