Answered step by step

Verified Expert Solution

Question

1 Approved Answer

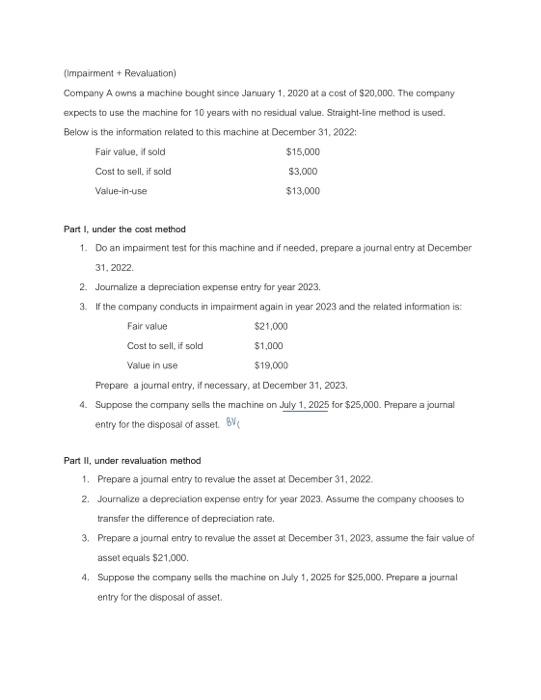

(Impairment + Revaluation) Company A owns a machine bought since January 1, 2020 at a cost of $20,000. The company expects to use the

(Impairment + Revaluation) Company A owns a machine bought since January 1, 2020 at a cost of $20,000. The company expects to use the machine for 10 years with no residual value. Straight-line method is used. Below is the information related to this machine at December 31, 2022: Fair value, if sold Cost to sell, if sold Value-in-use $15,000 $3,000 $13,000 Part 1, under the cost method 1. Do an impairment test for this machine and if needed, prepare a journal entry at December 31, 2022. 2. Journalize a depreciation expense entry for year 2023. 3. If the company conducts in impairment again in year 2023 and the related information is: $21,000 $1,000 $19,000 Fair value Cost to sell, if sold Value in use Prepare a journal entry, if necessary, at December 31, 2023, 4. Suppose the company sells the machine on July 1, 2025 for $25,000. Prepare a journal entry for the disposal of asset. BV Part II, under revaluation method 1. Prepare a journal entry to revalue the asset at December 31, 2022. 2. Journalize a depreciation expense entry for year 2023. Assume the company chooses to transfer the difference of depreciation rate. 3. Prepare a journal entry to revalue the asset at December 31, 2023, assume the fair value of asset equals $21,000. 4. Suppose the company sells the machine on July 1, 2025 for $25,000. Prepare a journal entry for the disposal of asset.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The image you provided contains detailed instructions and financial information regarding impairment and revaluation accounting for a machine owned by Company A Based on this information I will guide ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started