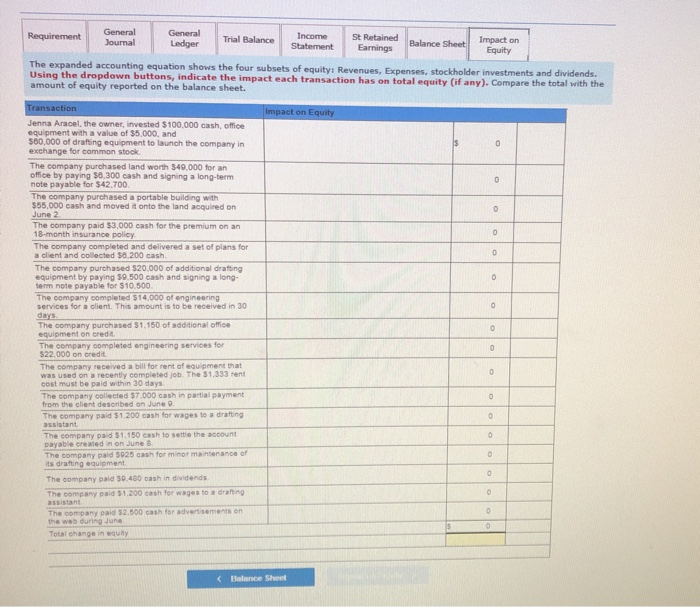

impact on equity

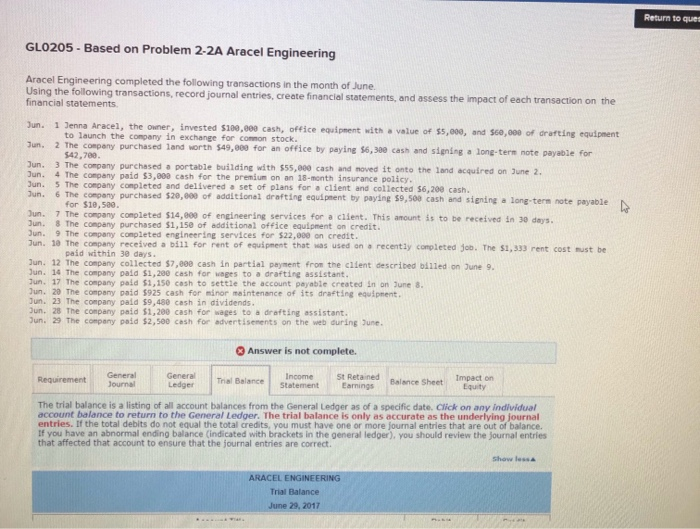

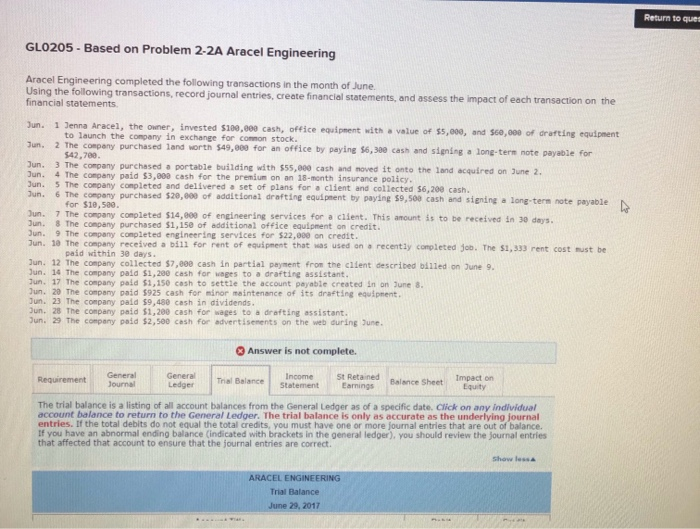

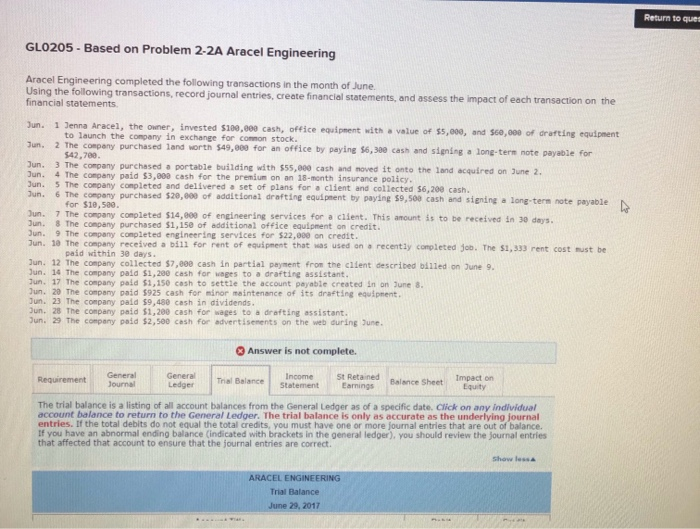

Return to ques GLO205 Based on Problem 2-2A Aracel Engineering Aracel Engineering completed the following transactions in the month of June. Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements Jun. 1 Jenna Aracel, the owner, invested $100,e00 cash, office equipnent with a value of $5,000, and $60,000 of drafting equipment to launch the company in exchange for common stock. 2 The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-term note payable for $42,700 3 The company purchased a portable building with $55,000 cash and noved it onto the land acquired on June 2,1 Jun. Jun. Jun. 4 The conpany paid $3,000 cash for the premium on an 18-month insurance policy. 5 The company conpleted and delivered a set of plans for a client and collected $6,200 cash, 6 The company purchased $20,000 of additional drafting equipment by paying $9,500 cash and signing a long-term note payable for $10,500. Jun. Jun. Jun. 7 The company completed $14,000 of engineering services for a client. This amount is to be received in 30 days. Jun. 8 The company purchased $1.150 of additional office equipment on credit. Jun. 9 The company conpleted engineering services for $22,000 on credit. Jun. 10 The conpany received a bill for rent of equipment that was used on a recently completed job. The $1,333 rent cost sust be paid within 30 days. Jun. 12 The company collected $7,000 cash in partial payment from the client described billed on June 9, Jun. 14 The company paid $1,280 cash for wages to a drafting assistant. Jun. 17 The company paid $1,150 cash to settle the account payable created in on June 8. Jun. 20 The company paid $925 cash for minor meintenance of its drafting equipment. Jun. 23 The company paid $9,480 cash in dividends. Jun. 28 The company paid $1.200 cash for wages to a drafting assistant. Jun. 29 The company paid $2,500 cash for advertisenents on the web during June Answer is not complete. General Journal General Ledger Income Statement St Retained Earnings Impact on Equity Requirement Trial Balance Balance Sheet The trial balance is a listing of all account balances from the General Ledger as of a specific date. Click on any individual account balance to return to the General Ledger. The trial balance is only as accurate as the underlying journal entries. If the total debits do not equal the total credits, you must have one or more fournal entries that are out of balance. If you have an abnormal ending balance (indicated with brackets in the general ledger), you should review the journal entries that affected that account to ensure that the journal entries are correct. show less ARACEL ENGINEERING Trial Balance June 29, 2017 General General Requirement Income Trial Balance St Retained Impact on Equity Balance Sheet Journal Ledger Statement Earnings The expanded accounting equation shows the four subsets of equity: Revenues. Expenses, stockholder investments and dividends. Using the dropdown buttons, indicate the impact each transaction has on total equity (if any). Compare the total with the amount of equity reported on the balance sheet. Transaction Impact on Equity Jenna Aracel, the owner,, invested $100,000 cash, office equipment with a value of $5,000, and s00,000 of drafting equipment to launch the company in exchange for common stock C The company purchased land worth $49,000 for an office by paying $8,300 cash and signing a long-term note payable for $42,700. The company purchased a portable building with $55,000 cash and moved it onto the land acquired on June 2 The company paid $3,000 cash for the premium on an 18-month insurance policy The company completed and delivered a set of plans for a client and collected 36.200 cash. The company purchased $20,000 of additional drafting equipment by paying $9.500 cash and signing a long- term note payable for $10.500. The company completed $14,000 of engineering services for a client. This amount is to be received inn 30 days The company purchased$1.150 of additional office equipment on oredit The company completed engineering services for $22.000 on credit 0 0 The company received a bill for rent of equipment that was used on a recentlyy completed job. The $1.333 rent Cost must be paid within 30 days ern The company collected $7.000 cash in partial payment from the client desoribed on June C The company paid $1.200 cash for wapes to a drafting assistant The company paid $1.150 cash to settle the account pavable created in on June 8 The company paid S025 cash for minor maintenance of its drafting equipment The company paid SD.480 cash in dividends The company paid $1.200 cash for wages to a drafting assistant. The company paid 52,500 cash for advertisements on the web during June Total change in equty Balance Sheet