Answered step by step

Verified Expert Solution

Question

1 Approved Answer

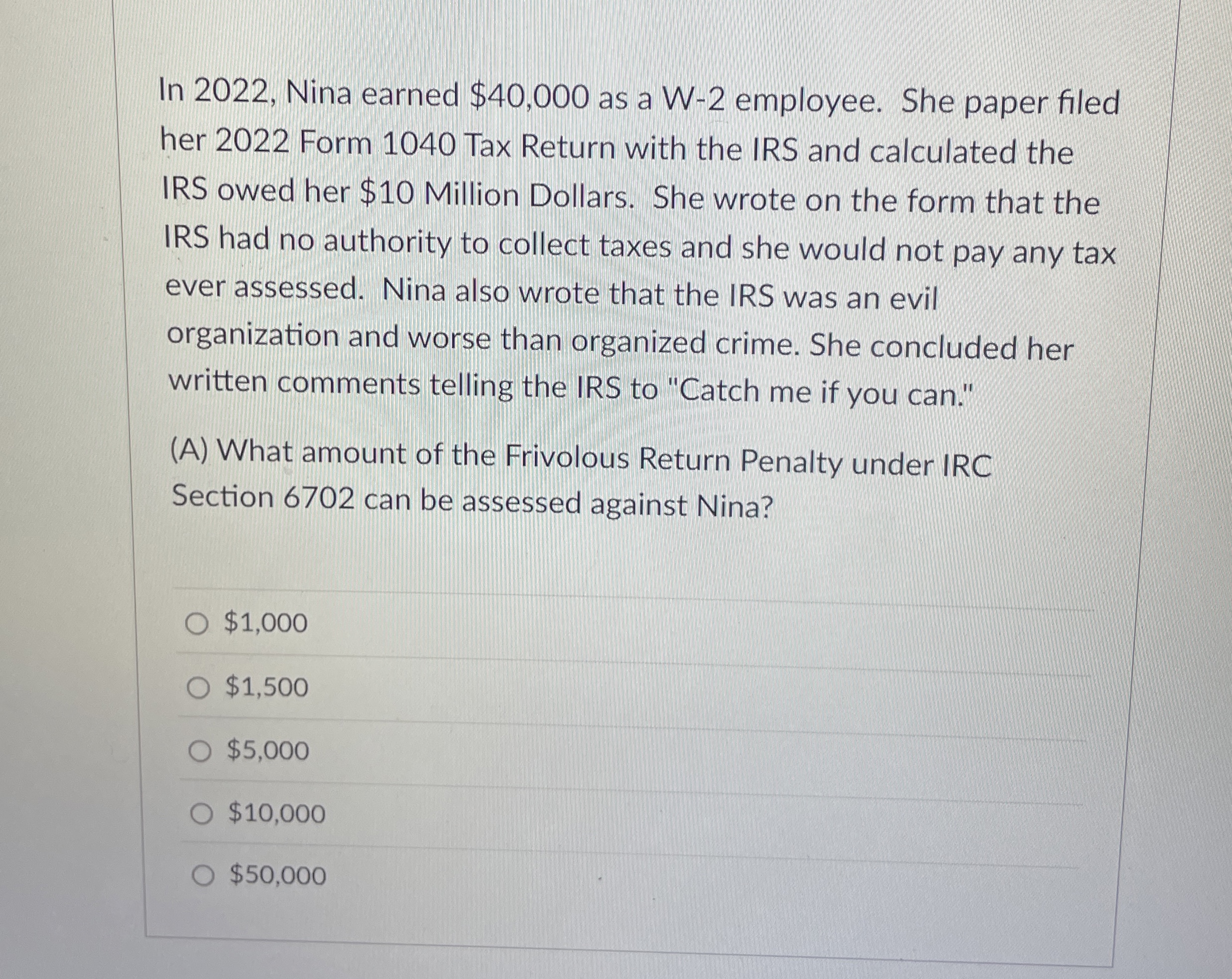

In 2 0 2 2 , Nina earned $ 4 0 , 0 0 0 as a W - 2 employee. She paper filed her

In Nina earned $ as a W employee. She paper filed

her Form Tax Return with the IRS and calculated the

IRS owed her $ Million Dollars. She wrote on the form that the

IRS had no authority to collect taxes and she would not pay any tax

ever assessed. Nina also wrote that the IRS was an evil

organization and worse than organized crime. She concluded her

written comments telling the IRS to "Catch me if you can."

A What amount of the Frivolous Return Penalty under IRC

Section can be assessed against Nina?

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started