Answered step by step

Verified Expert Solution

Question

1 Approved Answer

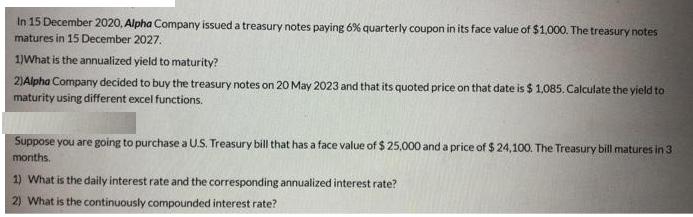

In 15 December 2020, Alpha Company issued a treasury notes paying 6% quarterly coupon in its face value of $1,000. The treasury notes matures

In 15 December 2020, Alpha Company issued a treasury notes paying 6% quarterly coupon in its face value of $1,000. The treasury notes matures in 15 December 2027. 1) What is the annualized yield to maturity? 2) Alpha Company decided to buy the treasury notes on 20 May 2023 and that its quoted price on that date is $ 1,085. Calculate the yield to maturity using different excel functions. Suppose you are going to purchase a U.S. Treasury bill that has a face value of $ 25,000 and a price of $ 24,100. The Treasury bill matures in 3 months. 1) What is the daily interest rate and the corresponding annualized interest rate? 2) What is the continuously compounded interest rate?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 To find the annualized yield to maturity for the treasury notes we need to first calculate the annual coupon payment by multiplying the quarter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started