Question

In 2015, Texans Inc has an EBITDA of $100, Depreciation of $20, and a tax rate of 20%. If they have no capex and no

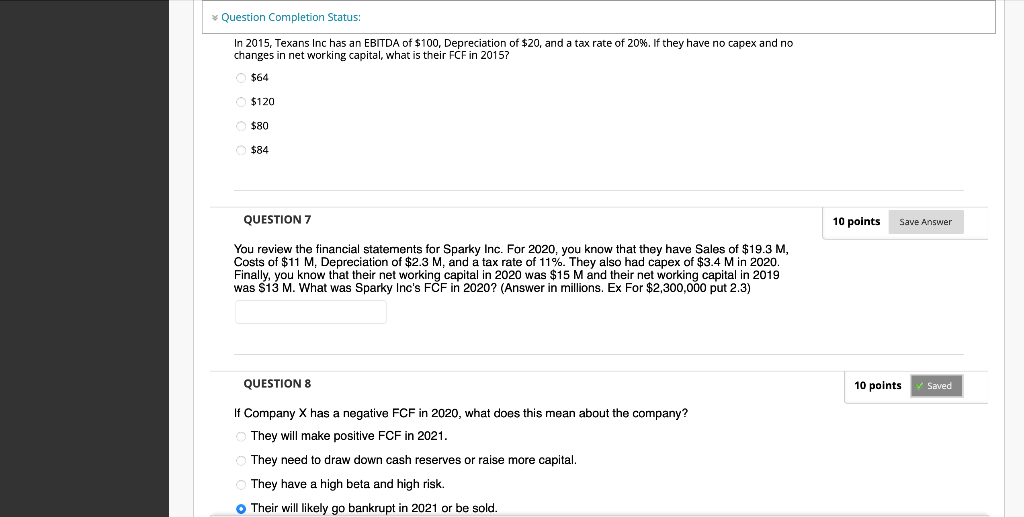

In 2015, Texans Inc has an EBITDA of $100, Depreciation of $20, and a tax rate of 20%. If they have no capex and no changes in net working capital, what is their FCF in 2015? You review the financial statements for Sparky Inc. For 2020, you know that they have Sales of $19.3 M, Costs of $11 M, Depreciation of $2.3 M, and a tax rate of 11%. They also had capex of $3.4 M in 2020. Finally, you know that their net working capital in 2020 was $15 M and their net working capital in 2019 was $13 M. What was Sparky Incs FCF in 2020? (Answer in millions. Ex For $2,300,000 put 2.3)

In 2015, Texans Inc has an EBITDA of $100, Depreciation of $20, and a tax rate of 20%. If they have no capex and no changes in net working capital, what is their FCF in 2015? You review the financial statements for Sparky Inc. For 2020, you know that they have Sales of $19.3 M, Costs of $11 M, Depreciation of $2.3 M, and a tax rate of 11%. They also had capex of $3.4 M in 2020. Finally, you know that their net working capital in 2020 was $15 M and their net working capital in 2019 was $13 M. What was Sparky Incs FCF in 2020? (Answer in millions. Ex For $2,300,000 put 2.3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started