Answered step by step

Verified Expert Solution

Question

1 Approved Answer

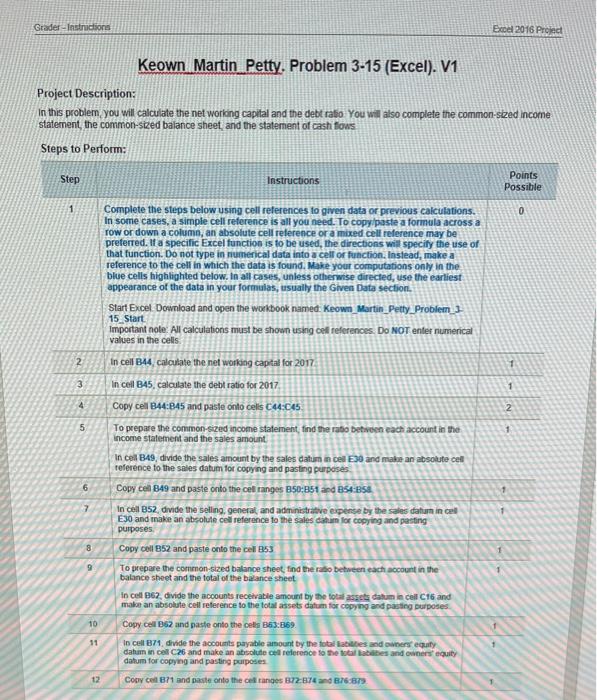

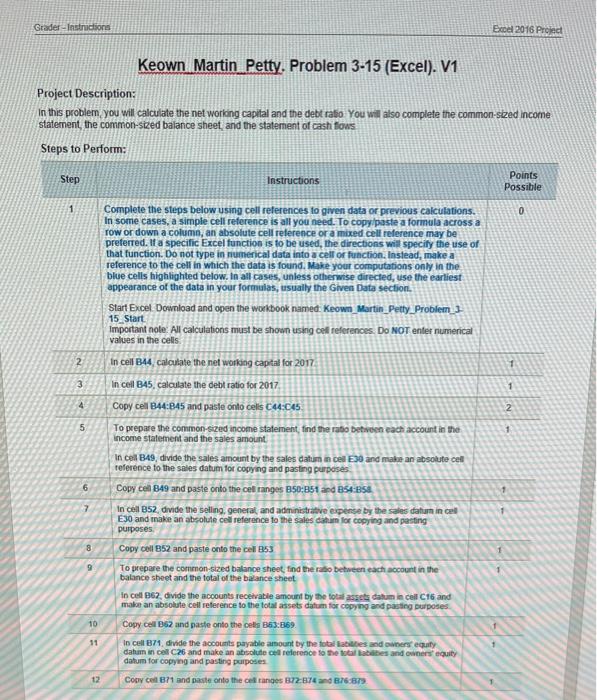

Important Note: All calculations must be shown using cell references. Do not entdr numerical values in the cells.Thank you Project Description: In this problem, you

Important Note: All calculations must be shown using cell references. Do not entdr numerical values in the cells.Thank you

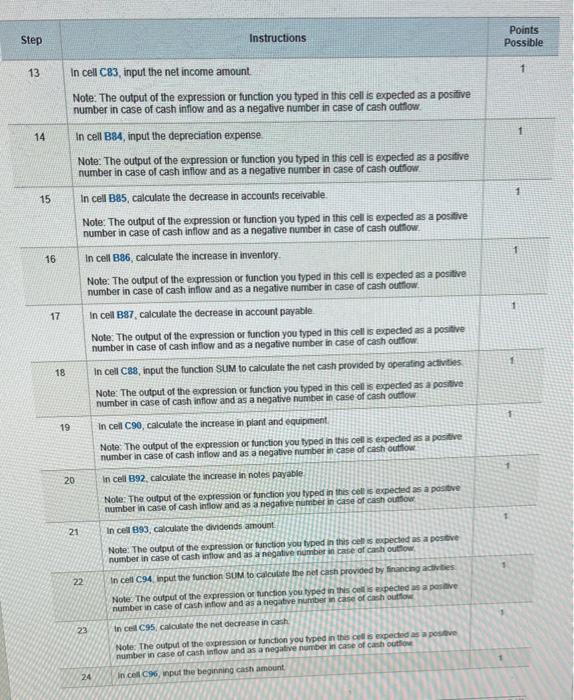

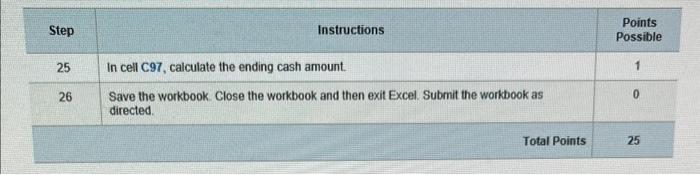

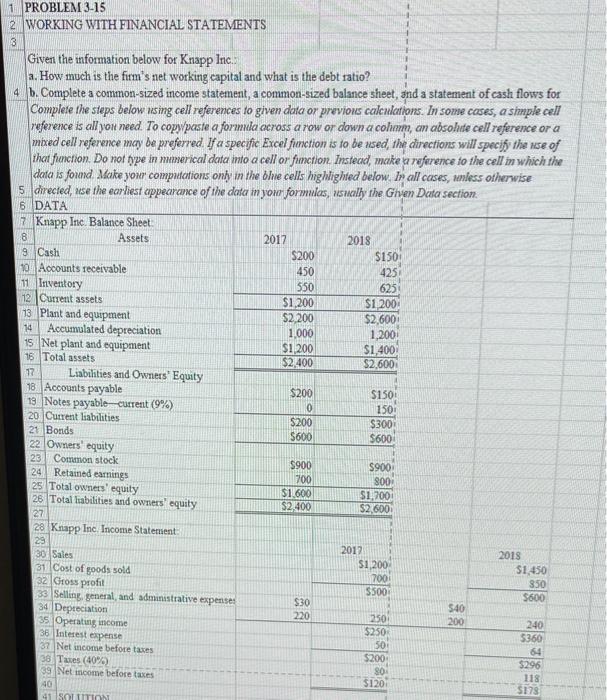

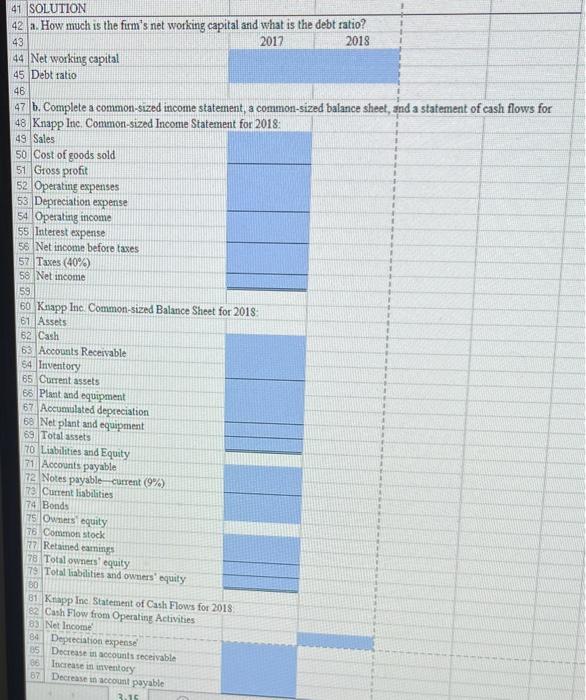

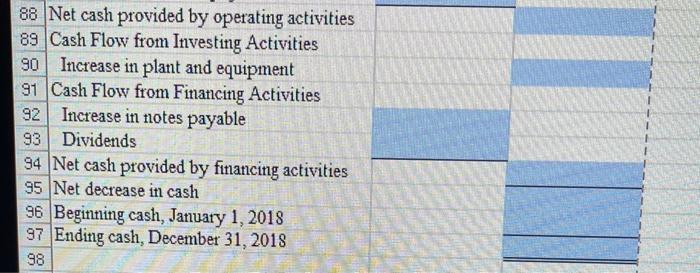

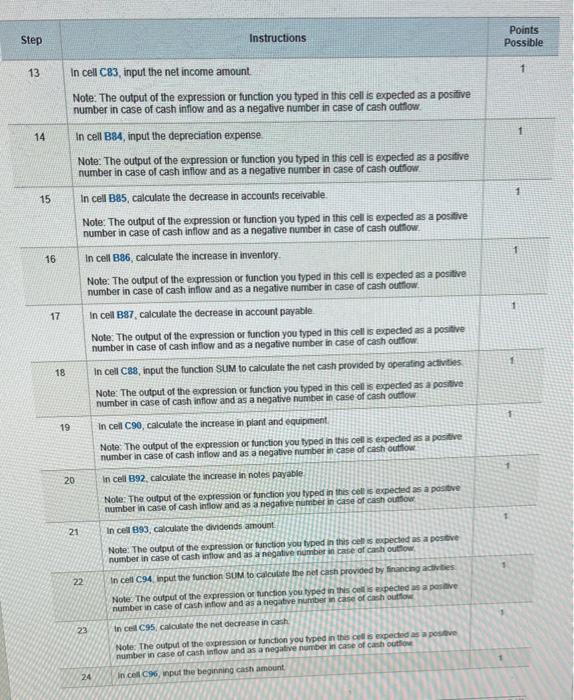

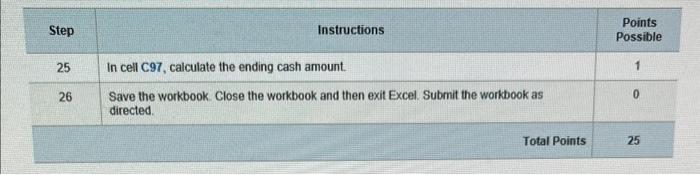

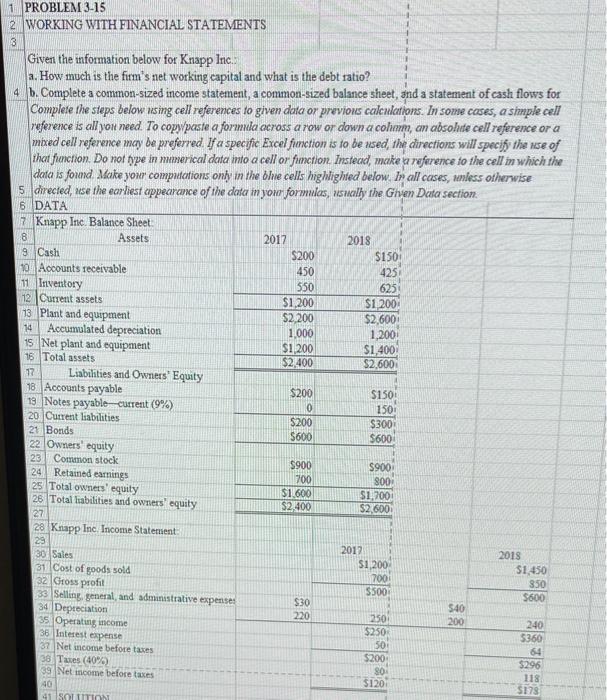

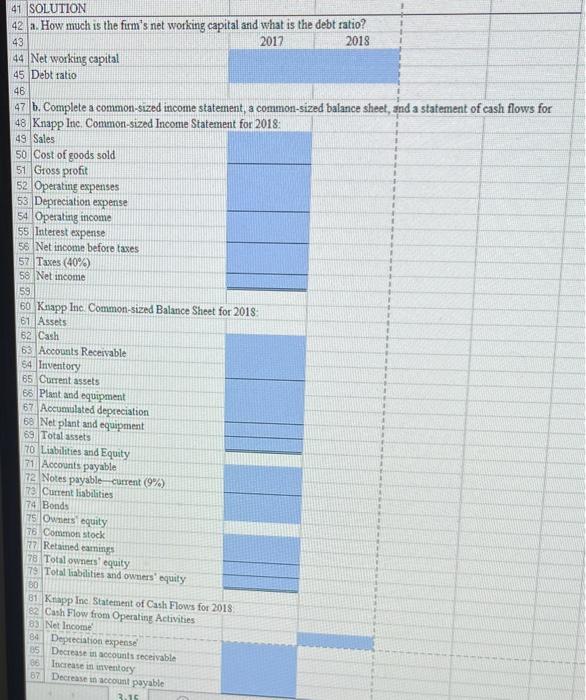

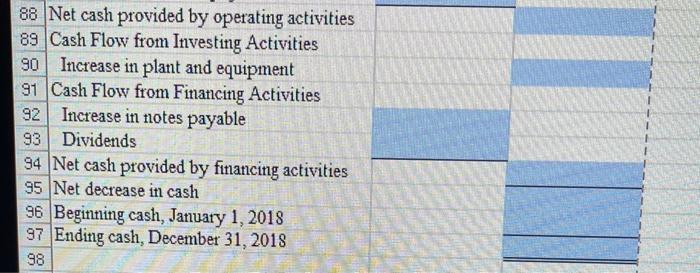

Project Description: In this problem, you will calculate the net workno caoilal and the debt rato You will also comnoleta the mmmon-sbad inrmma Step Instructions Points Possible 13 In cell C83, input the net income amount. Note: The output of the expression of function you typed in this cell is expected as a posifive number in case of cash infiow and as a negative number in case of cash outtlow. 14 In cell B84, input the depreciation expense. 1 Note: The output of the expression or function you typed in this cell is expected as a positive number in case of cash inflow and as a negative number in case of cash outflow. 15 In cell Ba5, calculate the decrease in accounts receivable. 1 Note: The output of the expression or function you typed in this cell is expected as a positre number in case of cash inflow and as a negative number in case of cash outlilow. 16 In cell B86, calculate the increase in inventory. Note: The output of the expression or function you typed in this cell is expected as a positive number in case of cash inflow and as a negative number in case of cash outtow. 17 In cell B87, calculate the decrease in account payable Note: The output of the expression or function you typed in this cell is expected as a positive number in case of cash inflow and as a negative number in case of cash outtown. 18 In cell Ca8, input the function SUM to caloulate the net cast provided by operating actubibes. Note: The output of the expression or function you typed in this cell is expected as a postive number in case of cash inflow and as a negative number in case of cash orittow 19 In cell C90, calculate the increase in plant and equipment. Note: The oulput of the expression or function you typed in this cell is expected as a postive number in case of cash infiow and as a negative number in case of cash outtlow: 20 In cel B92, calculate the increase in noles payabie. Note: The output of the expression or function you typed in this cell is expected as a postive number in case of cash insiow and as a nepative number in case of cash oiftow 21 In cel 893, calculate the dividends ampount. Note, The output of the expression or function you fiped in this cell is oupectid as a postve number in case of cash inflow and as a negative number in care of cazh cutlow 22 In cell c94 hnput the function sum to calcuitate the pel cash provideo by firincreg activites. Note The output of the expression or tinction you typed in this celis eipected as a ponative. number in case of cash inflow and as a neparye nutber m case of cach outhore. 23 in cen c95, calallate the nut decrease in cash. Note. The outpun of the oxpression or tunction you typed in this ciet is expectid as a poseve. number in case of cast inflow and as a negatre number in case of cash outhou. 24 In Col C96, input the beginning cast amount. \begin{tabular}{|l|l|l|} \hline Step & \multicolumn{1}{|c|}{ Instructions } \\ \hline 25 & In cell C97, calculate the ending cash amount. & Points \\ \hline 26 & Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. & 1 \\ \hline \end{tabular} WORKING WITH FINANCIAL STATEMENTS Given the information below for Knapp Inc.: a. How much is the firm's net working capital and what is the debt ratio? b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows for Complete the steps below using cell references to given dota or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formila across a row or down a cohmm, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the nse of that fiaction. Do not type in mmerical data into a cell or fimction. Instead, make a reference to the cell in which the data is foind. Make your computations ony in the bhe cells highlighted below. In all cases, mentess otherwise 5 directed, use the earliest copearance of the dada in nomn formulas usuall, the Ginam Data section. 41 SOLUIION 42 a. How much is the firm's net working capital and what is the debt ratio? 44 Net working capital 45 Debt tatio 46 47 b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows for 48 Knapp Inc, Common-sized Income Statement for 2018: 49 Sales Cost of goods sold 51 Gross profit 52. Operating expenses 53 Depreciation expense 54 Operating income 55 Interest expense 55 Net income before taxes 57. Taxes (40%) 58 Net income 59 60 Knapp lne Common-sized Balance Sheet for 2018: 61 Assets 62 Cash 63. Accounts Recervable 54 Inventory 65 Current assets 65 Plant and equipment 67. Accumulated depreciation 69. Net plant and equipment 69 Total assets 70 Liabilities and Equity 71 Accounts payable. 72 Notes payable current (9%) 73 Current liablities 74 Bonds 75 Owners equity 76 Common stock. 77. Retained eamings 78 Total owners' equity 79 Total liabilities and owners' equity 81. Krapp Inc Statement of Cash Flows for 2018. 82 Caih Flow from Operating Activities a3 Net Inoome' 84 Depreciation expense' 05 Decrease in accounts receivable Increase in inventory 67. Decrease in account payable 88 Net cash provided by operating activities 89 Cash Flow from Investing Activities 90 Increase in plant and equipment 91 Cash Flow from Financing Activities 92 Increase in notes payable 93 Dividends 94 Net cash provided by financing activities 95 Net decrease in cash 96 Beginning cash, January 1, 2018 97 Ending cash, December 31,2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started