Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IMPORTANT NOTE: This question is very similar to others that have been answered already but the numbers are slightly different, so please don't copy an

IMPORTANT NOTE: This question is very similar to others that have been answered already but the numbers are slightly different, so please don't copy an answer from another question. I need Parts A, B, and C! Please show work. Thank you!

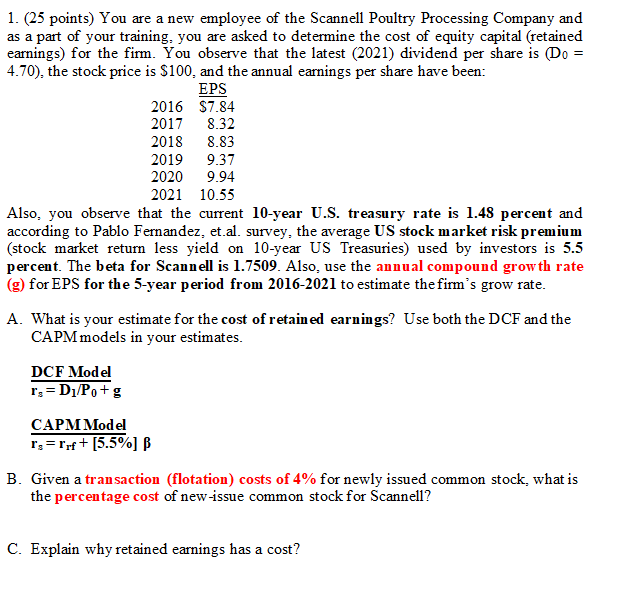

1. (25 points) You are a new employee of the Scannell Poultry Processing Company and as a part of your training, you are asked to determine the cost of equity capital (retained earnings) for the firm. You observe that the latest (2021) dividend per share is Do = 4.70), the stock price is $100, and the annual earnings per share have been: EPS 2016 $7.84 2017 8.32 2018 8.83 2019 9.37 2020 9.94 2021 10.55 Also, you observe that the current 10-year U.S. treasury rate is 1.48 percent and according to Pablo Fernandez, et.al. survey, the average US stock market risk premium (stock market return less yield on 10-year US Treasuries) used by investors is 5.5 percent. The beta for Scannell is 1.7509. Also, use the annual compound growth rate (g) for EPS for the 5-year period from 2016-2021 to estimate the firm's grow rate. A. What is your estimate for the cost of retained earnings? Use both the DCF and the CAPM models in your estimates. DCF Model rs =D1/P+g CAPM Model r;=r + [5.5%] B B. Given a transaction (flotation) costs of 4% for newly issued common stock, what is the percentage cost of new-issue common stock for Scannell? C. Explain why retained earnings has a cost? aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started