Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2017, Blue Diamond Corp. was considering a major expansion of its manufacturing operations. The firm has sufficient land to accommodate the doubling of

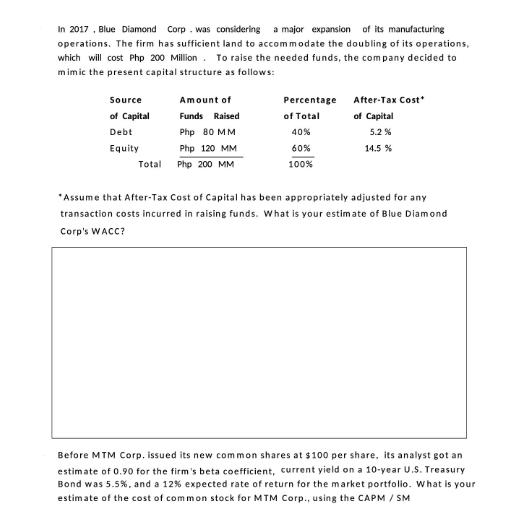

In 2017, Blue Diamond Corp. was considering a major expansion of its manufacturing operations. The firm has sufficient land to accommodate the doubling of its operations, which will cost Php 200 Million. To raise the needed funds, the company decided to mimic the present capital structure as follows: Source of Capital Debt Equity Amount of Funds Raised Php 80 MM Php 120 MM Total Php 200 MM Percentage of Total 40% 60% 100% After-Tax Cost* of Capital 5.2% 14.5 % *Assume that After-Tax Cost of Capital has been appropriately adjusted for any transaction costs incurred in raising funds. What is your estimate of Blue Diamond Corp's WACC? Before MTM Corp. issued its new common shares at $100 per share, its analyst got and estimate of 0.90 for the firm's beta coefficient, current yield on a 10-year U.S. Treasury Bond was 5.5%, and a 12% expected rate of return for the market portfolio. What is your estimate of the cost of common stock for MTM Corp., using the CAPM / SM

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the weighted cost of debt and equity and then combine them to find the WACC Given the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started