Question

Imagine you are working as a graduate tax accountant at the local tax firm in Perth, Western Australia. You are assisting the senior tax practitioner,

Imagine you are working as a graduate tax accountant at the local tax firm in Perth, Western Australia. You are assisting the senior tax practitioner, Abigail, with a business client's GST compliance.

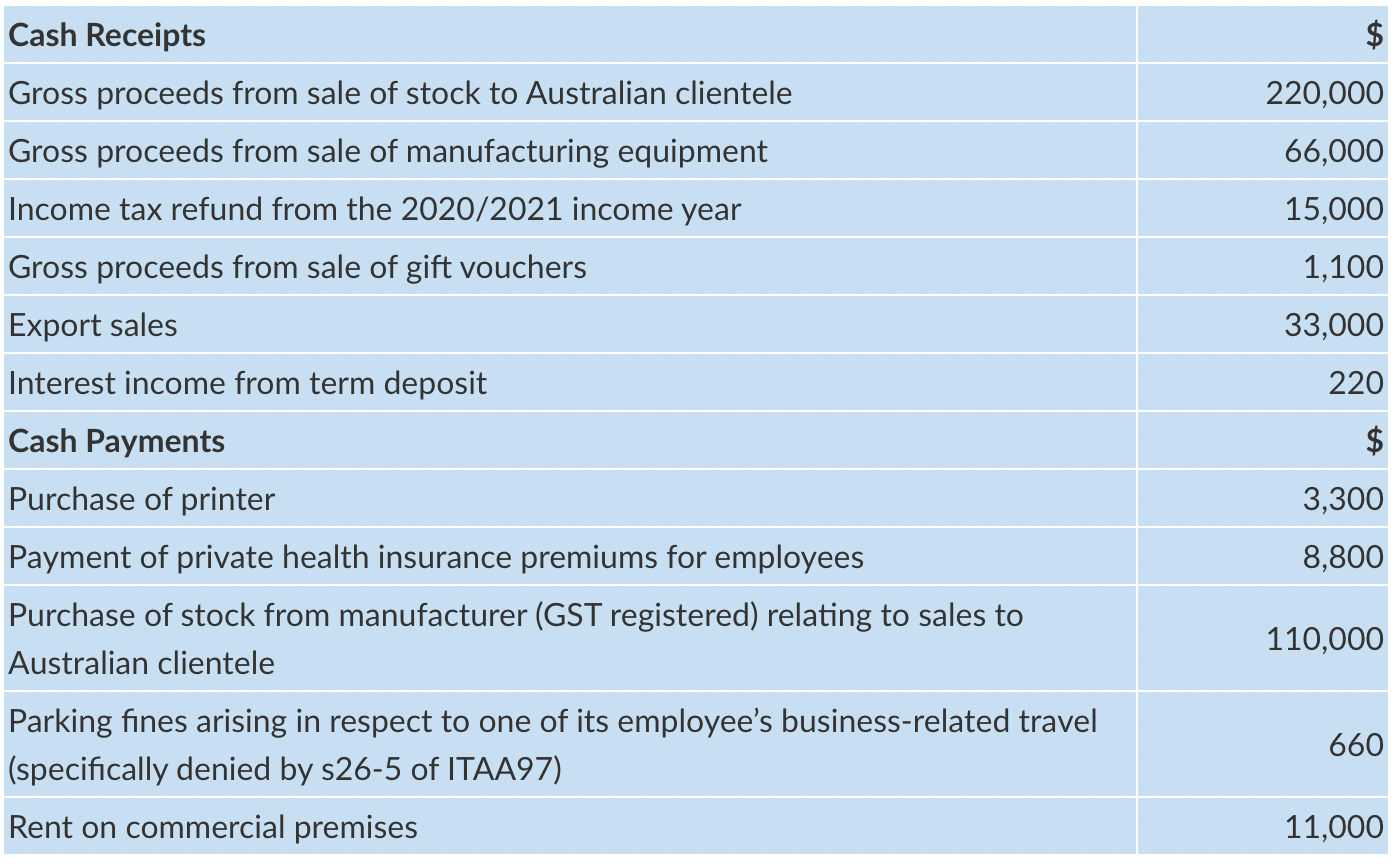

Twenty Questions & Co is a business registered for GST located in regional New South Wales. The business has records for the quarter ending 31 March 2022 as follows:\

Additional information:

- Where applicable, figures are GST inclusive.

- Valid tax invoices are held for all relevant payments.

- All payments relate to the carrying on of the business.

- The business accounts for GST on a cash basis and lodges quarterly business activity statements.

- Unless stated, sales are connected with Australia.

- Gift vouchers are sold with a stated monetary value and entitlement to the holder to buy goods up to the stated monetary value.

- Export sales relate to sales to Japanese clientele and were exported within 60 days of receiving consideration.

REQUIRED:

Calculate the net GST payable (refundable) to the ATO for the period ending 31 March 2022 by answering the following questions

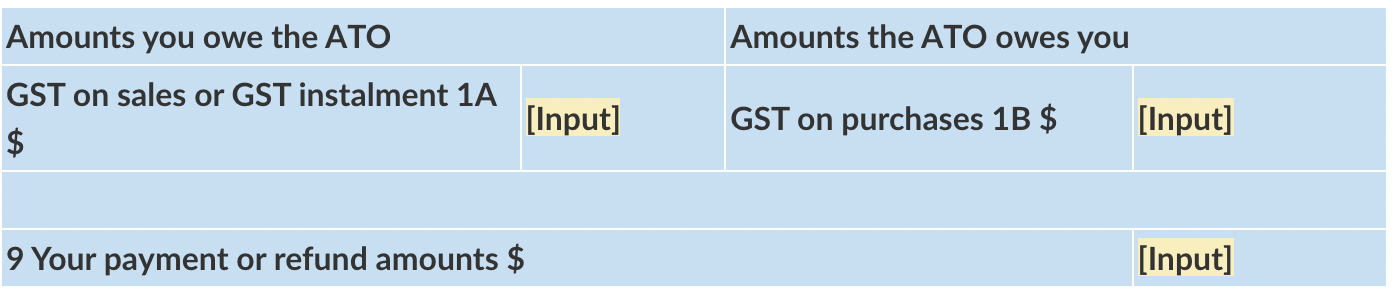

Question: Determine the net GST payable (refundable) to the ATO by completing the following summary taken from the business activity statement (2 marks):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started