Answered step by step

Verified Expert Solution

Question

1 Approved Answer

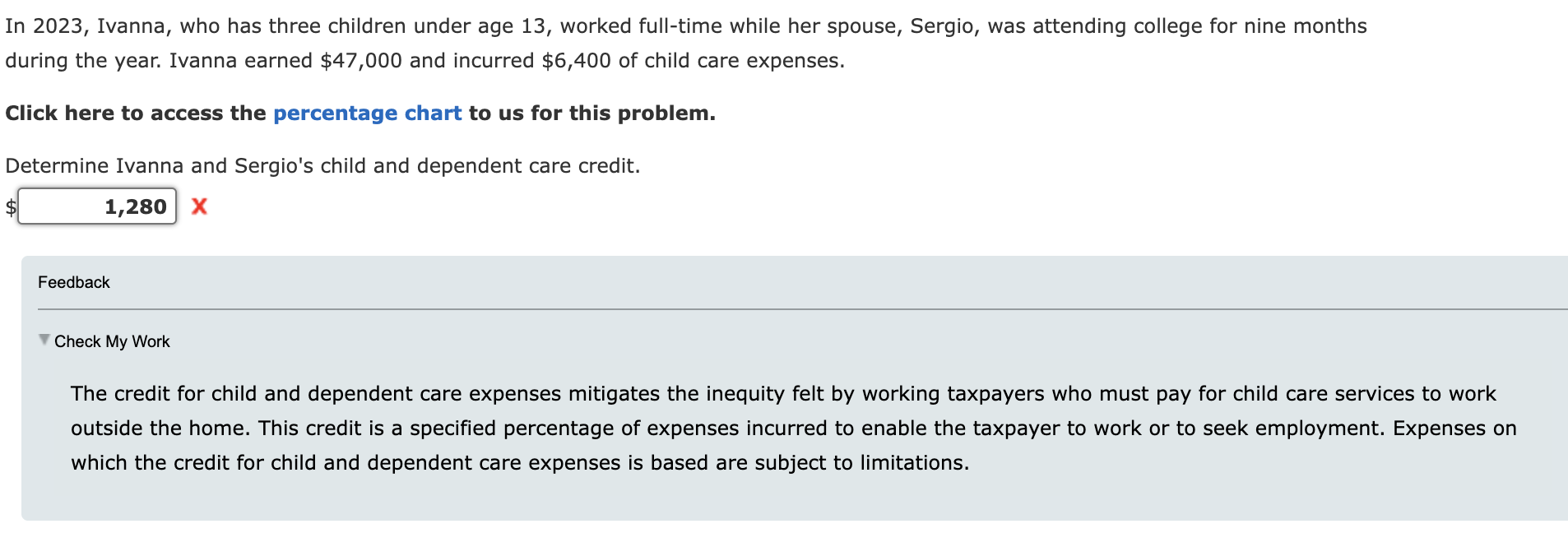

In 2 0 2 3 , Ivanna, who has three children under age 1 3 , worked full - time while her spouse, Sergio, was

In Ivanna, who has three children under age worked fulltime while her spouse, Sergio, was attending college for nine months

during the year. Ivanna earned $ and incurred $ of child care expenses.

Click here to access the percentage chart to us for this problem.

Determine Ivanna and Sergio's child and dependent care credit.

$

The credit for child and dependent care expenses mitigates the inequity felt by working taxpayers who must pay for child care services to work

outside the home. This credit is a specified percentage of expenses incurred to enable the taxpayer to work or to seek employment. Expenses on

which the credit for child and dependent care expenses is based are subject to limitations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started