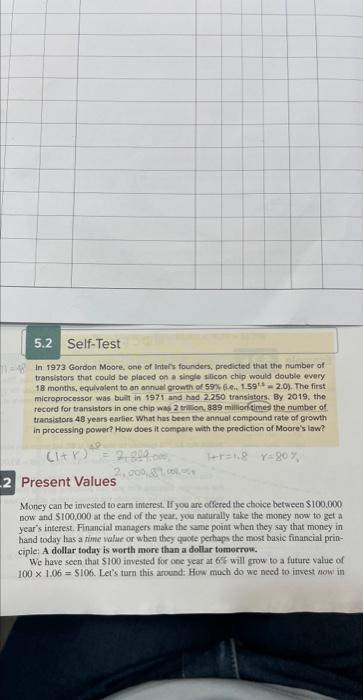

In 1973 Gordon Moore, one of lnters founders, predicted that the number of transistors that could be placed on a single silicon chip would double evecy. 18 months, equivalent to an annuel growth of 59%,(4.1.591/1=2.0). The first microprocessor was bult in 1971 and hod 2,250 transisters. By 2019, the record for transistors in one chip was 2 trifien. 889 millign times the number of transistors 48 years evrliec. What has been the annual compound rate of growth in processing power? How does it cempare with the prediction of Moore's law? Present Values Money can be irvested to earm interest. If you are offered the chovec between $100.000 now and $100,000 at the end of the year, yow naturally take the money now to get a year's interest. Financial managers make the sume point when they say that money in hand today has a nime salue or when they quote pertaps the most basic financial principle: A dollar today is worth more than a dollar tomorrow. We have seen that $100 imvested for one year at 6 es will grow to a future value of 1001.06=5106. Let's turn this around: Hor much do we need to invest now in In 1973 Gordon Moore, one of lnters founders, predicted that the number of transistors that could be placed on a single silicon chip would double evecy. 18 months, equivalent to an annuel growth of 59%,(4.1.591/1=2.0). The first microprocessor was bult in 1971 and hod 2,250 transisters. By 2019, the record for transistors in one chip was 2 trifien. 889 millign times the number of transistors 48 years evrliec. What has been the annual compound rate of growth in processing power? How does it cempare with the prediction of Moore's law? Present Values Money can be irvested to earm interest. If you are offered the chovec between $100.000 now and $100,000 at the end of the year, yow naturally take the money now to get a year's interest. Financial managers make the sume point when they say that money in hand today has a nime salue or when they quote pertaps the most basic financial principle: A dollar today is worth more than a dollar tomorrow. We have seen that $100 imvested for one year at 6 es will grow to a future value of 1001.06=5106. Let's turn this around: Hor much do we need to invest now in