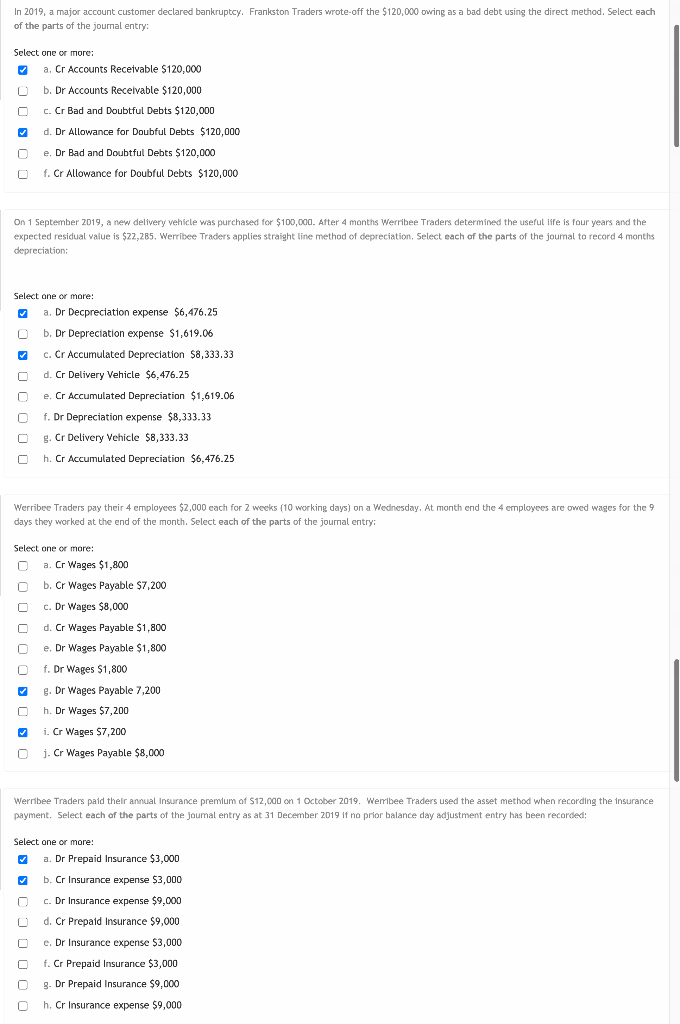

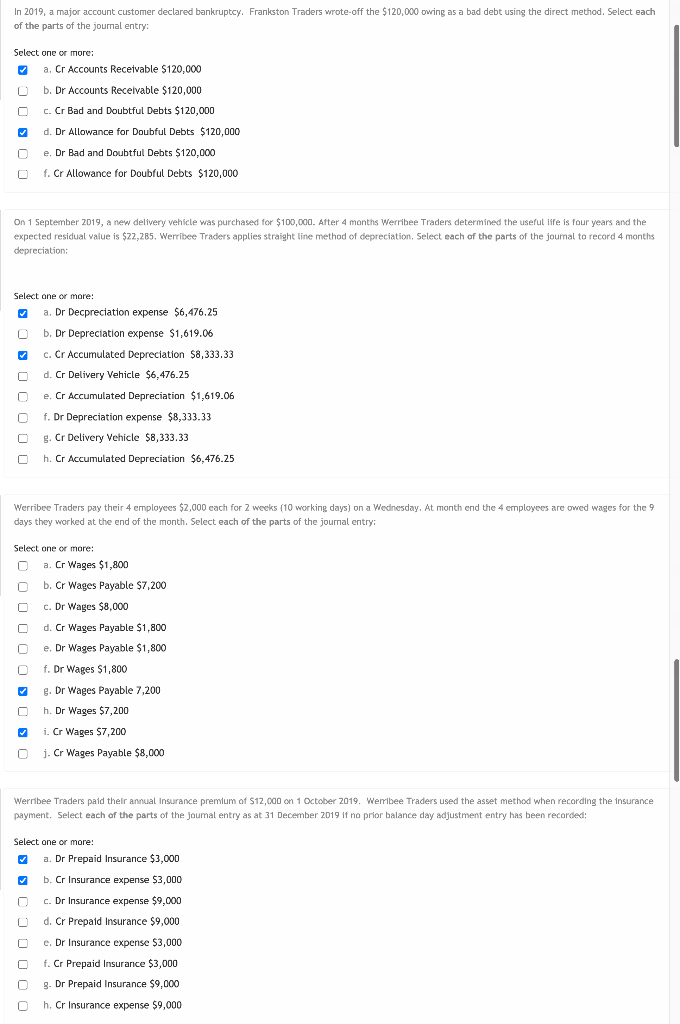

In 2019, a major account customer declared bankruptcy. Frankston Traders wrote-off the $120,000 owing as a bad debt using the direct method. Select each of the parts of the journal entry: Select one or more: a. Cr Accounts Receivable $120,000 b. Dr Accounts Receivable $120,000 c. Cr Bad and Doubtful Debts $120,000 c d. Dr Allowance for Doubful Debts $120,000 e. Dr Bad and Doubtful Debts $120,000 . f. Cr Allowance for Doubful Debts $120,000 C O On 1 September 2019, a new delivery vehicle was purchased for $100,000. After 4 months Werribee Traders determined the useful life is four years and the expected residual value is $22,285, Werribee Traders applies straight line method of depreciation, Select each of the parts of the joumal to record 4 months depreciation: Select one or more: a. Dr Decpreciation expense $6,476.25 L b. Dr Depreciation expense $1,619.06 c. Cr Accumulated Depreciation $8,333.33 d. Cr Delivery Vehicle $6,476.25 . $ e. Cr Accumulated Depreciation $1,619.06 O f. Dr Depreciation expense $8,333.33 g. Cr Delivery Vehicle $8,333.33 h. Cr Accumulated Depreciation $6,476.25 Werribee Traders pay their 4 employees $2,000 each for 2 weeks (10 working days) on a Wednesday. At month end the 4 employees are owed wages for the 9 days they worked at the end of the month. Select each of the parts of the journal entry: Select one or more: 0 a. Cr Wages $1,800 b. Cr Wages Payable $7,200 c. Dr Wages $8,000 d. Cr Wages Payable $1,800 e. Dr Wages Payable $1,800 f. Dr Wages $1,800 O g. Dr Wages Payable 7,200 h. Dr Wages $7,200 i. Cr Wages $7,200 j. Cr Wages Payable $8,000 0 Werribee Traders paid their annual Insurance premium of $12,000 on 1 October 2019. Werribee Traders used the asset method when recording the insurance payment. Select each of the parts of the joumal entry as at 31 December 2019 if no prior balance day adjustment entry has been recorded: Select one or more! a. Dr Prepaid Insurance $3,000 b. Cr Insurance expense $3,000 C c. Dr Insurance expense $9,000 d. Cr Prepaid Insurance $9,000 e. Dr Insurance expense $3,000 f. Cr Prepaid Insurance $3,000 3. Dr Prepaid Insurance $9,000 h. Cr Insurance expense $9,000