Question

In 2014, due to an intentional adulteration of its fields by a large pesticide company, Herbivore Organix reported an operating loss of $188,000 for

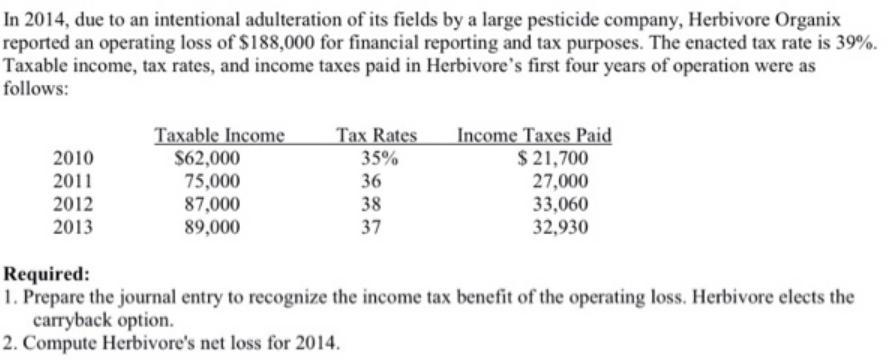

In 2014, due to an intentional adulteration of its fields by a large pesticide company, Herbivore Organix reported an operating loss of $188,000 for financial reporting and tax purposes. The enacted tax rate is 39%. Taxable income, tax rates, and income taxes paid in Herbivore's first four years of operation were as follows: Taxable Income $62,000 75,000 87,000 89,000 Tax Rates 35% 36 38 Income Taxes Paid $ 21,700 27,000 33,060 32,930 2010 2011 2012 2013 37 Required: 1. Prepare the journal entry to recognize the income tax benefit of the operating loss. Herbivore elects the carryback option. 2. Compute Herbivore's net loss for 2014.

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Operating loss 188000 Deferred tax asset 73320 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App