Answered step by step

Verified Expert Solution

Question

1 Approved Answer

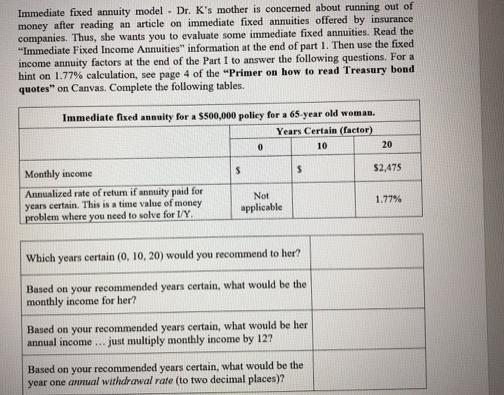

Immediate fixed annuity model Dr. K's mother is concerned about running out of money after reading an article on immediate fixed annuities offered by

Immediate fixed annuity model Dr. K's mother is concerned about running out of money after reading an article on immediate fixed annuities offered by insurance companies. Thus, she wants you to evaluate some immediate fixed annuities. Read the "Immediate Fixed Income Annuities" information at the end of part 1. Then use the fixed income annuity factors at the end of the Part I to answer the following questions. For a hint on 1.77% calculation, see page 4 of the "Primer on how to read Treasury bond quotes" on Canvas. Complete the following tables. Immediate fixed annuity for a $500,000 policy for a 65-year old woman. Years Certain (factor) 10 20 Monthly income $2,475 Annualized rate of retum if annuity paid for years certain. This is a time value of money problem where you need to solve for I/Y. Not 1.77% applicable Which years certain (0, 10, 20) would you recommend to her? Based on your recommended years certain, what would be the monthly income for her? Based on your recommended years certain, what would be her annual income ... just multiply monthly income by 127 Based on your recommended years certain, what would be the year one annual withdrawal rate (to two decimal places)?

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Which years certain 0 10 20 would you recommend to her Based on your recommended years certain what would be the monthly income for her I would recomm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started