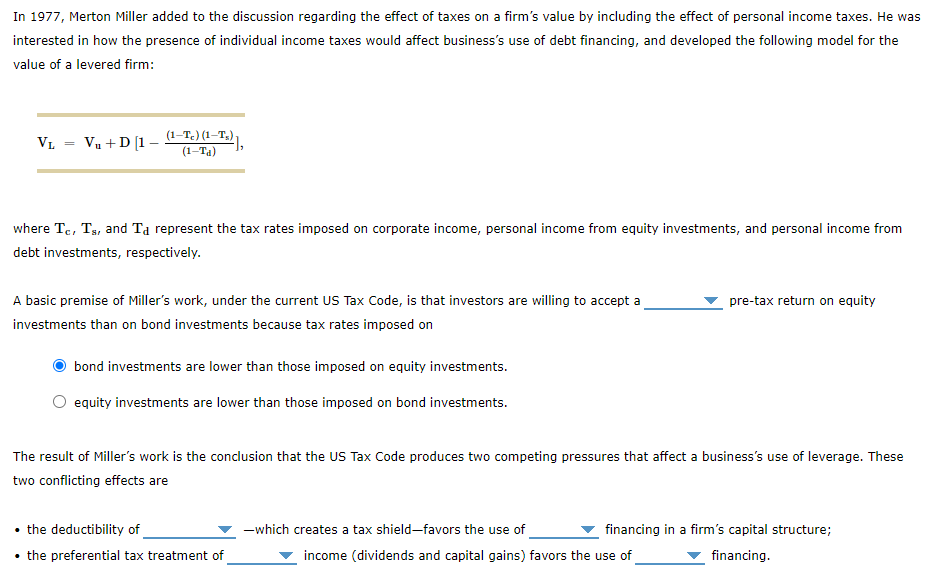

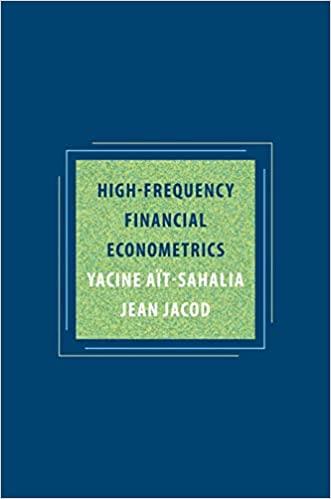

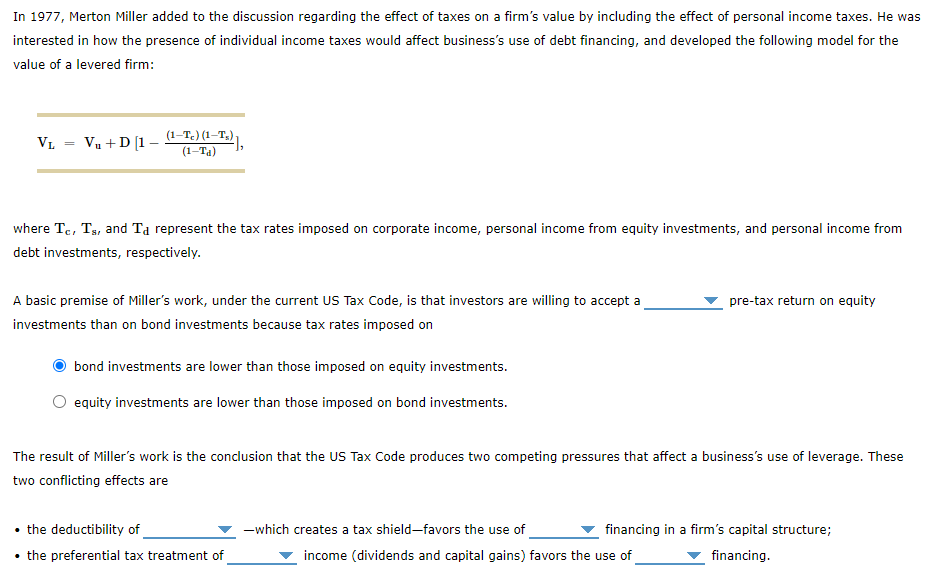

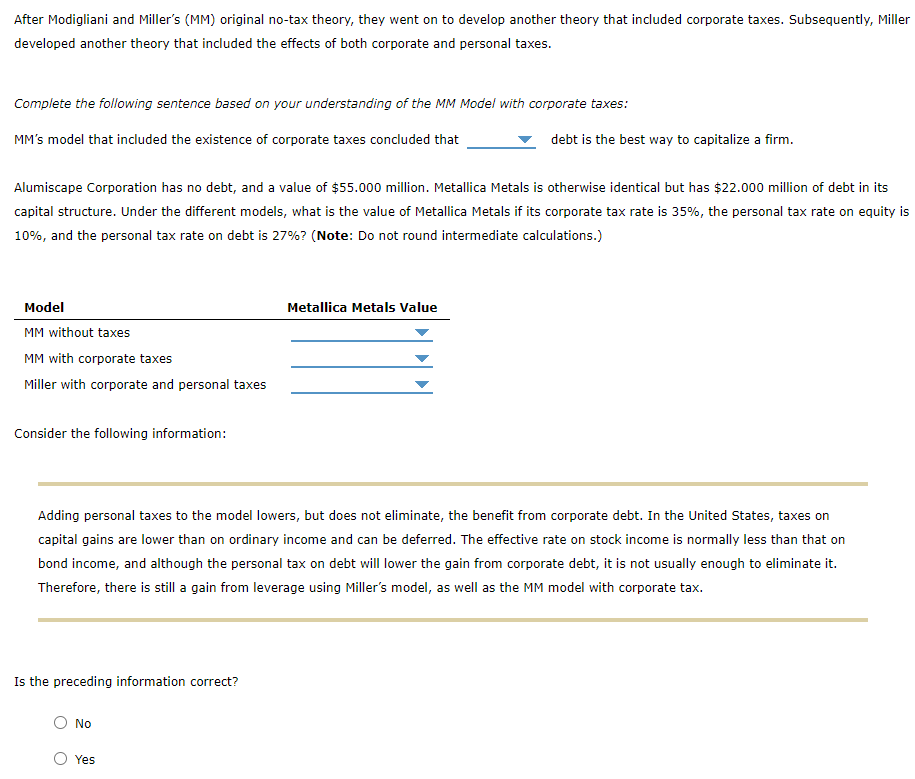

In 1977, Merton Miller added to the discussion regarding the effect of taxes on a firm's value by including the effect of personal income taxes. He was interested in how the presence of individual income taxes would affect business's use of debt financing, and developed the following model for the value of a levered firm: VL VE+D [1 (S-T)(1-T), (1-T) where Tc, Ts, and Ta represent the tax rates imposed on corporate income, personal income from equity investments, and personal income from debt investments, respectively. pre-tax return on equity A basic premise of Miller's work, under the current US Tax Code, is that investors are willing to accept a investments than on bond investments because tax rates imposed on bond investments are lower than those imposed on equity investments. equity investments are lower than those imposed on bond investments. The result of Miller's work is the conclusion that the US Tax Code produces two competing pressures that affect a business's use of leverage. These two conflicting effects are the deductibility of the preferential tax treatment of which creates a tax shield-favors the use of financing in a firm's capital structure; income (dividends and capital gains) favors the use of financing. After Modigliani and Miller's (MM) original no-tax theory, they went on to develop another theory that included corporate taxes. Subsequently, Miller developed another theory that included the effects of both corporate and personal taxes. Complete the following sentence based on your understanding of the MM Model with corporate taxes: MM's model that included the existence of corporate taxes concluded that debt is the best way to capitalize a firm. Alumiscape Corporation has no debt, and a value of $55.000 million. Metallica Metals is otherwise identical but has $22.000 million of debt in its capital structure. Under the different models, what is the value of Metallica Metals if its corporate tax rate is 35%, the personal tax rate on equity is 10%, and the personal tax rate on debt is 27%? (Note: Do not round intermediate calculations.) Metallica Metals Value Model MM without taxes MM with corporate taxes Miller with corporate and personal taxes Consider the following information: Adding personal taxes to the model lowers, but does not eliminate, the benefit from corporate debt. In the United States, taxes on capital gains are lower than on ordinary income and can be deferred. The effective rate on stock income is normally less than that on bond income, and although the personal tax on debt will lower the gain from corporate debt, it is not usually enough to eliminate it. Therefore, there is still a gain from leverage using Miller's model, as well as the MM model with corporate tax. Is the preceding information correct? No Yes In 1977, Merton Miller added to the discussion regarding the effect of taxes on a firm's value by including the effect of personal income taxes. He was interested in how the presence of individual income taxes would affect business's use of debt financing, and developed the following model for the value of a levered firm: VL VE+D [1 (S-T)(1-T), (1-T) where Tc, Ts, and Ta represent the tax rates imposed on corporate income, personal income from equity investments, and personal income from debt investments, respectively. pre-tax return on equity A basic premise of Miller's work, under the current US Tax Code, is that investors are willing to accept a investments than on bond investments because tax rates imposed on bond investments are lower than those imposed on equity investments. equity investments are lower than those imposed on bond investments. The result of Miller's work is the conclusion that the US Tax Code produces two competing pressures that affect a business's use of leverage. These two conflicting effects are the deductibility of the preferential tax treatment of which creates a tax shield-favors the use of financing in a firm's capital structure; income (dividends and capital gains) favors the use of financing. After Modigliani and Miller's (MM) original no-tax theory, they went on to develop another theory that included corporate taxes. Subsequently, Miller developed another theory that included the effects of both corporate and personal taxes. Complete the following sentence based on your understanding of the MM Model with corporate taxes: MM's model that included the existence of corporate taxes concluded that debt is the best way to capitalize a firm. Alumiscape Corporation has no debt, and a value of $55.000 million. Metallica Metals is otherwise identical but has $22.000 million of debt in its capital structure. Under the different models, what is the value of Metallica Metals if its corporate tax rate is 35%, the personal tax rate on equity is 10%, and the personal tax rate on debt is 27%? (Note: Do not round intermediate calculations.) Metallica Metals Value Model MM without taxes MM with corporate taxes Miller with corporate and personal taxes Consider the following information: Adding personal taxes to the model lowers, but does not eliminate, the benefit from corporate debt. In the United States, taxes on capital gains are lower than on ordinary income and can be deferred. The effective rate on stock income is normally less than that on bond income, and although the personal tax on debt will lower the gain from corporate debt, it is not usually enough to eliminate it. Therefore, there is still a gain from leverage using Miller's model, as well as the MM model with corporate tax. Is the preceding information correct? No Yes