Answered step by step

Verified Expert Solution

Question

1 Approved Answer

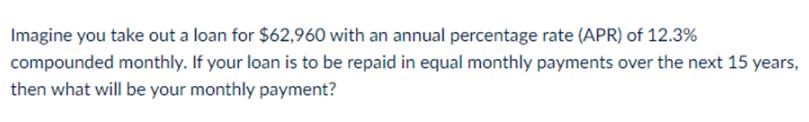

Imagine you take out a loan for $62,960 with an annual percentage rate (APR) of 12.3% compounded monthly. If your loan is to be

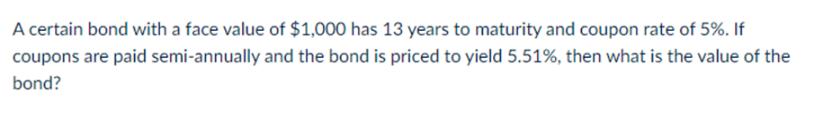

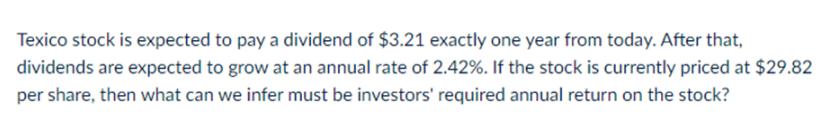

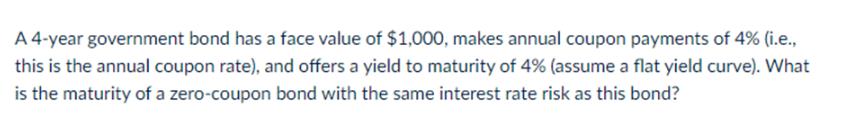

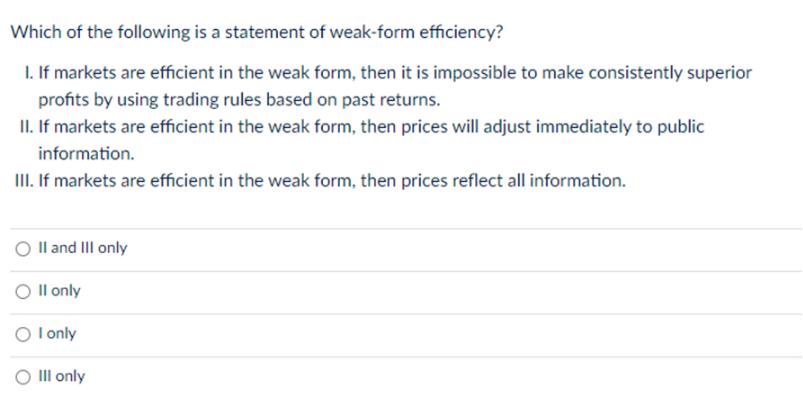

Imagine you take out a loan for $62,960 with an annual percentage rate (APR) of 12.3% compounded monthly. If your loan is to be repaid in equal monthly payments over the next 15 years, then what will be your monthly payment? A certain bond with a face value of $1,000 has 13 years to maturity and coupon rate of 5%. If coupons are paid semi-annually and the bond is priced to yield 5.51%, then what is the value of the bond? Texico stock is expected to pay a dividend of $3.21 exactly one year from today. After that, dividends are expected to grow at an annual rate of 2.42%. If the stock is currently priced at $29.82 per share, then what can we infer must be investors' required annual return on the stock? A 4-year government bond has a face value of $1,000, makes annual coupon payments of 4% (i.e., this is the annual coupon rate), and offers a yield to maturity of 4% (assume a flat yield curve). What is the maturity of a zero-coupon bond with the same interest rate risk as this bond? Which of the following is a statement of weak-form efficiency? 1. If markets are efficient in the weak form, then it is impossible to make consistently superior profits by using trading rules based on past returns. II. If markets are efficient in the weak form, then prices will adjust immediately to public information. III. If markets are efficient in the weak form, then prices reflect all information. O II and III only Oll only O I only O Ill only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Imagine you take out a loan for 62960 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started