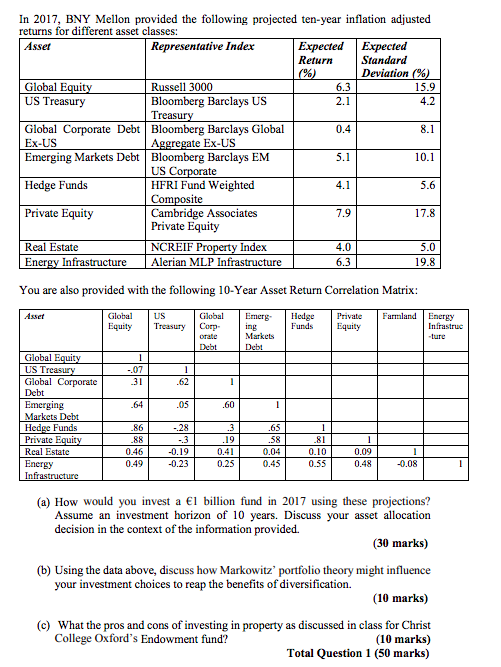

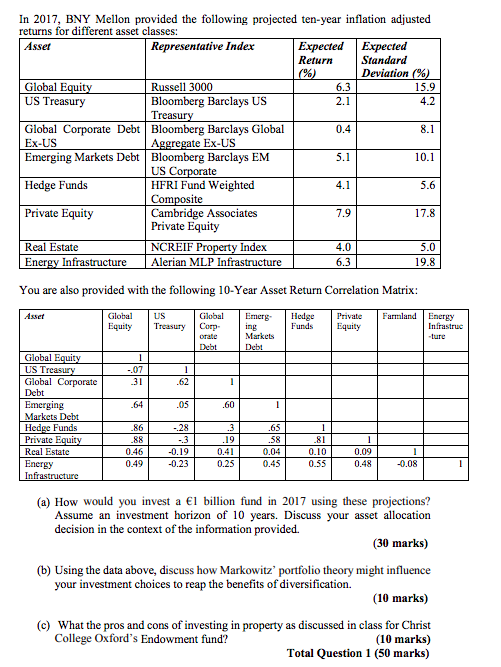

In 2017, BNY Mellon provided the following projected ten-year inflation adjusted returns for different asset classes: Representative Index Return Deviation Global Equit 6.3 Russell 3000 Bloomberg Barclays US Treasu 15.9 US Treasury Global Corporate Debt Bloomberg Barclays Global 0.4 Ex-US Aggregate Ex-US 5.1 Emerging Markets Debt Bloomberg Barclays EM Hedge Funds Private Equity US Co HFRI Fund Weighted Co1 Cambridge Associates Private Equity NCREIF P 10.1 5.6 17.8 7.9 Real Estate Energy InfrastructureAlerian MLP Infrastructure 4.0 6.3 5.0 19.8 You are also provided with the following 10-Year Asset Return Correlation Matrix: US GlobaEm Hedge Private Farmland Energy FundsEquity EquityTreasury Corp- US Treas Global Corporate Dcbt Emerging 07 62 64 86 0.46 Hedge Funds 28 Private Equity Rcal Estate Encrgy 65 58 0.04 0.45 0.41 0.25 0.10 0.55 0.09 0.48 0.49 0.23 0.08 (a) How would you invest a bon fund in 2017 using these projections? Discuss your asset allocation Assume an investment horizon of 10 years. decision in the context of the information provided. (30 marks) (b) Using the data above, discuss how Markowitz' portfolio theory might influence (10 marks) your investment choices to reap the benefits of diversifica tion. (c) What the pros and cons of investing in property as discussed in class for Christ (10 marks) Total Question 1 (50 marks) College Oxford's Endowment fund? In 2017, BNY Mellon provided the following projected ten-year inflation adjusted returns for different asset classes: Representative Index Return Deviation Global Equit 6.3 Russell 3000 Bloomberg Barclays US Treasu 15.9 US Treasury Global Corporate Debt Bloomberg Barclays Global 0.4 Ex-US Aggregate Ex-US 5.1 Emerging Markets Debt Bloomberg Barclays EM Hedge Funds Private Equity US Co HFRI Fund Weighted Co1 Cambridge Associates Private Equity NCREIF P 10.1 5.6 17.8 7.9 Real Estate Energy InfrastructureAlerian MLP Infrastructure 4.0 6.3 5.0 19.8 You are also provided with the following 10-Year Asset Return Correlation Matrix: US GlobaEm Hedge Private Farmland Energy FundsEquity EquityTreasury Corp- US Treas Global Corporate Dcbt Emerging 07 62 64 86 0.46 Hedge Funds 28 Private Equity Rcal Estate Encrgy 65 58 0.04 0.45 0.41 0.25 0.10 0.55 0.09 0.48 0.49 0.23 0.08 (a) How would you invest a bon fund in 2017 using these projections? Discuss your asset allocation Assume an investment horizon of 10 years. decision in the context of the information provided. (30 marks) (b) Using the data above, discuss how Markowitz' portfolio theory might influence (10 marks) your investment choices to reap the benefits of diversifica tion. (c) What the pros and cons of investing in property as discussed in class for Christ (10 marks) Total Question 1 (50 marks) College Oxford's Endowment fund