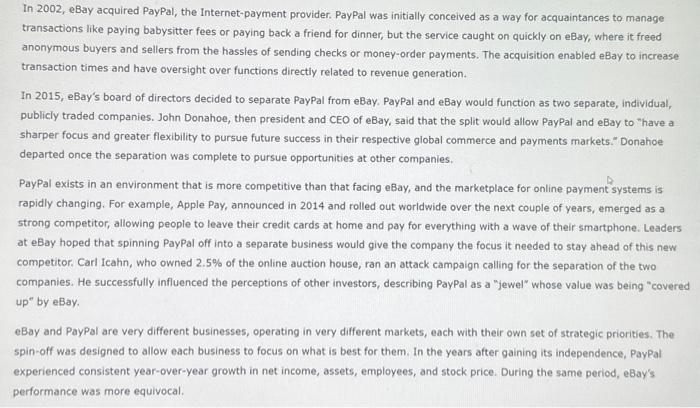

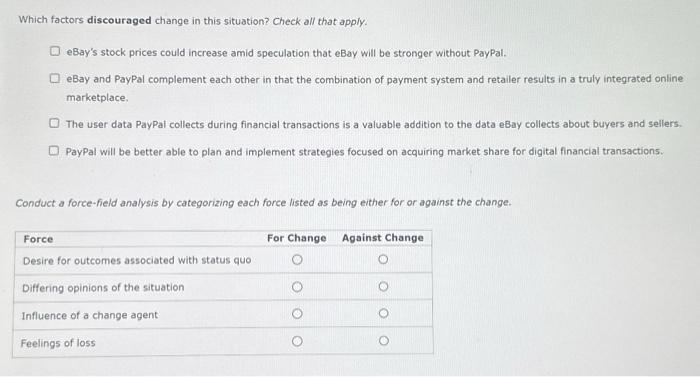

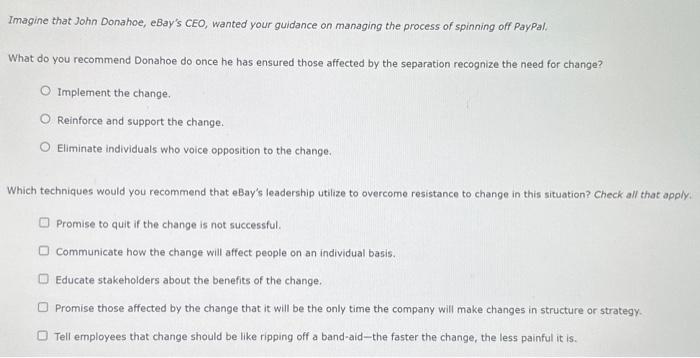

In 2002, eBay acquired PayPal, the Internet-payment provider. PayPal was initially conceived as a way for acquaintances to manage transactions like paying babysitter fees or paying back a friend for dinner, but the service caught on quickly on eBay, where it freed anonymous buyers and sellers from the hassles of sending checks or money-order payments. The acquisition enabled eBay to increase transaction times and have oversight over functions directly related to revenue generation. In 2015, eBay's board of directors decided to separate PayPal from eBay. PayPal and eBay would function as two separate, individual, publicly traded companies. John Donahoe, then president and CEO of eBay, said that the split would allow PayPal and eBay to "have a sharper focus and greater flexibility to pursue future success in their respective global commerce and payments markets." Donahoe departed once the separation was complete to pursue opportunities at other companies. PayPal exists in an environment that is more competitive than that facing eBay, and the marketplace for online payment systems is rapidly changing. For example, Apple Pay, announced in 2014 and rolled out worldwide over the next couple of years, emerged as a strong competitor, allowing people to leave their credit cards at home and pay for everything with a wave of their smartphone. Leaders at eBay hoped that spinning Paypal off into a separate business would give the company the focus it needed to stay ahead of this new competitor. Carl Icahn, who owned 2.5% of the online auction house, ran an attack campaign calling for the separation of the two companies. He successfully influenced the perceptions of other investors, describing PayPal as a "jewel" whose value was being "covered up" by eBay. eBay and Paypal are very different businesses, operating in very different markets, each with their own set of strategic priorities. The spin-off was designed to allow each business to focus on what is best for them. In the years after gaining its independence, PayPal experienced consistent year-over-year growth in net income, assets, employees, and stock price. During the same period, eBay's performance was more equivocal. Which factors discouraged change in this situation? Check all that apply. eBay's stock prices could increase amid speculation that eBay will be stronger without PayPal. eBay and PayPal complement each other in that the combination of payment system and retailer results in a truly integrated online marketplace. The user data PayPai collects during financial transactions is a valuable addition to the data eBay collects about buyers and sellers. Paypal will be better able to plan and implement strategles focused on acquiring market share for digital financial transactions. Conduct a force-field analysis by categorizing each force listed as being either for or against the change. Imagine that John Donahoe, eBay's CEO, wanted your guidance on managing the process of spinning off PayPal. What do you recommend Donahoe do once he has ensured those affected by the separation recognize the need for change? Implement the change. Reinforce and support the change. Eliminate individuals who voice opposition to the change. Which techniques would you recommend that eBay's leadership utilize to overcome resistance to change in this situation? Check all that apply. Promise to quit if the change is not successful. Communicate how the change will affect people on an individual basis. Educate stakeholders about the benefits of the change. Promise those affected by the change that it will be the only time the company will make changes in structure or strategy. Tell employees that change should be like ripping off a band-aid-the faster the change, the less painful it is