Implement your work with neat work I will appreciate

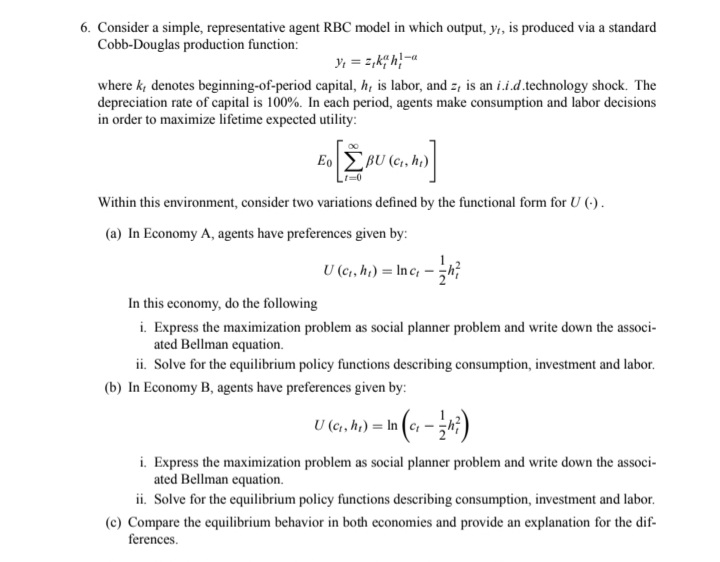

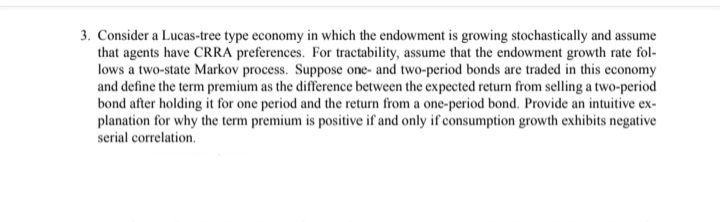

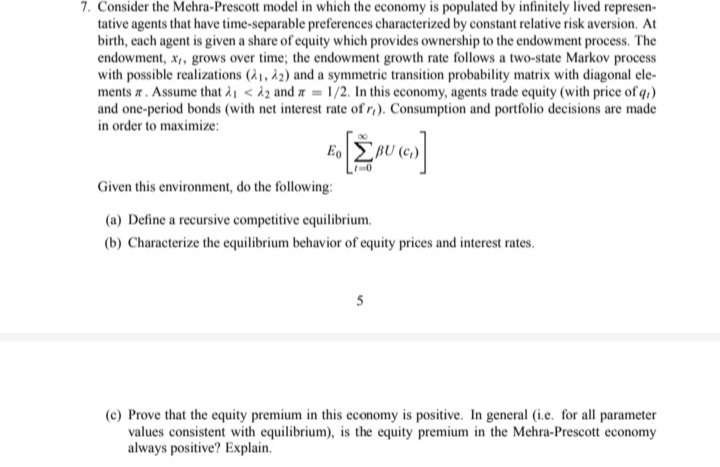

6. Consider a simple, representative agent RBC model in which output, yr, is produced via a standard Cobb-Douglas production function: where k, denotes beginning-of-period capital, h, is labor, and =, is an i.i.d.technology shock. The depreciation rate of capital is 100%. In each period, agents make consumption and labor decisions in order to maximize lifetime expected utility: Within this environment, consider two variations defined by the functional form for U (-) . (a) In Economy A, agents have preferences given by: U (cq, h,) = Inc - gh; In this economy, do the following i. Express the maximization problem as social planner problem and write down the associ- ated Bellman equation. ii. Solve for the equilibrium policy functions describing consumption, investment and labor. (b) In Economy B, agents have preferences given by: U (c, h,) = Inc - 5h?) i. Express the maximization problem as social planner problem and write down the associ- ated Bellman equation. ii. Solve for the equilibrium policy functions describing consumption, investment and labor. (c) Compare the equilibrium behavior in both economies and provide an explanation for the dif- ferences.3. Consider a Lucas-tree type economy in which the endowment is growing stochastically and assume that agents have CRRA preferences. For tractability, assume that the endowment growth rate fol- lows a two-state Markov process. Suppose one- and two-period bonds are traded in this economy and define the term premium as the difference between the expected return from selling a two-period bond after holding it for one period and the return from a one-period bond. Provide an intuitive ex- planation for why the term premium is positive if and only if consumption growth exhibits negative serial correlation.7. Consider the Mehra-Prescott model in which the economy is populated by infinitely lived represen- tative agents that have time-separable preferences characterized by constant relative risk aversion, At birth, each agent is given a share of equity which provides ownership to the endowment process. The endowment, x, grows over time; the endowment growth rate follows a two-state Markov process with possible realizations (21, 12) and a symmetric transition probability matrix with diagonal ele- ments * . Assume that ,