Answered step by step

Verified Expert Solution

Question

1 Approved Answer

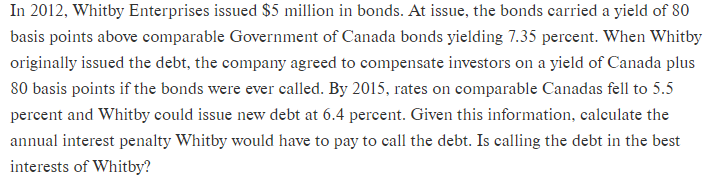

In 2 0 1 2 , Whitby Enterprises issued $ 5 million in bonds. At issue, the bonds carried a yield of 8 0 basis

In Whitby Enterprises issued $ million in bonds. At issue, the bonds carried a yield of basis points above comparable Government of Canada bonds yielding percent. When Whitby

originally issued the debt, the company agreed to compensate investors on a yield of Canada plus basis points if the bonds were ever called. By rates on comparable Canadas fell to

percent and Whitby could issue new debt at percent. Given this information, calculate the annual interest penalty Whitby would have to pay to call the debt. Is calling the debt in the best interests of Whitby?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started