Question

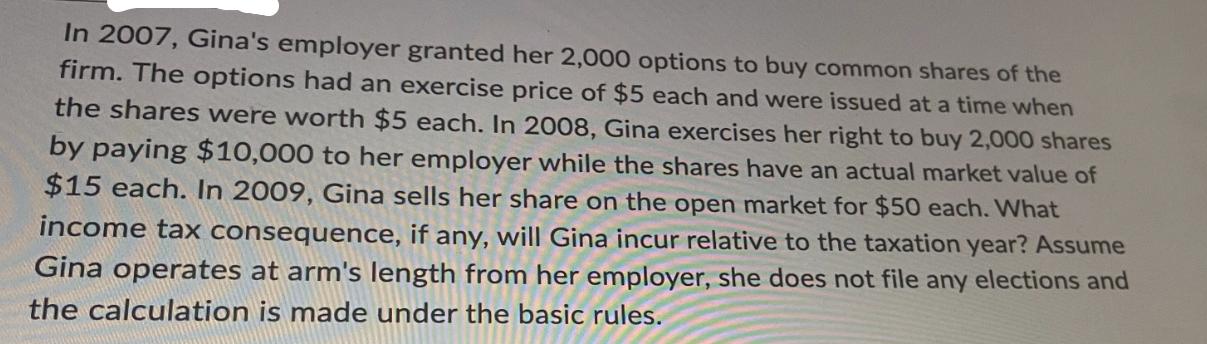

In 2007, Gina's employer granted her 2,000 options to buy common shares of the firm. The options had an exercise price of $5 each

In 2007, Gina's employer granted her 2,000 options to buy common shares of the firm. The options had an exercise price of $5 each and were issued at a time when the shares were worth $5 each. In 2008, Gina exercises her right to buy 2,000 shares by paying $10,000 to her employer while the shares have an actual market value of $15 each. In 2009, Gina sells her share on the open market for $50 each. What income tax consequence, if any, will Gina incur relative to the taxation year? Assume Gina operates at arm's length from her employer, she does not file any elections and the calculation is made under the basic rules.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres a breakdown of Ginas income tax consequences for each event assuming US tax law 2007 Grant of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting A User Perspective

Authors: Robert E Hoskin, Maureen R Fizzell, Donald C Cherry

6th Canadian Edition

470676604, 978-0470676608

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App