Question

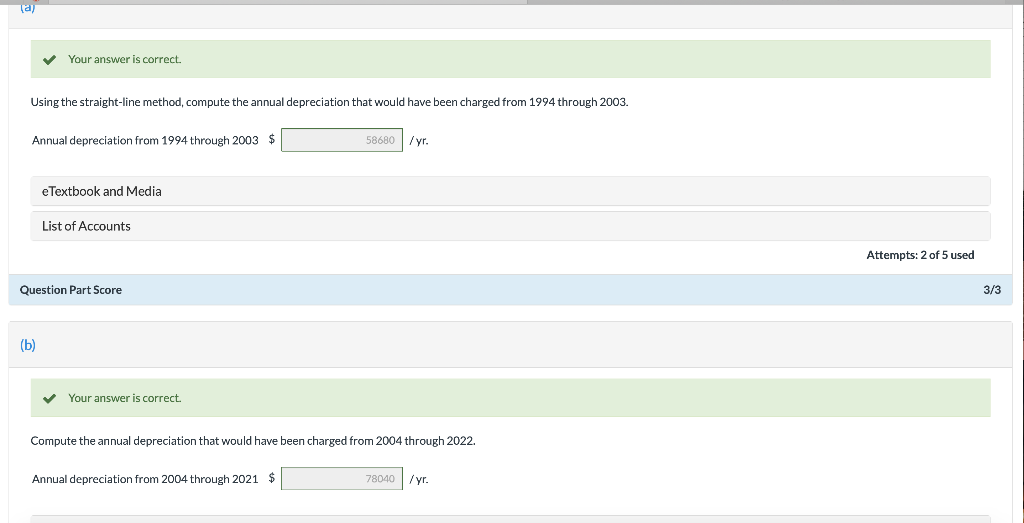

In 1993, Kingbird Company completed the construction of a building at a cost of $2,420,000 and first occupied it in January 1994. It was estimated

In 1993, Kingbird Company completed the construction of a building at a cost of $2,420,000 and first occupied it in January 1994. It was estimated that the building will have a useful life of 40 years and a salvage value of $72,800 at the end of that time. Early in 2004, an addition to the building was constructed at a cost of $605,000. At that time, it was estimated that the remaining life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a salvage value of $24,200. In 2022, it is determined that the probable life of the building and addition will extend to the end of 2053, or 20 years beyond the original estimate.

I cannot get this! please help

Compute the annual depreciation to be charged, beginning with 2022. (Round answer to 0 decimal places, e.g. 45,892.)

| Annual depreciation expensebuilding | $ |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started