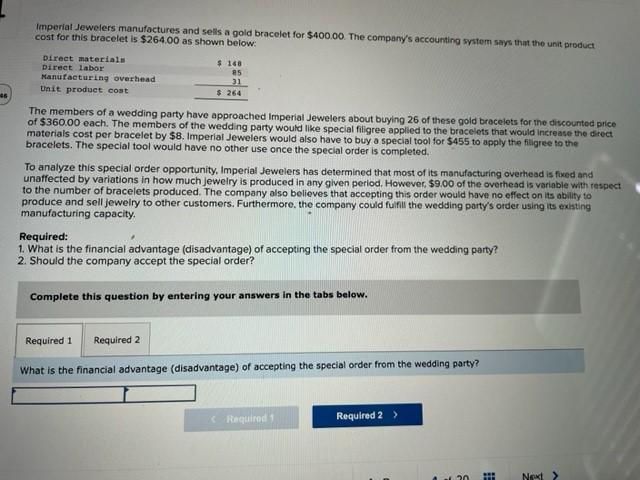

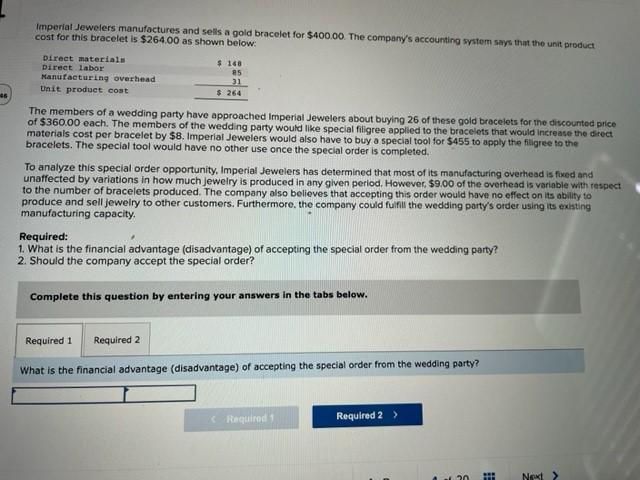

Impiorial Jewelers manufactures and sells a gold bracelet for $400.00. The company's accounting system says that the unit product cost for this bracelet is $264.00 as shown below: The members of a wedding party have approached Imperial Jewelers about buyling 26 of these gold bracelets for the discourted price of $360.00 each. The members of the wedding party would like speclal filigree applied to the bracelets that would increase the direct materials cost per bracelet by $8. Imperial Jewelers would also have to buy a special tool for $455 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufocturing ouerhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $9.00 of the overhead is variable with respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell Jewelry to other customers. Furthermore. the company could fulfill the wedding party's order using its existing manufacturing capacity. Required: 1. What is the financial advantage (disadvantage) of accepting the special order from the wedcling party? 2. Should the company accept the special order? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) of accepting the special order from the wedding party? Required: 1. What is the financial advantage (disadvantage) of accepting the special 2. Should the company accept the special order? Complete this question by entering your answers in the tabs belov Should the company accept the special order? Impiorial Jewelers manufactures and sells a gold bracelet for $400.00. The company's accounting system says that the unit product cost for this bracelet is $264.00 as shown below: The members of a wedding party have approached Imperial Jewelers about buyling 26 of these gold bracelets for the discourted price of $360.00 each. The members of the wedding party would like speclal filigree applied to the bracelets that would increase the direct materials cost per bracelet by $8. Imperial Jewelers would also have to buy a special tool for $455 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufocturing ouerhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $9.00 of the overhead is variable with respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell Jewelry to other customers. Furthermore. the company could fulfill the wedding party's order using its existing manufacturing capacity. Required: 1. What is the financial advantage (disadvantage) of accepting the special order from the wedcling party? 2. Should the company accept the special order? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) of accepting the special order from the wedding party? Required: 1. What is the financial advantage (disadvantage) of accepting the special 2. Should the company accept the special order? Complete this question by entering your answers in the tabs belov Should the company accept the special order