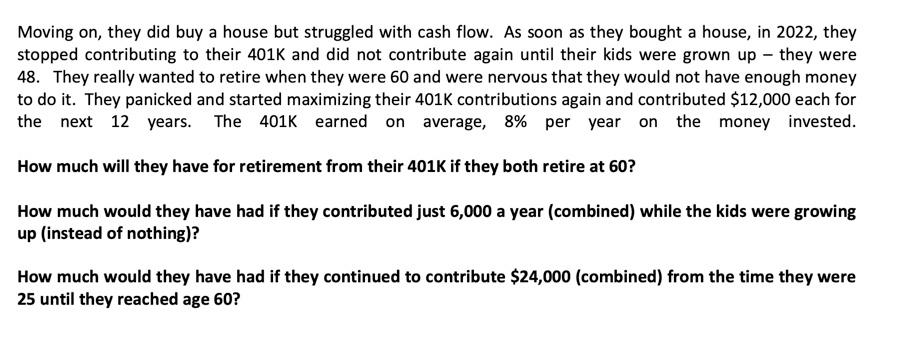

In 2017, Joe and Michelle finally finished school and each accepted a job making $75,000 each. They heard it was a great idea to start contributing right away to their 401K and have each put away $12,000 a year. During the next five years, they are enjoying life. They spend a bunch of money on travel both in the U.S. and around the world. They each bought a brand new car, one got a BMW and one got a Acura RDX. They incurred over $30,000 in credit debt and still have student loans of $50,000 each. In 2022, at the age of 30, they found out they were having a baby girl. They are super excited but realized things were going to change. They decided they want to buy a house. Each of their salaries have increased by 5% per year so that's been great. They've been stacking some money aside and have $80,000 for a down payment. They are feeling good about their 401K, as they have each continued to contribute $12,000 each since they started working 5 years ago. Unfortunately, they still have credit card debt of $30,000, resulting in minimum payments of $850 a month, they have student loan debt with monthly payments of $1,200 a month, and car payments totaling $1,250 a month. They also spend a bunch of money on travel, insurance, and dinners out. They go talk to a mortgage broker and find out what they need to do to qualify for a new house. They could qualify for a mortgage equal to no more than 28% of their gross monthly income but their total outstanding debt (including mortgage, credit card debt, student loan debt and car payments) cannot exceed 40% of gross monthly income. They could get an interest rate of 5.5% for a 30 year mortgage but they must have a credit score equal to or above 720. If they have a score less than that, the interest rate goes up - up to 6.5% if their credit score is below 720 and to 7.5% if it is below 700. If the credit score is less than 680, they can't qualify for a house at all. They were a bit worried because they had paid late on their credit card twice in the past year. They found out their score was a 690. In any case, they were happy they could buy a house but concerned about what they could afford. The mortgage broker also told them they would need 4% in closing costs, 20% down payment for a 30 year mortgage. They are really hoping to buy that $500,000 house inside the beltline. How big a house could they afford (i.e. how much of a mortgage will they qualify for)? Moving on, they did buy a house but struggled with cash flow. As soon as they bought a house, in 2022, they stopped contributing to their 401K and did not contribute again until their kids were grown up - they were 48. They really wanted to retire when they were 60 and were nervous that they would not have enough money to do it. They panicked and started maximizing their 401K contributions again and contributed $12,000 each for the next 12 years. The 401K earned on average, 8% per year on the money invested. How much will they have for retirement from their 401K if they both retire at 60? How much would they have had if they contributed just 6,000 a year (combined) while the kids were growing up (instead of nothing)? How much would they have had if they continued to contribute $24,000 (combined) from the time they were 25 until they reached age 60