Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 1995, Lihir Gold Limited was granted a special mining lease to develop a gold mining project situated on Lihir Island, Papua New Guinea.

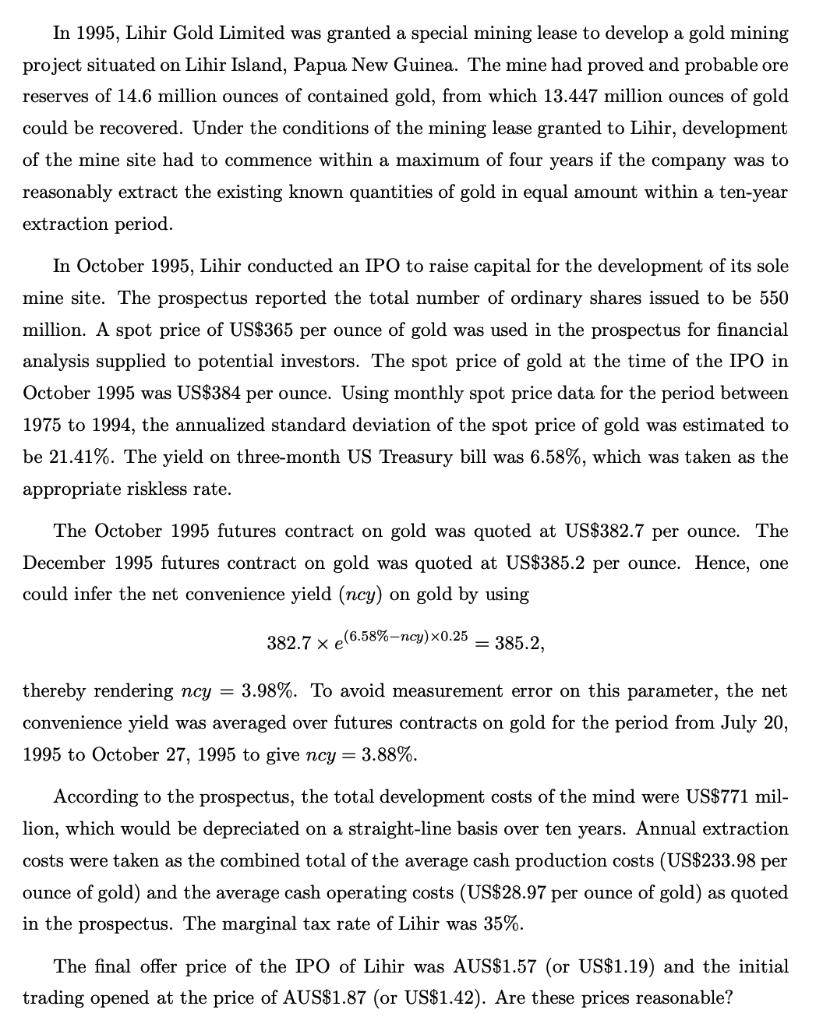

In 1995, Lihir Gold Limited was granted a special mining lease to develop a gold mining project situated on Lihir Island, Papua New Guinea. The mine had proved and probable ore reserves of 14.6 million ounces of contained gold, from which 13.447 million ounces of gold could be recovered. Under the conditions of the mining lease granted to Lihir, development of the mine site had to commence within a maximum of four years if the company was to reasonably extract the existing known quantities of gold in equal amount within a ten-year extraction period. In October 1995, Lihir conducted an IPO to raise capital for the development of its sole mine site. The prospectus reported the total number of ordinary shares issued to be 550 million. A spot price of US$365 per ounce of gold was used in the prospectus for financial analysis supplied to potential investors. The spot price of gold at the time of the IPO in October 1995 was US$384 per ounce. Using monthly spot price data for the period between 1975 to 1994, the annualized standard deviation of the spot price of gold was estimated to be 21.41%. The yield on three-month US Treasury bill was 6.58%, which was taken as the appropriate riskless rate. The October 1995 futures contract on gold was quoted at US$382.7 per ounce. The December 1995 futures contract on gold was quoted at US$385.2 per ounce. Hence, one could infer the net convenience yield (ncy) on gold by using 382.7 x (6.58%-ncy)0.25 = 385.2, thereby rendering ncy = 3.98%. To avoid measurement error on this parameter, the net convenience yield was averaged over futures contracts on gold for the period from July 20, 1995 to October 27, 1995 to give ncy = 3.88%. According to the prospectus, the total development costs of the mind were US$771 mil- lion, which would be depreciated on a straight-line basis over ten years. Annual extraction costs were taken as the combined total of the average cash production costs (US$233.98 per ounce of gold) and the average cash operating costs (US$28.97 per ounce of gold) as quoted in the prospectus. The marginal tax rate of Lihir was 35%. The final offer price of the IPO of Lihir was AUS$1.57 (or US$1.19) and the initial trading opened at the price of AUS$1.87 (or US$1.42). Are these prices reasonable?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started