Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 1 9 8 9 , General Motors ( GM ) was evaluating the acquisition of Hughes Aircraft Corporation. Recognizing that the appropriate discount rate

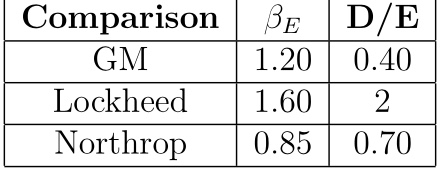

In General Motors GM was evaluating the acquisition of Hughes Aircraft Corporation. Recognizing that the appropriate discount rate for the projected cash flows of Hughes was different than its own cost of capital, GM assumed that Hughes had approximately the same risk as Lockheed or Northrop, which had low risk defense contracts and products that were similar to Hughes. Specifically, assume the following inputs:

Target DE for Hughes' acquisition

Hughes' expected cash flow next year million USD

Growth rate of Hughes' cash flows per year

Appropriate discount rate on debt riskless rate

Expected return of the tangency portfolio

A Analyze the Hughes acquisition which took place by first computing the betas of the comparison firms, Lockheed and Northrop, as if they were all equity financed. Assume there are no taxes.

b Compute the beta of the assets of the Hughes acquisition, assuming there are no taxes, by taking the average of the asset betas of Lockheed and Northrop.

c Compute the cost of capital for the Hughes acquisition, assuming there are no taxes.

d Compute the value of Hughes with the cost of capital estimated in exercise c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started