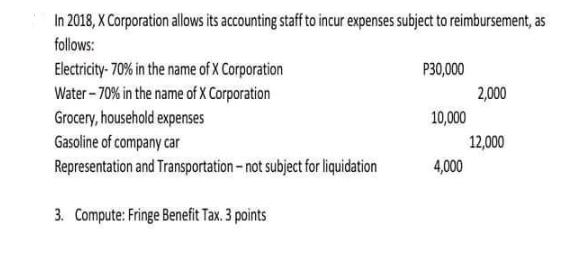

In 2018, X Corporation allows its accounting staff to incur expenses subject to reimbursement, as follows: Electricity- 70% in the name of X Corporation

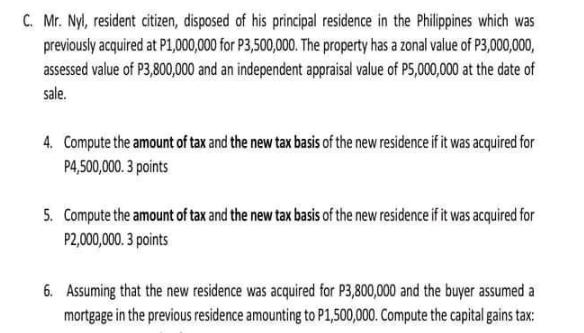

In 2018, X Corporation allows its accounting staff to incur expenses subject to reimbursement, as follows: Electricity- 70% in the name of X Corporation Water-70% in the name of X Corporation Grocery, household expenses Gasoline of company car Representation and Transportation - not subject for liquidation 3. Compute: Fringe Benefit Tax. 3 points P30,000 10,000 4,000 2,000 12,000 C. Mr. Nyl, resident citizen, disposed of his principal residence in the Philippines which was previously acquired at P1,000,000 for P3,500,000. The property has a zonal value of P3,000,000, assessed value of P3,800,000 and an independent appraisal value of P5,000,000 at the date of sale. 4. Compute the amount of tax and the new tax basis of the new residence if it was acquired for P4,500,000. 3 points 5. Compute the amount of tax and the new tax basis of the new residence if it was acquired for P2,000,000. 3 points 6. Assuming that the new residence was acquired for P3,800,000 and the buyer assumed a mortgage in the previous residence amounting to P1,500,000. Compute the capital gains tax: In 2018, X Corporation allows its accounting staff to incur expenses subject to reimbursement, as follows: Electricity- 70% in the name of X Corporation Water-70% in the name of X Corporation Grocery, household expenses Gasoline of company car Representation and Transportation - not subject for liquidation 3. Compute: Fringe Benefit Tax. 3 points P30,000 10,000 4,000 2,000 12,000 C. Mr. Nyl, resident citizen, disposed of his principal residence in the Philippines which was previously acquired at P1,000,000 for P3,500,000. The property has a zonal value of P3,000,000, assessed value of P3,800,000 and an independent appraisal value of P5,000,000 at the date of sale. 4. Compute the amount of tax and the new tax basis of the new residence if it was acquired for P4,500,000. 3 points 5. Compute the amount of tax and the new tax basis of the new residence if it was acquired for P2,000,000. 3 points 6. Assuming that the new residence was acquired for P3,800,000 and the buyer assumed a mortgage in the previous residence amounting to P1,500,000. Compute the capital gains tax: In 2018, X Corporation allows its accounting staff to incur expenses subject to reimbursement, as follows: Electricity- 70% in the name of X Corporation Water-70% in the name of X Corporation Grocery, household expenses Gasoline of company car Representation and Transportation - not subject for liquidation 3. Compute: Fringe Benefit Tax. 3 points P30,000 10,000 4,000 2,000 12,000 C. Mr. Nyl, resident citizen, disposed of his principal residence in the Philippines which was previously acquired at P1,000,000 for P3,500,000. The property has a zonal value of P3,000,000, assessed value of P3,800,000 and an independent appraisal value of P5,000,000 at the date of sale. 4. Compute the amount of tax and the new tax basis of the new residence if it was acquired for P4,500,000. 3 points 5. Compute the amount of tax and the new tax basis of the new residence if it was acquired for P2,000,000. 3 points 6. Assuming that the new residence was acquired for P3,800,000 and the buyer assumed a mortgage in the previous residence amounting to P1,500,000. Compute the capital gains tax:

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the calculations step by step Compute the Fringe Benefit Tax To calculate the Fringe Benefit Tax FBT for the expenses incurred by X Corporation for its accounting staff we need to dete...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started