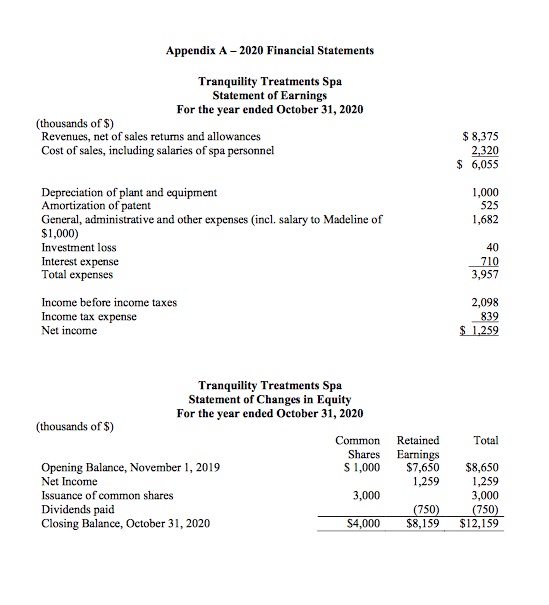

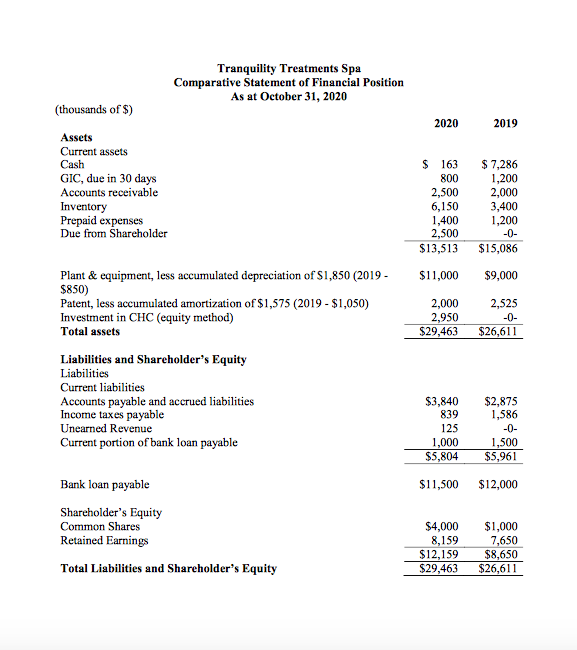

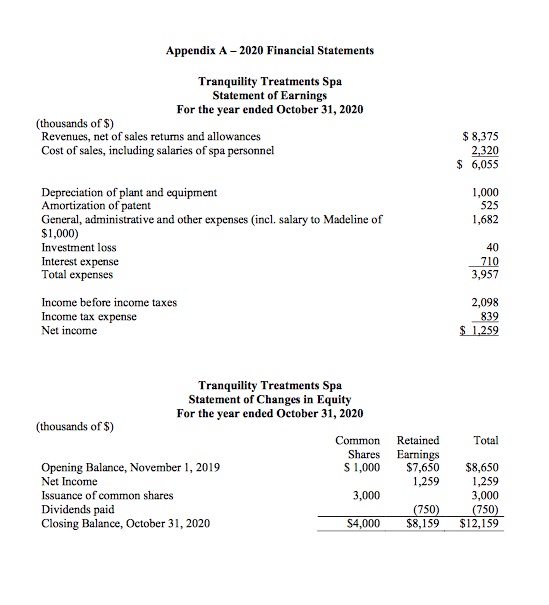

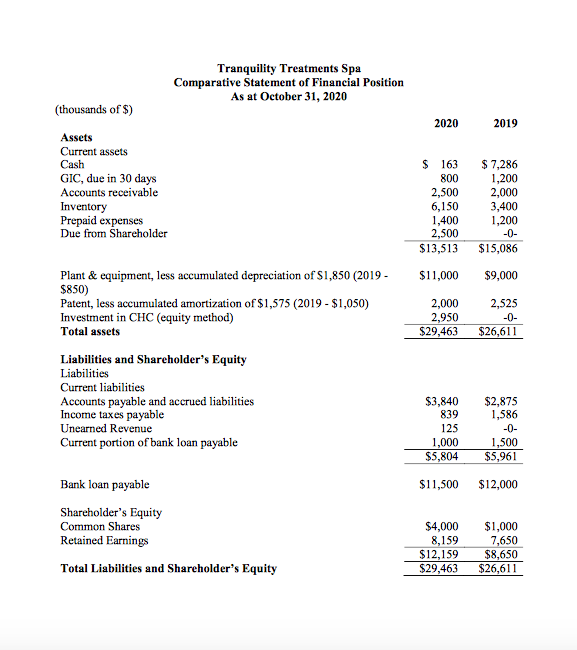

In 2012, Madeline Massingill opened a series of spas and created her own line of beauty products. The company manufactures the beauty products in a plant in Ponoka, Alberta. By year-end October 31, 2020, the company had expanded considerably. The 2020 Statement of Earnings, Statement of Changes in Equity, and Comparative Statement of Financial Positions for 2019 and 2020, are presented in Appendix A.

Madeline is pleased with TTSs growth. She gave herself a substantial raise in 2020, purchased a 20% stake in Catwalk Hair Care (CHC), and wants to expand further in 2021. In order to do this, she has to negotiate a loan with the bank. She requires your help in completing a statement of cash flow for the year ended October 31, 2020. Additional information necessary for the completion of this statement follows:

-

The Due from shareholder account represents money Madeline borrowed from the company for personal use.

-

New equipment was purchased in 2020. No dispositions of equipment were made during the year.

-

TTS purchased its 20% stake in CHC entirely by issuing shares of its own stock. TTS did not issue any other capital stock during the year. CHC had a net loss of $200 thousand in 2020. TTS had received dividends of $10 thousand in 2020.

Questions:

a.) Prepare a Statement of Cash Flow for TTS using the 2020 statement of earnings and

statement of financial position. Use the indirect method of preparation. Be sure to

include any required disclosures.

b.) Assume you are the loan officer reviewing Madelines loan application, for which she

submitted the financial statements. Based on the cash flow statement prepared in part 1 above, assess TTSs financial position.

Appendix A-2020 Financial Statements Tranquility Treatments Spa Statement of Earnings For the year ended October 31, 2020 (thousands of $) Revenues, net of sales retums and allowances Cost of sales, including salaries of spa personnel $ 8,375 2,320 $ 6,055 1,000 525 1,682 Depreciation of plant and equipment Amortization of patent General, administrative and other expenses (incl. salary to Madeline of $1,000) Investment loss Interest expense Total expenses Income before income taxes Income tax expense Net income 40 710 3,957 2,098 839 $ 1,259 Tranquility Treatments Spa Statement of Changes in Equity For the year ended October 31, 2020 (thousands of $) Total Common Shares S 1,000 Retained Earnings $7,650 1,259 Opening Balance, November 1, 2019 Net Income Issuance of common shares Dividends paid Closing Balance, October 31, 2020 3,000 $8,650 1,259 3,000 (750) $12,159 (750) $8,159 $4,000 Tranquility Treatments Spa Comparative Statement of Financial Position As at October 31, 2020 (thousands of $) 2020 2019 Assets Current assets Cash GIC, due in 30 days Accounts receivable Inventory Prepaid expenses Due from Shareholder $ 163 800 2,500 6,150 1,400 2,500 $13,513 $ 7,286 1,200 2,000 3,400 1,200 -0- $15,086 $11,000 $9,000 Plant & equipment, less accumulated depreciation of S1,850 (2019 - $850) Patent, less accumulated amortization of $1,575 (2019 - $1,050) Investment in CHC (equity method) Total assets 2,000 2,950 $29,463 2,525 -0- $26,611 Liabilities and Shareholder's Equity Liabilities Current liabilities Accounts payable and accrued liabilities Income taxes payable Unearned Revenue Current portion of bank loan payable $3,840 839 125 1,000 $5,804 $2,875 1,586 -O- 1,500 $5,961 $11,500 $12,000 Bank loan payable Shareholder's Equity Common Shares Retained Earnings Total Liabilities and Shareholder's Equity $4,000 8,159 $12,159 $29,463 $1,000 7,650 $8,650 $26,611 Appendix A-2020 Financial Statements Tranquility Treatments Spa Statement of Earnings For the year ended October 31, 2020 (thousands of $) Revenues, net of sales retums and allowances Cost of sales, including salaries of spa personnel $ 8,375 2,320 $ 6,055 1,000 525 1,682 Depreciation of plant and equipment Amortization of patent General, administrative and other expenses (incl. salary to Madeline of $1,000) Investment loss Interest expense Total expenses Income before income taxes Income tax expense Net income 40 710 3,957 2,098 839 $ 1,259 Tranquility Treatments Spa Statement of Changes in Equity For the year ended October 31, 2020 (thousands of $) Total Common Shares S 1,000 Retained Earnings $7,650 1,259 Opening Balance, November 1, 2019 Net Income Issuance of common shares Dividends paid Closing Balance, October 31, 2020 3,000 $8,650 1,259 3,000 (750) $12,159 (750) $8,159 $4,000 Tranquility Treatments Spa Comparative Statement of Financial Position As at October 31, 2020 (thousands of $) 2020 2019 Assets Current assets Cash GIC, due in 30 days Accounts receivable Inventory Prepaid expenses Due from Shareholder $ 163 800 2,500 6,150 1,400 2,500 $13,513 $ 7,286 1,200 2,000 3,400 1,200 -0- $15,086 $11,000 $9,000 Plant & equipment, less accumulated depreciation of S1,850 (2019 - $850) Patent, less accumulated amortization of $1,575 (2019 - $1,050) Investment in CHC (equity method) Total assets 2,000 2,950 $29,463 2,525 -0- $26,611 Liabilities and Shareholder's Equity Liabilities Current liabilities Accounts payable and accrued liabilities Income taxes payable Unearned Revenue Current portion of bank loan payable $3,840 839 125 1,000 $5,804 $2,875 1,586 -O- 1,500 $5,961 $11,500 $12,000 Bank loan payable Shareholder's Equity Common Shares Retained Earnings Total Liabilities and Shareholder's Equity $4,000 8,159 $12,159 $29,463 $1,000 7,650 $8,650 $26,611