Question

In 2016, Fletcher Lester is about to make his first major decision as Chief Executive Officer of Humphry Control & Instrument Corporation, a manufacturer of

In 2016, Fletcher Lester is about to make his first major decision as Chief Executive Officer of Humphry Control & Instrument Corporation, a manufacturer of electronic test instruments and control systems for automated machine tools. The corporation was founded in 2010 by three former employees from a key-player company of the same industry. The companys records of growth and profitability were extraordinary during the period 2010-2013, with earnings amounting to over $30 million in the third year of operation. Because investors assumed that this earnings trend would continue, the companys stock sold at approximately 20 times earnings during 2013, e.g., P/E ratio = 20, giving the firm a total market value of $600 million. At that point, each of the companys three founders held about 10 percent of the stock and had a net worth of approximately $60 million on an initial investment of about $60,000. The remaining 70 percent of the stock was owned by other stockholders, mainly mutual funds and banks trustees. The extraordinary expansion during the first three years of the new companys life was financed partly by the sale of stock now owned by hedge funds. Most of the bank credit consisted of short-term loans used to finance computer equipment purchased off the shelf and integrated into the control systems leased to clients. Each client leased a package that included computer hardware and monitoring instruments plus machine control programs especially designed by Humphrys programmers to meet clients specialized needs. The three founders made two mistakes. First, they put up their own stock in the company as collateral for personal bank loans that they used to buy the stock of other high technology companies (that also suffered price declines later on). Second, Humphry purchased a large quantity of computer modules just before the announcement that the dominant computer manufacturing company was releasing a new model with operating characteristics that make it incompatible with Humphrys hardware. Because users of automated machine tools want to be able to take advantage of the latest advances in machine tool and computer technology, Humphry was forced to adapt its old equipment to the new standards at a higher cost (than competitors). It could not recover this cost, though, by charging higher leasing rates. Thus, profits never reached the levels that had been anticipated. At the same time, Humphry had to revamp most of its older computer control programs at considerable cost to run under the new system. The net result was that profits skidded from $30 million in 2013 to $ 520,000 in 2014, then to a loss of $24 million in 2015. The sharp earnings decline, coming at a time when stocks in the same industry were also weak, drove the price of the stock down from its 2013 high of $200 to a low of $10 per share. The fall in the price of the stock reduced the value of the stock that the three founders had put up as collateral for their personal bank loans. When the market value of the securities dropped below the amount of the loans, the bank, acting under a clause in the loan contract, sold the pledged securities on the open market to generate funds to repay the bank loan. This very large sale further depressed the price of Humphrys stock, so the proceeds from the stock sale were not sufficient to retire the bank loan. The bank then sued the three founders for the deficit and won a judgment that required the founders to turn their other stocks (of other high-tech firms) over to the bank. This additional stock was still not sufficient to pay off the loan in full, so finally the three men declared personal bankruptcy. Thus, in just six years, each of the founders saw his net worth go from $60,000 to $60 million to zero. The corporation itself was badly damaged by this series of events, but it remained intact. When the three major stockholders lost their shares in the company, a hedge fund, who now had control of the firm, decided to put in a completely new board of directors and to install Fletcher Lester as president and Chief executive officer. Lester was given significant stock options in the company and was told that he was expected to return the firms lost luster. At the last annual meeting there had been some debate among the key owners concerning the firms underlying philosophy. The more aggressive ones (e.g. hedge fund) wanted the company to take more chances, while the conservative parties preferred a cautious approach. The issue was never resolved, and Lester concluded that he could decide the risk posture of the firm for himself. Lester was certain that his own position would be on solid ground if he followed a high-risk, high-return policy-and was successful. His stock options under these conditions would be extremely valuable, and his salary would be assured. He also knew that he would be out of a job if he followed such a policy and the company was not successful. On the other hand, he was not altogether sure what his position would be if he followed a conservative policy. The company could survive and earn a modest profit, but he might still end up losing his job anyway. The first major decision Lester must make involves a manufacturing technology for producing very large scale integrated (VLSI) circuits that form the heart of a new generation of testing equipment that can be used in extremely hot or cold environments. Three alternative processes are available, and some information on these methods is presented in Table 1. With Project A, Monolithic Business Machines, Inc. would provide Humphry with all necessary equipment for manufacturing the very large integrated circuits. The initial one-time cost of this equipment would be $50 million. The actual cash inflows from this system would depend partly on sales of the new service and also on the level of mainly variable operating costs incurred by Humphry. Project B calls for Humphry to build its own production equipment but to license the Monolithic Business Machines process for making the large super-conductor chips. Initial costs with this system are not known with certainty, and it will obligate the firm to cover a substantially higher level of fixed operating costs than would be required for Project A. Project C calls for the immediate implementation, without preliminary testing, of a production process now in the final stages of development by Humphry. This alternative would avoid the expense of license fees, but production costs, quality control standards, and the reliability of the chips produced by the new method are highly uncertain. Lester noted that if the worst possible cash inflows resulted from Project C, Humphry would be insolvent and would be forced to declare bankruptcy. All of the projects cash outflows will be incurred in the first year. For lack of better information, he estimates that the actual first-year cash inflow from each project, whatever the flow turns out to be, will continue for the entire ten-year life of each project. Of course, if the large first year loss on Project C is incurred, the company will be bankrupt.

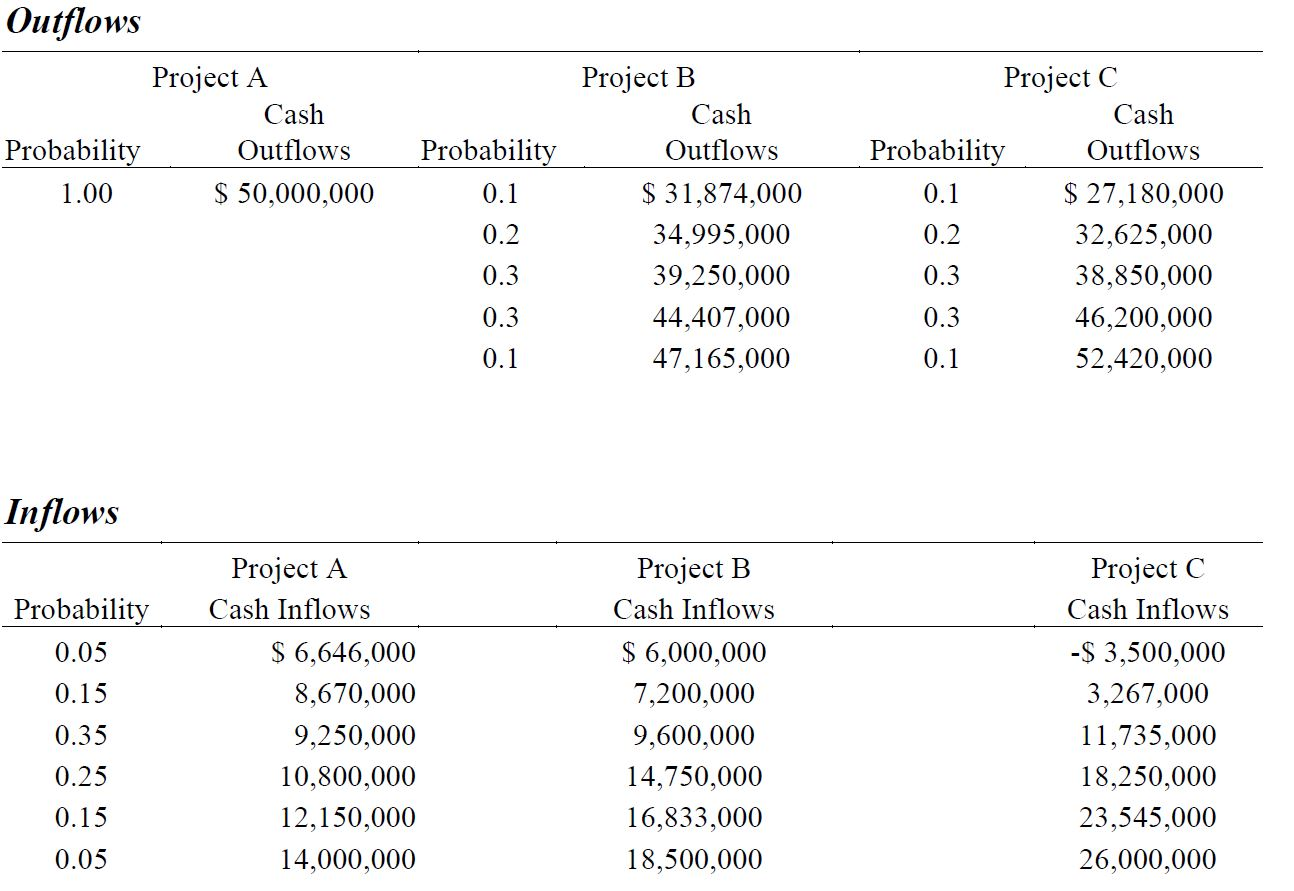

Table 1 Alternative Systems for Semiconductor Production Outflows

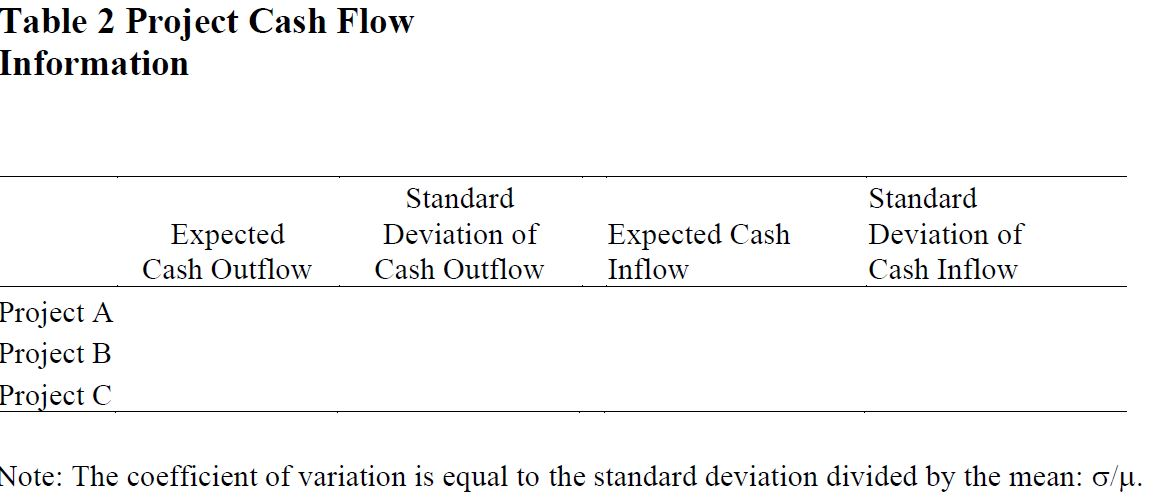

Outflows Project A Cash Probability Outflows 1.00 $ 50,000,000 Probability 0.1 0.2 0.3 0.3 0.1 Project B Cash Outflows $ 31,874,000 34,995,000 39,250,000 44,407,000 47,165,000 Project C Cash Probability Outflows 0.1 $ 27,180,000 0.2 32,625,000 0.3 38,850,000 46,200,000 0.1 52,420,000 0.3 Inflows Probability 0.05 0.15 0.35 0.25 0.15 0.05 Project A Cash Inflows $ 6,646,000 8,670,000 9,250,000 10,800,000 12,150,000 14,000,000 Project B Cash Inflows $ 6,000,000 7,200,000 9,600,000 14,750,000 16,833,000 18,500,000 Project C Cash Inflows -$ 3,500,000 3,267,000 11,735,000 18,250,000 23,545,000 26,000,000 Table 2 Project Cash Flow Information Expected Cash Outflow Standard Deviation of Cash Outflow Expected Cash Inflow Standard Deviation of Cash Inflow Project A Project B Project C Note: The coefficient of variation is equal to the standard deviation divided by the mean: 0/u

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started