Answered step by step

Verified Expert Solution

Question

1 Approved Answer

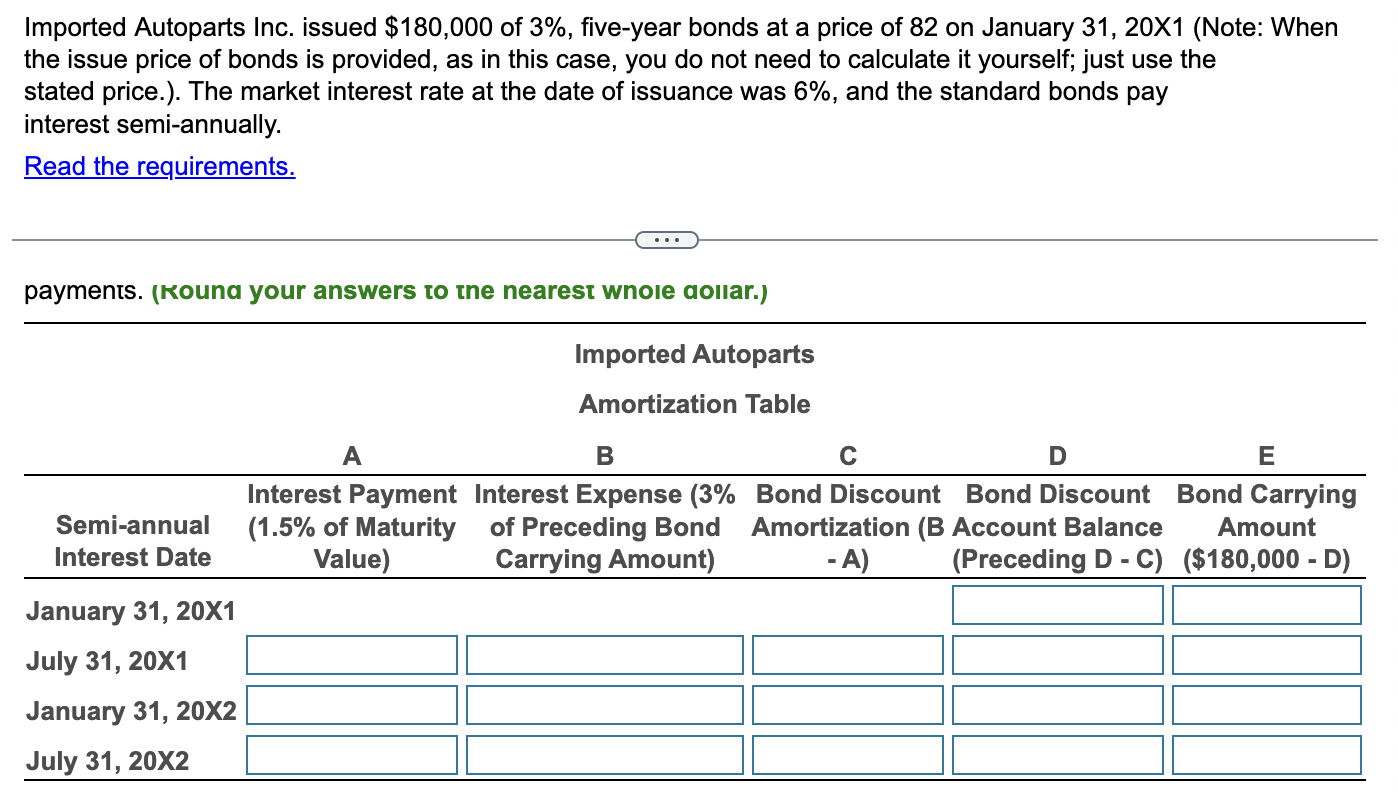

Imported Autoparts Inc. issued $ 1 8 0 , 0 0 0 of 3 % , five - year bonds at a price of 8

Imported Autoparts Inc. issued $ of fiveyear bonds at a price of on January Note: When

the issue price of bonds is provided, as in this case, you do not need to calculate it yourself; just use the

stated price. The market interest rate at the date of issuance was and the standard bonds pay

interest semiannually.

Read the requirements.

payments. Kouna your answers to tne nearest wnole aollar. Complete the table, calculating all the requested information for the two companies. Use yearend figures in place of averages where needed for the purpose of calculating ratios in this exercise Requirements Complete the table, calculating all the requested information for the two companies. Use yearend figures in place of averages where needed for the purpose of calculating the ratios in this exercise.Data tableExamine the following selected financial information for Great Deal Corporation and Best Stores, Inc., as of the end of their fiscal years ending in : Click the icon to view the financial information. Read the requirements. Complete the table, calculating all the requested information for the two companies. Use yearend figures in place of averages where needed for the purpose of calculating ratios in this exercise. Round your answers to two decimal places, XXX Enter amounts in millions as provided to you in the problem statement. how to identify total ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started