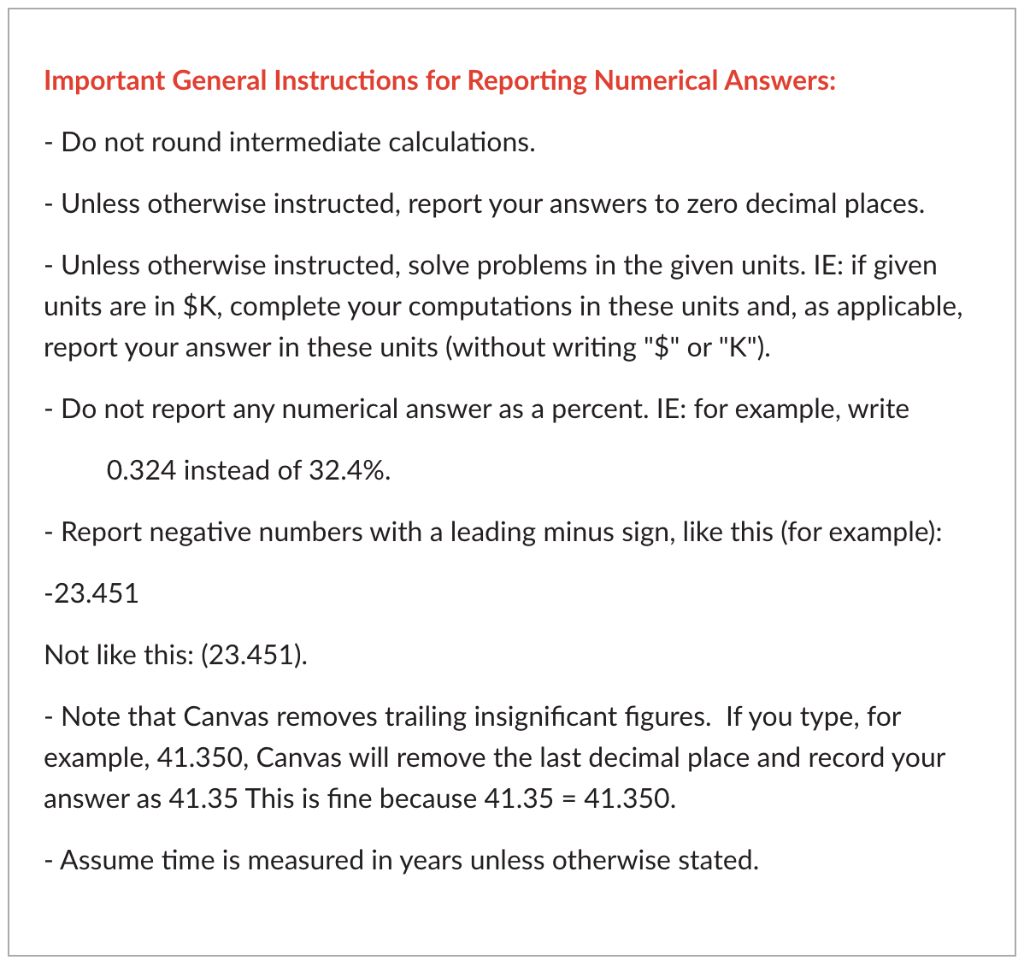

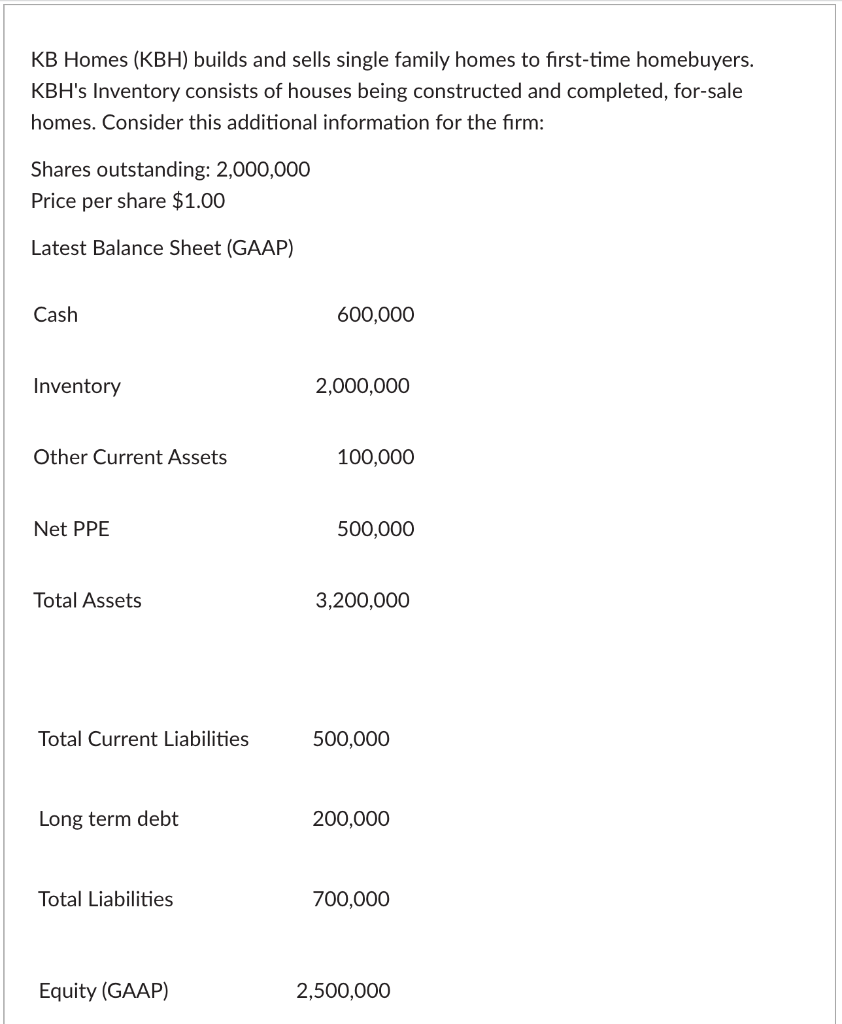

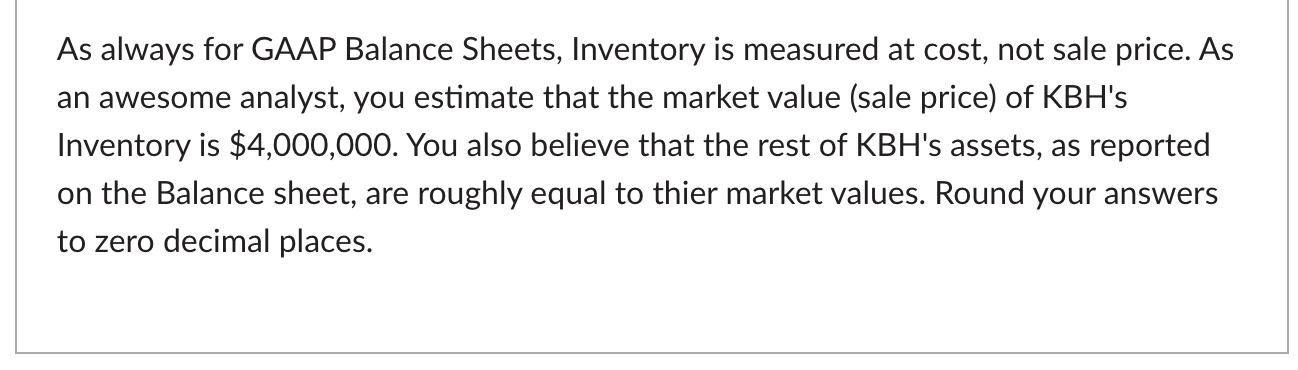

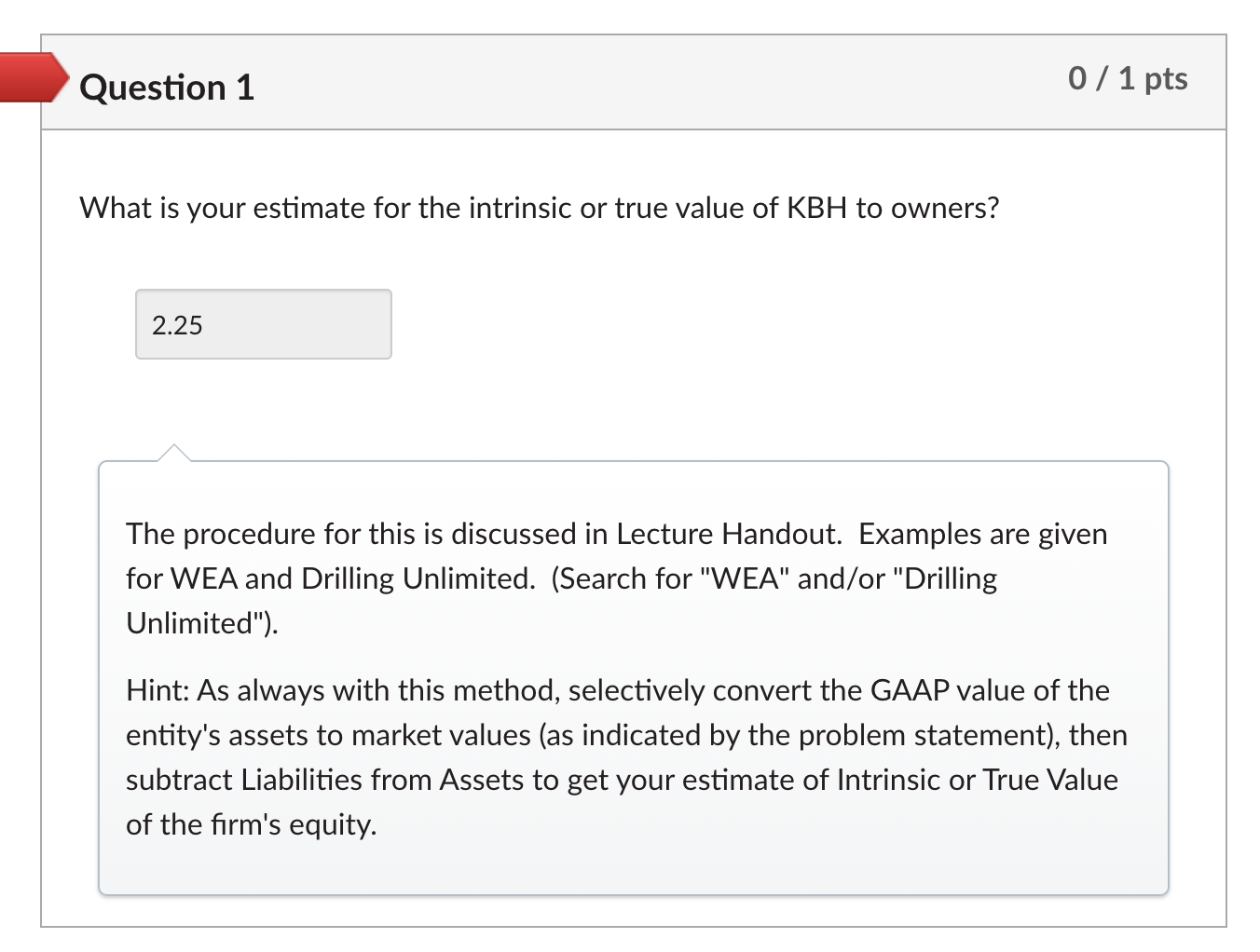

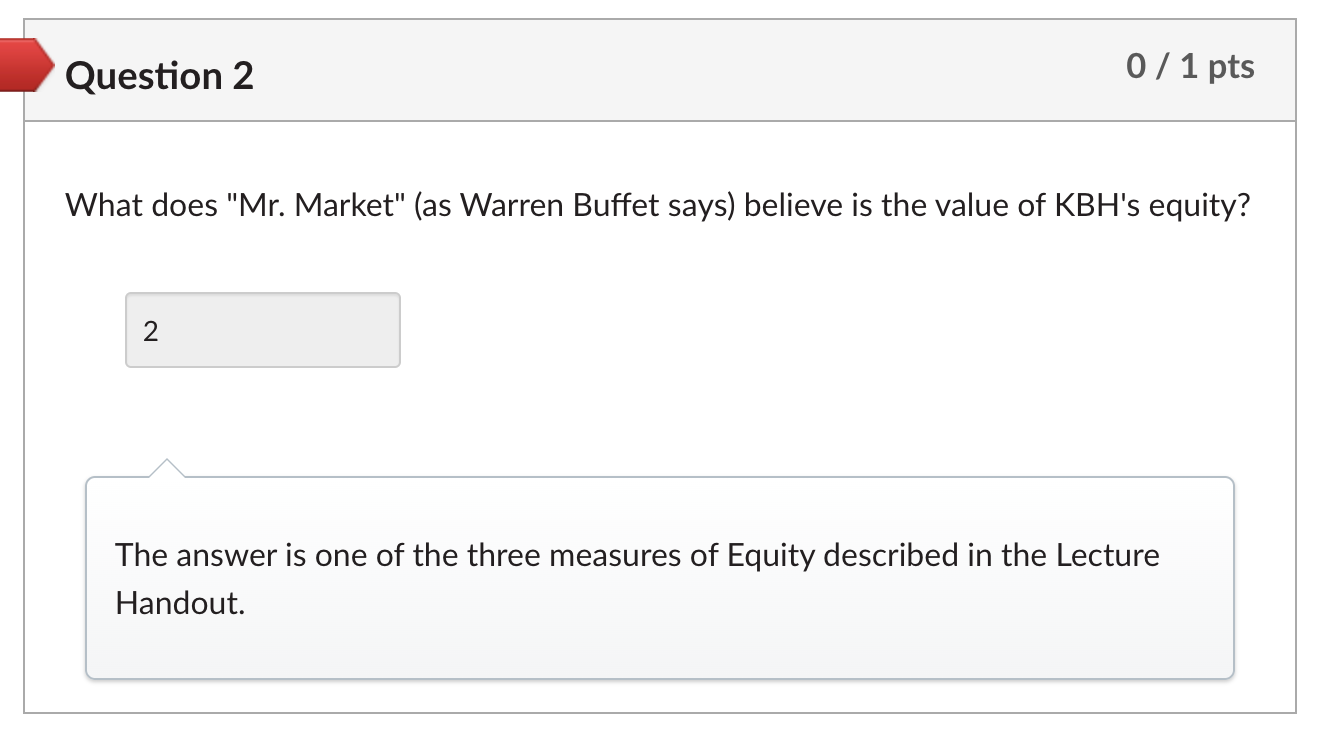

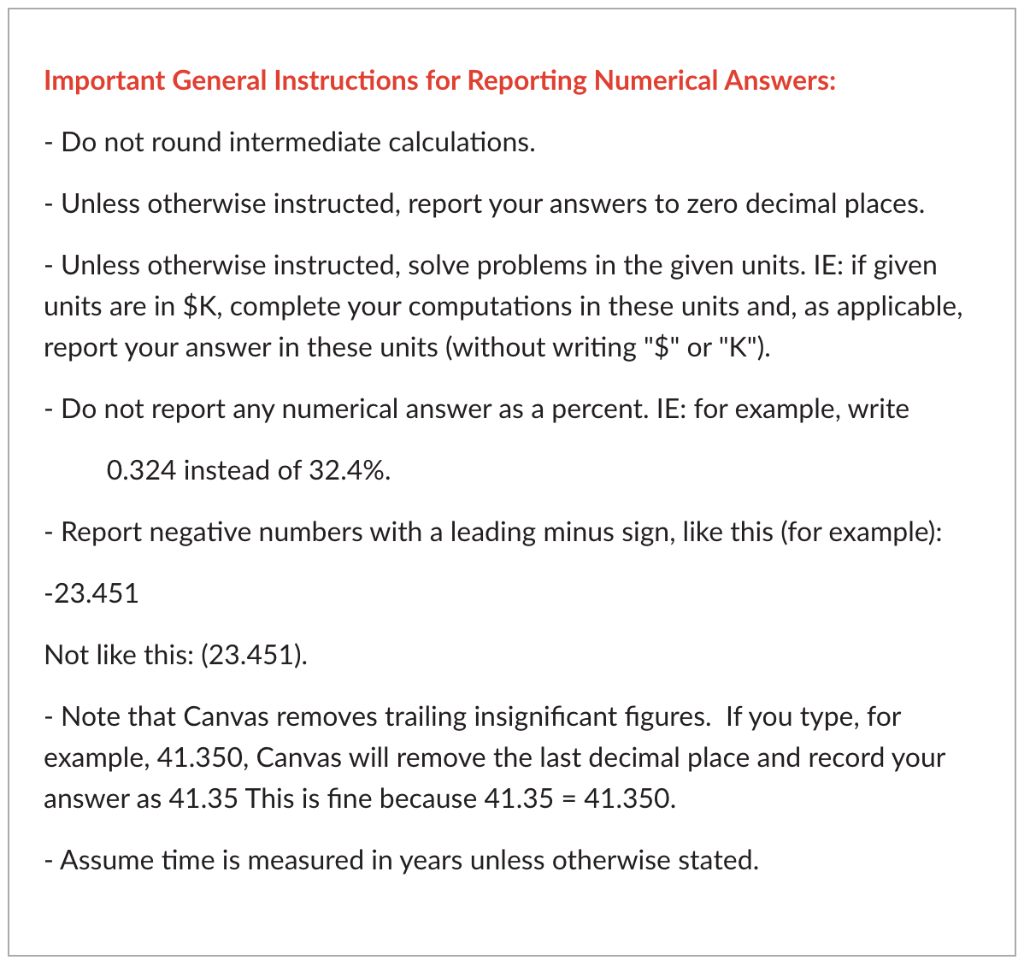

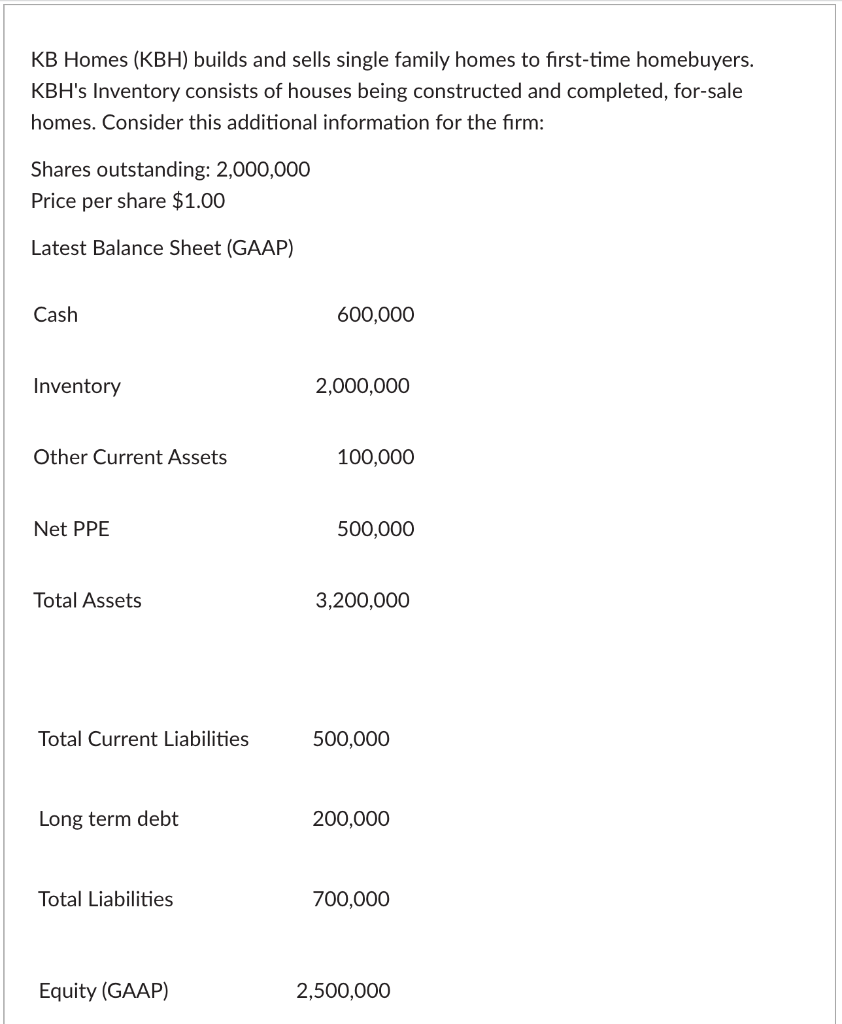

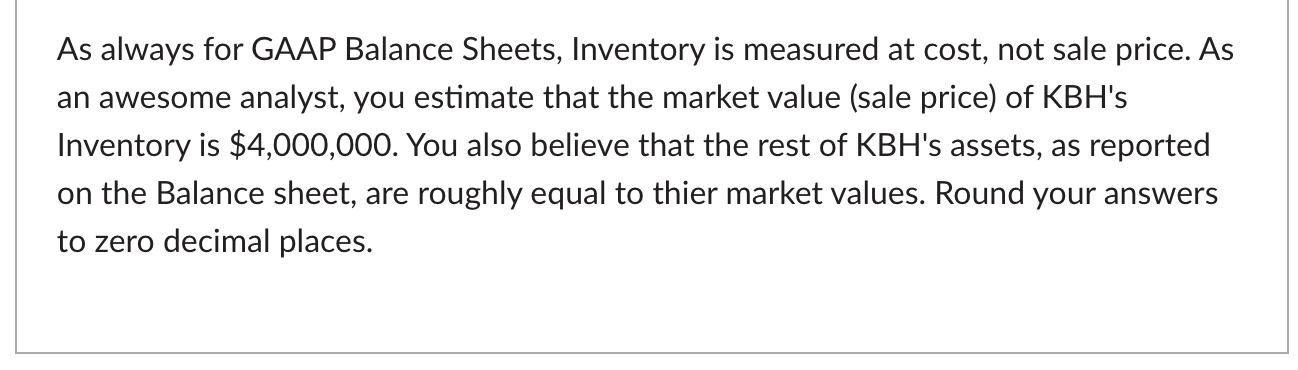

Important General Instructions for Reporting Numerical Answers: - Do not round intermediate calculations. - Unless otherwise instructed, report your answers to zero decimal places. - Unless otherwise instructed, solve problems in the given units. IE: if given units are in $K, complete your computations in these units and, as applicable, report your answer in these units (without writing "$" or "K"). - Do not report any numerical answer as a percent. IE: for example, write 0.324 instead of 32.4%. - Report negative numbers with a leading minus sign, like this (for example): -23.451 Not like this: (23.451). - Note that Canvas removes trailing insignificant figures. If you type, for example, 41.350, Canvas will remove the last decimal place and record your answer as 41.35 This is fine because 41.35 = 41.350. - Assume time is measured in years unless otherwise stated. KB Homes (KBH) builds and sells single family homes to first-time homebuyers. KBH's Inventory consists of houses being constructed and completed, for-sale homes. Consider this additional information for the firm: Shares outstanding: 2,000,000 Price per share $1.00 Latest Balance Sheet (GAAP) Cash 600,000 Inventory 2,000,000 Other Current Assets 100,000 Net PPE 500,000 Total Assets 3,200,000 Total Current Liabilities 500,000 Long term debt 200,000 Total Liabilities 700,000 Equity (GAAP) 2,500,000 As always for GAAP Balance Sheets, Inventory is measured at cost, not sale price. As an awesome analyst, you estimate that the market value (sale price) of KBH's Inventory is $4,000,000. You also believe that the rest of KBH's assets, as reported on the Balance sheet, are roughly equal to thier market values. Round your answers to zero decimal places. Question 1 0/ 1 pts What is your estimate for the intrinsic or true value of KBH to owners? 2.25 The procedure for this is discussed in Lecture Handout. Examples are given for WEA and Drilling Unlimited. (Search for "WEA" and/or "Drilling Unlimited"). Hint: As always with this method, selectively convert the GAAP value of the entity's assets to market values (as indicated by the problem statement), then subtract Liabilities from Assets to get your estimate of Intrinsic or True Value of the firm's equity. Question 2 0 / 1 pts What does "Mr. Market" (as Warren Buffet says) believe is the value of KBH's equity? 2 The answer is one of the three measures of Equity described in the Lecture Handout. Important General Instructions for Reporting Numerical Answers: - Do not round intermediate calculations. - Unless otherwise instructed, report your answers to zero decimal places. - Unless otherwise instructed, solve problems in the given units. IE: if given units are in $K, complete your computations in these units and, as applicable, report your answer in these units (without writing "$" or "K"). - Do not report any numerical answer as a percent. IE: for example, write 0.324 instead of 32.4%. - Report negative numbers with a leading minus sign, like this (for example): -23.451 Not like this: (23.451). - Note that Canvas removes trailing insignificant figures. If you type, for example, 41.350, Canvas will remove the last decimal place and record your answer as 41.35 This is fine because 41.35 = 41.350. - Assume time is measured in years unless otherwise stated. KB Homes (KBH) builds and sells single family homes to first-time homebuyers. KBH's Inventory consists of houses being constructed and completed, for-sale homes. Consider this additional information for the firm: Shares outstanding: 2,000,000 Price per share $1.00 Latest Balance Sheet (GAAP) Cash 600,000 Inventory 2,000,000 Other Current Assets 100,000 Net PPE 500,000 Total Assets 3,200,000 Total Current Liabilities 500,000 Long term debt 200,000 Total Liabilities 700,000 Equity (GAAP) 2,500,000 As always for GAAP Balance Sheets, Inventory is measured at cost, not sale price. As an awesome analyst, you estimate that the market value (sale price) of KBH's Inventory is $4,000,000. You also believe that the rest of KBH's assets, as reported on the Balance sheet, are roughly equal to thier market values. Round your answers to zero decimal places. Question 1 0/ 1 pts What is your estimate for the intrinsic or true value of KBH to owners? 2.25 The procedure for this is discussed in Lecture Handout. Examples are given for WEA and Drilling Unlimited. (Search for "WEA" and/or "Drilling Unlimited"). Hint: As always with this method, selectively convert the GAAP value of the entity's assets to market values (as indicated by the problem statement), then subtract Liabilities from Assets to get your estimate of Intrinsic or True Value of the firm's equity. Question 2 0 / 1 pts What does "Mr. Market" (as Warren Buffet says) believe is the value of KBH's equity? 2 The answer is one of the three measures of Equity described in the Lecture Handout