please show solution so i can follow how to do it..

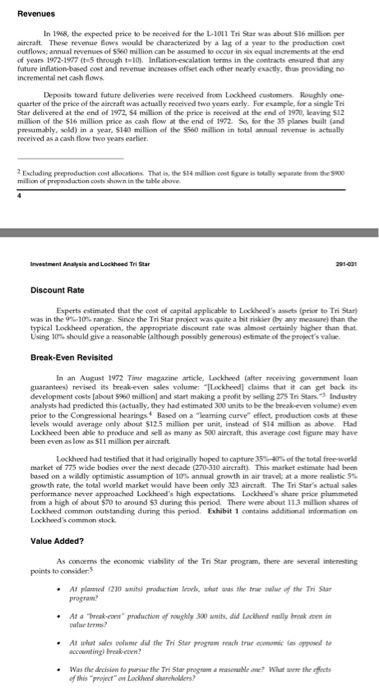

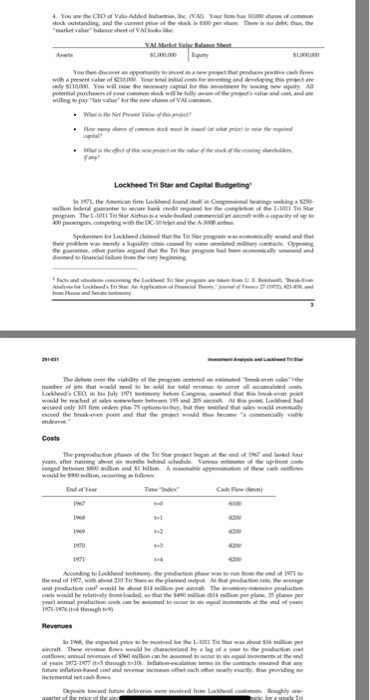

4. You ane the CEO od Vale-Added Indutries, Inc (VAD Your fm has 3000 shares of common ock outstanding, and the curnnt prior of the sack in 5330 per sn Thee is no debt thus the "market valae" blance sheet of VAl loks lke VALMekat el Balan Sheet Equity Aets S1000 S10000 You then discover an apportunity to invest in a new p that pdces posive c ws with a present vale of S20000 Your l intial cs for ieing and develping this pject are ely 10,000 You will raise the neaary capial for ths i by ng w euity Al petial purchases od your comen sock wbe lly ae of the s alue and c and ae willing to pay "air value or the new shans of VAl comon We is the Net Pree Vf Hr y sha of co ack st be d t t pi the oi capil e ng har Ws het of the w fay the Lockheed Tri Star and Capital Budgeting 171 the American firm Lockbeed found iin Cominl hearings seking a 525 milion federal gurantee to secure bank credit muied the ompletn o the L-1011 Tes Star program The L-1011 Tri Star Airus is a wide-bedied commenial acwith a capacity of up to 40 passengm, competing with the DC-30and theA300 cally wnd and that Spesmen or Lockheed climed that e Ti Sr p their pblem was merely a quidity cris camed by some unnamry contacts Oppsing the garantee, ohr parties argued tht the Tri Star progam hd ben ically unund and ded to iancal frm the very begining w Facts and situion conceming the Lockheed Tri Str pgam a Analyss for Lockheds T An Applation of Finnl Th" omHouse and Seme hnt Ev 2 21-nd The debate over the viability of the pogam d m m sal e mumber of jets that would need to be sld for total vr to av lacumlted os Lakheed's CEO, in his July 1901 testimony belore Congre ed tt is beekevm peint would be reached at sales somewhene betwen 195 and 25 At i poi Lockbend had secued only 303 firm ceders phs 75 option toby, bt they sed thut sales would eveuly eoed the break-even point and that the pjet wodd beme commercially viable mdea Costs The prepeadacion phases of the Tri Star project began at the md of 19 and lased four yean, after nnning about s months ehind schedle Vs mt of the up font costs anged between 5800 million and S1 illon. A reasonable a in of these ch ouows ww.ld be S00 milon ocouing as follo End of Year Tme Indes C w S) 1967 198 430 19 2 3 430 1971 4 40 Acceding to Lockheod testinony, the pduton phase was to rn m the end of 1971 to the end of 197, wih about 210 Tri Sas n the planned output At d rate the eage unit peodaction co would be bout S14 millon per acat The ioy-iie peaduction cts would be relativly fon-loaded, so that the $40 millon 534 n per plane, 38 planes per year) annual production ts can be aumd to occur in sis aqual inawnts at the nd of year 19- thugh t Revenues In 1968, the pected price to be ecved for the L- Ts Star was about $16 mon per aircraft These vue Bows would be characteriaed by a lag of a yer to the peadacon co outflows; annual nevenues of $0 millon can be amed to acur in eql inoments at the nd of years 172-1977 (t through te0 Inflation-ecalation tm in the ontracts anued tht any futune inflation-based cost and nevemue incass offet each other nearly eaty, thus prowiding no incremental et cah E Depoits toward future deliveries wene ecved from Lackheed cme garter of the prie of the arch Roughly one In 1968, the epected price to be received for the L-01 Tri Star was about S16 milion per aircraft These revenue fows would be characterized by a lag of a year to the peodaction cst outflows aneual nevenues of $S60 million can be assumed to ocour in six equal inaements at dhe end of years 1972-197 t5 through t30 Inflation-escalaticn terms in the contracts emuned that any future inflation-based cost and revenue increases offset each other nearly esactly, n powiding no incremental net cash lows Deposits towand future deliveries wene received from Lockheed customers Rugly one quarter of the price of the aircraft was actually received two years early. For esample, for a singgle T Sar delivered at the end of 1972 S4 million of the price is received at the end of 1s, leaving S12 milion of the $16 million price as cash flow at the end of 1072 So for the 35 planes built and presumably, sold) in a year, $140 million of the $560 millioe in total annual mem i actually received as a cash fow two years earlier 2Eading prepeodution cost allocations That is, the S14 mn st figure is totally wpe the 0 milin of prepoduton costs down in he table above inwestment Analysis and Lockeed T Sta Discount Rate Experts estimated that the cost of capital applicable to Lockheed's aets (prior to Tri Star) was in the 9%-10% range. Since the Tri Star project was quite a bit riskier by any measune) than the typical Lockheed operation, the appropriate discount rate was almost certainly higher than tat Using 10% should give a reasonable (although pssibly generou) estimate of the projet's vale Break-Even Revisited parante) reised its bea aine aticle, Lockhed aer ceing mt ln development conts about $60 milion and start making a profit by seing 275 Tri Stan Indy analysts had peedicted this (actually, they had estimated 300 units to be the beeak evem volume) even pricr to the Congressional hearings Based on a "leaming curve" effect, production cos at thse evels would average only about $12.5 million per unit intead of $14 milion s above Had Lockheed been able to produce and sell as many as 500 aircraft, this average cont figune may have been even as low as $11 million per aircraft In an August 1972 Tie sales volume: TLockheed] claims that it can get back its Lockheed had testified that it had originally hoped to capture 35%-40% of the total freewrld market of 775 wide bodies over the next decade (20-310 aircraft) This market etimute had bem based on a wildly optimistic assumpion of 10% annual growth in air travel at a mene realistic 5% growth rate, the total woeld market would have been only 323 aircraft. The Tri Star's actual sales performance never appeoached Lockheed's high expectations Leckheed's shane price plummeted from a high of about $70 to around $3 during this peried There were about 11.3miicn shares of Lockheed common oustanding during this period. Exhibt 1 contains additional indormation on Lockheed's common stock Value Added? As concems the economic viability of the Tri Star peogram, there ae several interesting points to coider At plamd (210 nito prodctin levek, het wes the true salur of the Ti Sr prga? At a Tesk- raduction of nughly 300 aits did Lochd raily ak lar ter At hat sdes lame did the Tri Star pragm reach true ecooc spp t accounting) beak-ew Was the decision o pursar the Ti Star progum a resole one? What w the fs of this "projetan Lackhnd hanholds? 3Tme (August 21, 1972 Machell Gondon, Hched to the Tei Stur-Disaser at Lockhed Would Cut a Wide SatheB'sMach I5, 195-34 one taes and depreciation tax shidlds hare n cases near the akevn volume the would nd to tet each other nearly completely 4 You are the CEO of Vale-Added Indstries, Inc. (VAD Your firm has M00 shanes of common sock outstanding and the carnmt price of the stock is S100 per share Thene is no debt ths the "market value" baane sheet of VAl kooks like VALMarket Veler alan Sheet s00000 Equity S10000 Assets You them discover an opportunity to invest in a new project that produces positive cash flows with a peent vala of 5210,000 Your total initial costs for ivesting and developing this peject are only Si10000 You wil raise the neoary capital for this imvestent by issuing new equity All pottal parchasers of your common stock wil be ally awase of the project's value and cost and ane willing to pay "air ealae for the new shares of VAl common Wlut is he Net Preet Valar of this peoject? ow y shes of con ok st be isd at aht pri to ise the epin cpl Whut is the t of he jct on the lar of the stock of the exiting sarold fay Lockheed Tri Star and Capital Budgeting In1971, the American firem Lockheed feund isell in Congressionl hearings seeking a $250- wllon federal guarante to secuse bank credin equired for the completion of the L-100 Ti Star pogam The L-101 T Star Aibus is a wide-bedied commercial et aiscat with a capacity of up to passengs, competing with the DC-10 eret and the A-3008 a Spekesmen fee Lockheed claimed thut the Tri Star progam was economically seund and that their pelem was merely a iquidity crisis cmed by some unrelated military contracts Opposing the guarantee, odher parties argued than the Ti Star peogram had been econoicaly unound and docned to financial faure from the very begiing Fats and sihtion coneming the Lockhed Ti Sur pogam ae un frm UE Rrnan Ev Anly or Lokheeds Tri ar An Applicaon of Fiancal Thry, f c 27 (172 82-83nd fm Hoase and Senate ttimoey Alyad d Ti a11 The debate over the viability of the program ambered on estimted reakeven sales"he umber of s that would need so be sold foe total nevenue to over all accumulated co Lckheed's CEO in his aly 1901 testimony before Congress, aserted that this beeak even point wwld be reached at sales somewhere betwen 195 and 305 aircralt. At this point, Lockhed had wued only 3 fim ordes plas 75 opione-t-buy, but they tenfied that sales would eventually eeed the breakven point and that the peojet would ths become "a commencially viable mdeavor Costs The prepeaducttion phases of the Ti Star project began at the md of 1967 and lasted four year, aher nnning about sx moeths behind schedule Various estimates of the up-froet costs anged betwm ss00 milion and $1 billion. A neasonable appeonimation of these cah outflows wold be $00 milion ocuring felows Cash Flew (Smm End of Year Time "nde 1967 400 4 -2 430 0 430 4200 Accoeding to Lockheed testimony, the paduction phase was to nun from the end of 1471 to the end of 1907, with aboue 20 Tri Stars as the planned ouput At production rte the aveage unit prodution co would be about S4 milion per aircrat The invntory-inenive prodaction cts would be relatively fron-loaded, so that the $490 million 514 mlon per plane, 35 planes per year) annual production cosb can be assumod to occur in si equal incements at the emd of years 1-19 thgh t Revenues In 1968, the epacted peice to be received for the L-301 Tri Star was about $36 milion per aircaft Thee nvnue Sows would be characteriaed by a lag of a yar to the peoduction cot outflows annaal nevenues of $50 milon can be aoumed to occur in sis equal increments at the md of years 172-1977 -5 through t-n Ination escalation tmms in the conacts eured at any fuure inationbased cost and evenae increases offset each odher nearly eacty, thus providing no incemental net cash Bows Depois towand futare deliveries were received fom Lockheed customers Roughly one qarter of the price of the ajncrat wasatally oived bwaaeculy Fr oample, for a single Tr Star delivered at the end oe pea e nd of 190, leaving $12 aiu the 35 e Revenues In 1968, the expected price to be received for the L-1011 Tri Star was about $16 millicn per aircraft These revenue Boes would be characterized by a lag of a year to the production cost outflows; annual revenues of $560 million can be assumed to occur in six equal increments at the end of years 1972-1977 (t-5 through t-10). Inflation-escalation terms in the contracts ensured that any future inflation-based cost and revenue increases offset each other nearly exactly, thus peoviding no incremental net cash flows Deposits toward future deliveries were received from Lockheed customers. Roughly one- quarter of the price of the aircraft was actually received two years early. Fer example, for a single Tri Star delivered at the end of 1972, $4 million of the price is received at the end of 1970, leaving $12 milion of the $16 million price as cash flow at the end of 1972. So, for the 3s planes built (and pesumably, sold) in a year, $140 million of the $560 million in total annual evenue is actually received as a cash flow two years earlier. 2 Excluding preproduction cost allocations That is, the S14 million cost Sigure is totally separate from the S900 milion of prpadaction costs shown in the table above. Investment Analysis and Lockheed Tri Star 21-03 Discount Rate Experts estimated that the cont of capital applicable to Lockheed's asscts (price to Tri Star) was in the 9%-10% range. Since the Tri Star project was quite a bit riskier (by any measure) than the typical Lockheed operaticn, the appropriate discount rate was almost certainly higher than that Using 10% should give a reasonable (although possibly grnerous) estimate of the project's value. Break-Even Revisited In an August 1972 Time magazine aticle, Lockheed (after receiving government loan guarantees) revised its break-even sales volume Lockheed] claims that it can get back its development costs [about $960 million) and start making a profit by selling 275 Tri Stars3 Industry analysts had predicted this (actually, they had estimated 300 units to be the break-even volume) even prior to the Congressional hearings Based on a "leaming curve" effect, production costs at these ievels would average only about $125 million per unit, instead of $14 million as above. Had Lockheed been able to produce and sell as many as 500 aircraft, this average cost figure may have been even as loww as $11 million per aircraft Lockheed had testified that it had originally hoped to capture 35%-40% of the total free-world market of 775 wide bodies over the next decade (270-310 aircraft). This market estimate had been based on a wildly optimistic assumption of 10% annual growth in air travel; at a more realistic 5% growth rate, the total world market would have been only 323 aircraft. The Tri Star's actual sales performance never approached Lockheed's high epectations Lockheed's share price plummeted from a high of about $70 to around $3 during this period There were about 11.3 million shares of Lockheed common outstanding during this period. Exhibit 1 contains additional information on Lockheed's common stock Value Added? As concems the economic viability of the Tri Star program, there are several interesting points to consider At plased (230 mits production levlk, ahat aas the tre alar of the Tri Star program At a reak-coen" production of noughly 300 anits, did Lockheed rally break en in lar terns? At what sales volume did the Tri Ster program reach true economic (as opposed to accounting) beeakeen Was the decisien to pursue the Tri Star prognam a reasonable one? What awere the fects of this "project" on Lackhed sharcholders? 4. You ane the CEO od Vale-Added Indutries, Inc (VAD Your fm has 3000 shares of common ock outstanding, and the curnnt prior of the sack in 5330 per sn Thee is no debt thus the "market valae" blance sheet of VAl loks lke VALMekat el Balan Sheet Equity Aets S1000 S10000 You then discover an apportunity to invest in a new p that pdces posive c ws with a present vale of S20000 Your l intial cs for ieing and develping this pject are ely 10,000 You will raise the neaary capial for ths i by ng w euity Al petial purchases od your comen sock wbe lly ae of the s alue and c and ae willing to pay "air value or the new shans of VAl comon We is the Net Pree Vf Hr y sha of co ack st be d t t pi the oi capil e ng har Ws het of the w fay the Lockheed Tri Star and Capital Budgeting 171 the American firm Lockbeed found iin Cominl hearings seking a 525 milion federal gurantee to secure bank credit muied the ompletn o the L-1011 Tes Star program The L-1011 Tri Star Airus is a wide-bedied commenial acwith a capacity of up to 40 passengm, competing with the DC-30and theA300 cally wnd and that Spesmen or Lockheed climed that e Ti Sr p their pblem was merely a quidity cris camed by some unnamry contacts Oppsing the garantee, ohr parties argued tht the Tri Star progam hd ben ically unund and ded to iancal frm the very begining w Facts and situion conceming the Lockheed Tri Str pgam a Analyss for Lockheds T An Applation of Finnl Th" omHouse and Seme hnt Ev 2 21-nd The debate over the viability of the pogam d m m sal e mumber of jets that would need to be sld for total vr to av lacumlted os Lakheed's CEO, in his July 1901 testimony belore Congre ed tt is beekevm peint would be reached at sales somewhene betwen 195 and 25 At i poi Lockbend had secued only 303 firm ceders phs 75 option toby, bt they sed thut sales would eveuly eoed the break-even point and that the pjet wodd beme commercially viable mdea Costs The prepeadacion phases of the Tri Star project began at the md of 19 and lased four yean, after nnning about s months ehind schedle Vs mt of the up font costs anged between 5800 million and S1 illon. A reasonable a in of these ch ouows ww.ld be S00 milon ocouing as follo End of Year Tme Indes C w S) 1967 198 430 19 2 3 430 1971 4 40 Acceding to Lockheod testinony, the pduton phase was to rn m the end of 1971 to the end of 197, wih about 210 Tri Sas n the planned output At d rate the eage unit peodaction co would be bout S14 millon per acat The ioy-iie peaduction cts would be relativly fon-loaded, so that the $40 millon 534 n per plane, 38 planes per year) annual production ts can be aumd to occur in sis aqual inawnts at the nd of year 19- thugh t Revenues In 1968, the pected price to be ecved for the L- Ts Star was about $16 mon per aircraft These vue Bows would be characteriaed by a lag of a yer to the peadacon co outflows; annual nevenues of $0 millon can be amed to acur in eql inoments at the nd of years 172-1977 (t through te0 Inflation-ecalation tm in the ontracts anued tht any futune inflation-based cost and nevemue incass offet each other nearly eaty, thus prowiding no incremental et cah E Depoits toward future deliveries wene ecved from Lackheed cme garter of the prie of the arch Roughly one In 1968, the epected price to be received for the L-01 Tri Star was about S16 milion per aircraft These revenue fows would be characterized by a lag of a year to the peodaction cst outflows aneual nevenues of $S60 million can be assumed to ocour in six equal inaements at dhe end of years 1972-197 t5 through t30 Inflation-escalaticn terms in the contracts emuned that any future inflation-based cost and revenue increases offset each other nearly esactly, n powiding no incremental net cash lows Deposits towand future deliveries wene received from Lockheed customers Rugly one quarter of the price of the aircraft was actually received two years early. For esample, for a singgle T Sar delivered at the end of 1972 S4 million of the price is received at the end of 1s, leaving S12 milion of the $16 million price as cash flow at the end of 1072 So for the 35 planes built and presumably, sold) in a year, $140 million of the $560 millioe in total annual mem i actually received as a cash fow two years earlier 2Eading prepeodution cost allocations That is, the S14 mn st figure is totally wpe the 0 milin of prepoduton costs down in he table above inwestment Analysis and Lockeed T Sta Discount Rate Experts estimated that the cost of capital applicable to Lockheed's aets (prior to Tri Star) was in the 9%-10% range. Since the Tri Star project was quite a bit riskier by any measune) than the typical Lockheed operation, the appropriate discount rate was almost certainly higher than tat Using 10% should give a reasonable (although pssibly generou) estimate of the projet's vale Break-Even Revisited parante) reised its bea aine aticle, Lockhed aer ceing mt ln development conts about $60 milion and start making a profit by seing 275 Tri Stan Indy analysts had peedicted this (actually, they had estimated 300 units to be the beeak evem volume) even pricr to the Congressional hearings Based on a "leaming curve" effect, production cos at thse evels would average only about $12.5 million per unit intead of $14 milion s above Had Lockheed been able to produce and sell as many as 500 aircraft, this average cont figune may have been even as low as $11 million per aircraft In an August 1972 Tie sales volume: TLockheed] claims that it can get back its Lockheed had testified that it had originally hoped to capture 35%-40% of the total freewrld market of 775 wide bodies over the next decade (20-310 aircraft) This market etimute had bem based on a wildly optimistic assumpion of 10% annual growth in air travel at a mene realistic 5% growth rate, the total woeld market would have been only 323 aircraft. The Tri Star's actual sales performance never appeoached Lockheed's high expectations Leckheed's shane price plummeted from a high of about $70 to around $3 during this peried There were about 11.3miicn shares of Lockheed common oustanding during this period. Exhibt 1 contains additional indormation on Lockheed's common stock Value Added? As concems the economic viability of the Tri Star peogram, there ae several interesting points to coider At plamd (210 nito prodctin levek, het wes the true salur of the Ti Sr prga? At a Tesk- raduction of nughly 300 aits did Lochd raily ak lar ter At hat sdes lame did the Tri Star pragm reach true ecooc spp t accounting) beak-ew Was the decision o pursar the Ti Star progum a resole one? What w the fs of this "projetan Lackhnd hanholds? 3Tme (August 21, 1972 Machell Gondon, Hched to the Tei Stur-Disaser at Lockhed Would Cut a Wide SatheB'sMach I5, 195-34 one taes and depreciation tax shidlds hare n cases near the akevn volume the would nd to tet each other nearly completely 4 You are the CEO of Vale-Added Indstries, Inc. (VAD Your firm has M00 shanes of common sock outstanding and the carnmt price of the stock is S100 per share Thene is no debt ths the "market value" baane sheet of VAl kooks like VALMarket Veler alan Sheet s00000 Equity S10000 Assets You them discover an opportunity to invest in a new project that produces positive cash flows with a peent vala of 5210,000 Your total initial costs for ivesting and developing this peject are only Si10000 You wil raise the neoary capital for this imvestent by issuing new equity All pottal parchasers of your common stock wil be ally awase of the project's value and cost and ane willing to pay "air ealae for the new shares of VAl common Wlut is he Net Preet Valar of this peoject? ow y shes of con ok st be isd at aht pri to ise the epin cpl Whut is the t of he jct on the lar of the stock of the exiting sarold fay Lockheed Tri Star and Capital Budgeting In1971, the American firem Lockheed feund isell in Congressionl hearings seeking a $250- wllon federal guarante to secuse bank credin equired for the completion of the L-100 Ti Star pogam The L-101 T Star Aibus is a wide-bedied commercial et aiscat with a capacity of up to passengs, competing with the DC-10 eret and the A-3008 a Spekesmen fee Lockheed claimed thut the Tri Star progam was economically seund and that their pelem was merely a iquidity crisis cmed by some unrelated military contracts Opposing the guarantee, odher parties argued than the Ti Star peogram had been econoicaly unound and docned to financial faure from the very begiing Fats and sihtion coneming the Lockhed Ti Sur pogam ae un frm UE Rrnan Ev Anly or Lokheeds Tri ar An Applicaon of Fiancal Thry, f c 27 (172 82-83nd fm Hoase and Senate ttimoey Alyad d Ti a11 The debate over the viability of the program ambered on estimted reakeven sales"he umber of s that would need so be sold foe total nevenue to over all accumulated co Lckheed's CEO in his aly 1901 testimony before Congress, aserted that this beeak even point wwld be reached at sales somewhere betwen 195 and 305 aircralt. At this point, Lockhed had wued only 3 fim ordes plas 75 opione-t-buy, but they tenfied that sales would eventually eeed the breakven point and that the peojet would ths become "a commencially viable mdeavor Costs The prepeaducttion phases of the Ti Star project began at the md of 1967 and lasted four year, aher nnning about sx moeths behind schedule Various estimates of the up-froet costs anged betwm ss00 milion and $1 billion. A neasonable appeonimation of these cah outflows wold be $00 milion ocuring felows Cash Flew (Smm End of Year Time "nde 1967 400 4 -2 430 0 430 4200 Accoeding to Lockheed testimony, the paduction phase was to nun from the end of 1471 to the end of 1907, with aboue 20 Tri Stars as the planned ouput At production rte the aveage unit prodution co would be about S4 milion per aircrat The invntory-inenive prodaction cts would be relatively fron-loaded, so that the $490 million 514 mlon per plane, 35 planes per year) annual production cosb can be assumod to occur in si equal incements at the emd of years 1-19 thgh t Revenues In 1968, the epacted peice to be received for the L-301 Tri Star was about $36 milion per aircaft Thee nvnue Sows would be characteriaed by a lag of a yar to the peoduction cot outflows annaal nevenues of $50 milon can be aoumed to occur in sis equal increments at the md of years 172-1977 -5 through t-n Ination escalation tmms in the conacts eured at any fuure inationbased cost and evenae increases offset each odher nearly eacty, thus providing no incemental net cash Bows Depois towand futare deliveries were received fom Lockheed customers Roughly one qarter of the price of the ajncrat wasatally oived bwaaeculy Fr oample, for a single Tr Star delivered at the end oe pea e nd of 190, leaving $12 aiu the 35 e Revenues In 1968, the expected price to be received for the L-1011 Tri Star was about $16 millicn per aircraft These revenue Boes would be characterized by a lag of a year to the production cost outflows; annual revenues of $560 million can be assumed to occur in six equal increments at the end of years 1972-1977 (t-5 through t-10). Inflation-escalation terms in the contracts ensured that any future inflation-based cost and revenue increases offset each other nearly exactly, thus peoviding no incremental net cash flows Deposits toward future deliveries were received from Lockheed customers. Roughly one- quarter of the price of the aircraft was actually received two years early. Fer example, for a single Tri Star delivered at the end of 1972, $4 million of the price is received at the end of 1970, leaving $12 milion of the $16 million price as cash flow at the end of 1972. So, for the 3s planes built (and pesumably, sold) in a year, $140 million of the $560 million in total annual evenue is actually received as a cash flow two years earlier. 2 Excluding preproduction cost allocations That is, the S14 million cost Sigure is totally separate from the S900 milion of prpadaction costs shown in the table above. Investment Analysis and Lockheed Tri Star 21-03 Discount Rate Experts estimated that the cont of capital applicable to Lockheed's asscts (price to Tri Star) was in the 9%-10% range. Since the Tri Star project was quite a bit riskier (by any measure) than the typical Lockheed operaticn, the appropriate discount rate was almost certainly higher than that Using 10% should give a reasonable (although possibly grnerous) estimate of the project's value. Break-Even Revisited In an August 1972 Time magazine aticle, Lockheed (after receiving government loan guarantees) revised its break-even sales volume Lockheed] claims that it can get back its development costs [about $960 million) and start making a profit by selling 275 Tri Stars3 Industry analysts had predicted this (actually, they had estimated 300 units to be the break-even volume) even prior to the Congressional hearings Based on a "leaming curve" effect, production costs at these ievels would average only about $125 million per unit, instead of $14 million as above. Had Lockheed been able to produce and sell as many as 500 aircraft, this average cost figure may have been even as loww as $11 million per aircraft Lockheed had testified that it had originally hoped to capture 35%-40% of the total free-world market of 775 wide bodies over the next decade (270-310 aircraft). This market estimate had been based on a wildly optimistic assumption of 10% annual growth in air travel; at a more realistic 5% growth rate, the total world market would have been only 323 aircraft. The Tri Star's actual sales performance never approached Lockheed's high epectations Lockheed's share price plummeted from a high of about $70 to around $3 during this period There were about 11.3 million shares of Lockheed common outstanding during this period. Exhibit 1 contains additional information on Lockheed's common stock Value Added? As concems the economic viability of the Tri Star program, there are several interesting points to consider At plased (230 mits production levlk, ahat aas the tre alar of the Tri Star program At a reak-coen" production of noughly 300 anits, did Lockheed rally break en in lar terns? At what sales volume did the Tri Ster program reach true economic (as opposed to accounting) beeakeen Was the decisien to pursue the Tri Star prognam a reasonable one? What awere the fects of this "project" on Lackhed sharcholders