Answered step by step

Verified Expert Solution

Question

1 Approved Answer

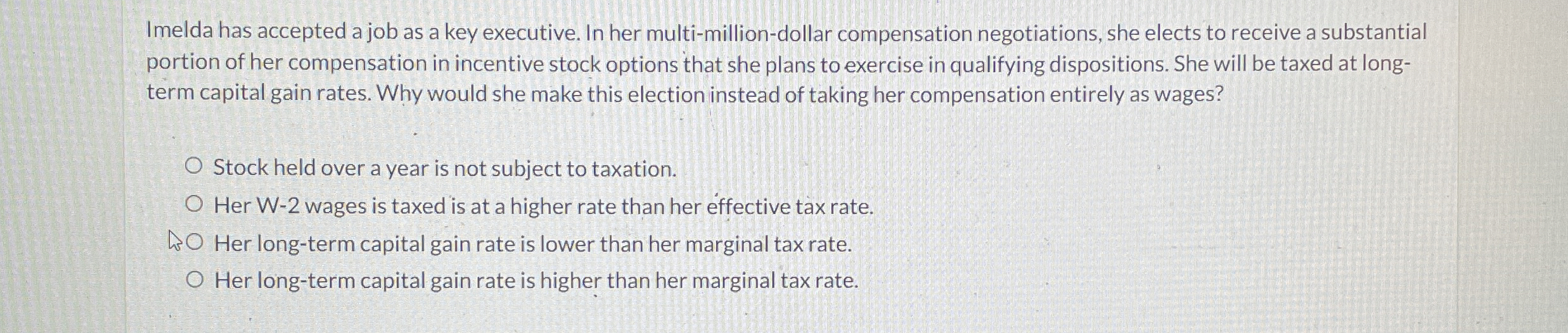

Imelda has accepted a job as a key executive. In her multi - million - dollar compensation negotiations, she elects to receive a substantial portion

Imelda has accepted a job as a key executive. In her multimilliondollar compensation negotiations, she elects to receive a substantial

portion of her compensation in incentive stock options that she plans to exercise in qualifying dispositions. She will be taxed at long

term capital gain rates. Why would she make this election instead of taking her compensation entirely as wages?

Stock held over a year is not subject to taxation.

Her W wages is taxed is at a higher rate than her effective tax rate.

Her longterm capital gain rate is lower than her marginal tax rate.

Her longterm capital gain rate is higher than her marginal tax rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started