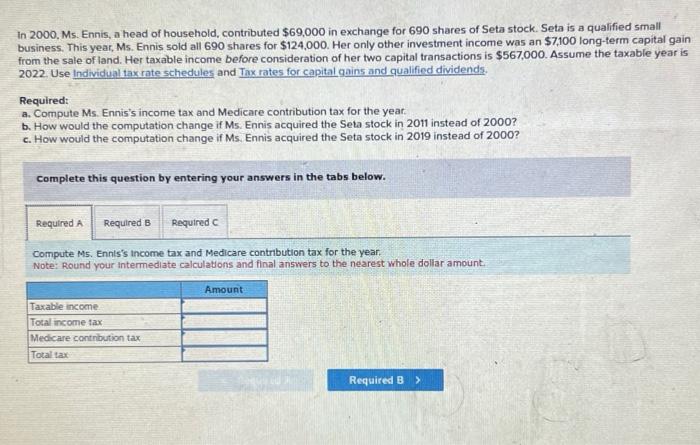

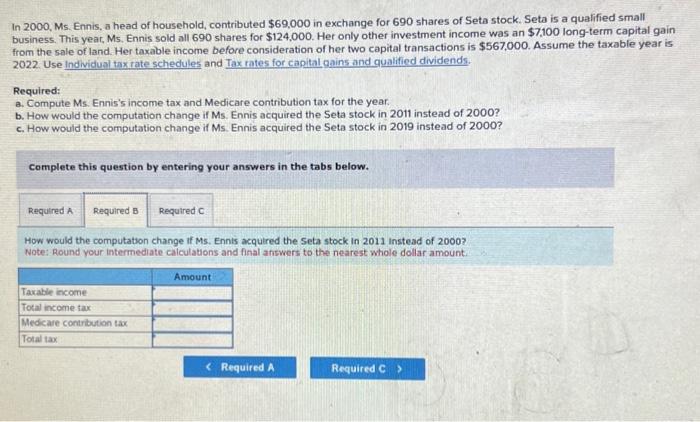

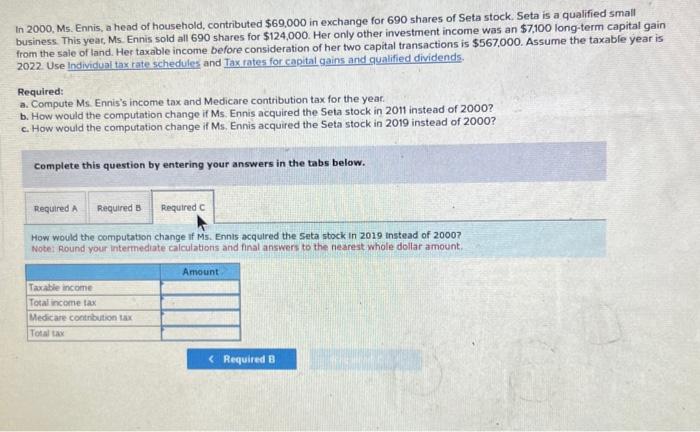

In 2000, Ms. Ennis, a head of household, contributed $69,000 in exchange for 690 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 690 shares for $124,000. Her only other investment income was an $7,100 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $567,000. Assume the taxable year is 2022 . Use Individual tax rate schedules and Tax rates for capital qains and qualifind dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year: b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000? Complete this question by entering your answers in the tabs below. Compute M5. Ennis's income tax and Medicare contribution tax for the year. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. In 2000 , Ms. Ennis, a head of household, contributed $69,000 in exchange for 690 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 690 shares for $124,000. Her only other investment income was an $7,100 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $567,000. Assume the taxable year is 2022 Use and Tax rates for capital qains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Complete this question by entering your answers in the tabs below. How would the computation change if Ms. Ennts acquired the Seta stock in 2011 instead of 2000 ? Note: Round your intermediate calculations and final afiswers to the nearest whole dollar amount: In 2000, M5. Ennis, a head of household, contributed $69,000 in exchange for 690 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 690 shares for $124,000. Her only other investment income was an $7,100 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $567.000. Assume the taxable year is 2022. Use individual tax rate schedules and Tax rates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000? Complete this question by entering your answers in the tabs below. How would the computation change if M's. Ennis acquired the Seta stock in 2019 instead of 20007 Notei Round your intermediate calculations and final answers to the nearest whole dollar amount