Question

In 2005, your investment company has offered to buy Ideko for $52.6 million. The projected improvements in working capital may or may not occur. If

In 2005, your investment company has offered to buy Ideko for $52.6 million. The projected improvements in working capital may or may not occur. If the projected improvements in working capital occur, the NPV of the investment opportunity will be approximately $54.59$ million. If the projected improvements in working capital do not occur, the NPV of the investment opportunity will be approximately $44.38 million. Infer the value of the projected improvements in working capital under the assumptions that Ideko's market share will increase by 0.6% per year and that investment, financing,

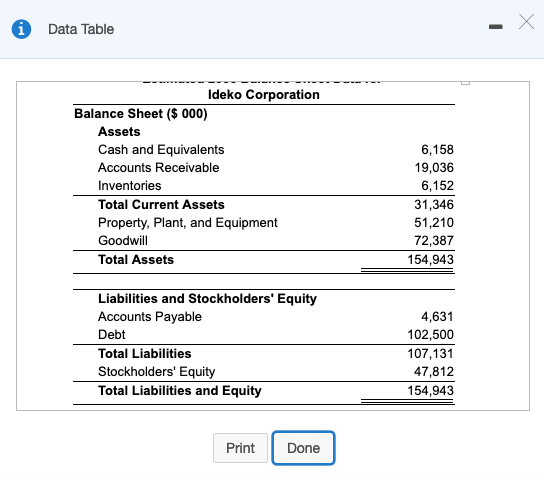

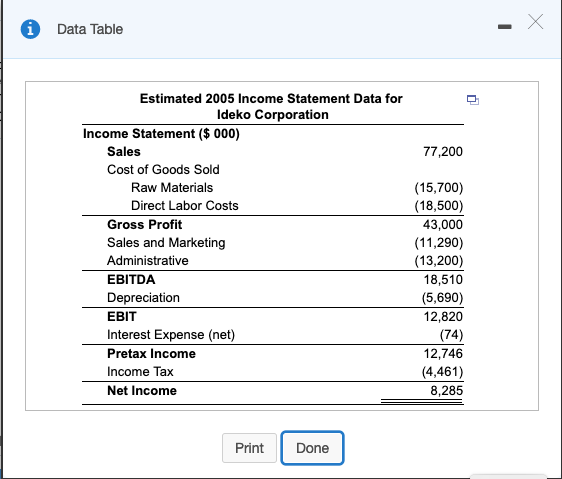

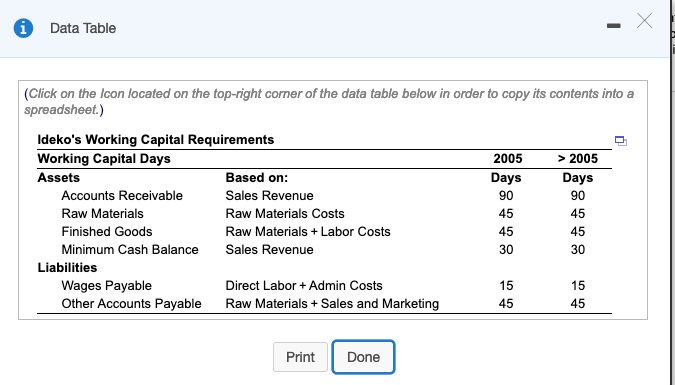

and dpreciation will be adjusted accordingly. Ideko's income statement and balance sheet along with the working capital are in the photos down below.

and dpreciation will be adjusted accordingly. Ideko's income statement and balance sheet along with the working capital are in the photos down below.

The NPV of the savings in working capital management is $ .... million

Data Table Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Goodwill Total Assets 6,158 19,036 6,152 31,346 51,210 72,387 154,943 Liabilities and Stockholders' Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 4,631 102,500 107,131 47,812 154,943 Print Done Data Table Estimated 2005 Income Statement Data for Ideko Corporation Income Statement $ 000) 77,200 Sales Cost of Goods Sold (15,700) (18,500) 43,000 (11,290) (13,200) 18,510 (5,690) 12,820 (74) 12,746 (4,461) 8,285 Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income Print Done Data Table (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) ldeko's Working Capital Requirements Working Capital Days Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Based on: Sales Revenue Raw Materials Costs Raw MaterialsLabor Costs Sales Revenue 2005 Days 90 45 45 30 2005 Days 90 45 45 30 Liabilities 15 45 15 45 Direct Labor +Admin Costs Wages Payable Other Accounts Payable Raw Materials +Sales and Marketing Print Done Data Table Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Goodwill Total Assets 6,158 19,036 6,152 31,346 51,210 72,387 154,943 Liabilities and Stockholders' Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 4,631 102,500 107,131 47,812 154,943 Print Done Data Table Estimated 2005 Income Statement Data for Ideko Corporation Income Statement $ 000) 77,200 Sales Cost of Goods Sold (15,700) (18,500) 43,000 (11,290) (13,200) 18,510 (5,690) 12,820 (74) 12,746 (4,461) 8,285 Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income Print Done Data Table (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) ldeko's Working Capital Requirements Working Capital Days Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Based on: Sales Revenue Raw Materials Costs Raw MaterialsLabor Costs Sales Revenue 2005 Days 90 45 45 30 2005 Days 90 45 45 30 Liabilities 15 45 15 45 Direct Labor +Admin Costs Wages Payable Other Accounts Payable Raw Materials +Sales and Marketing Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started