Question

In 2019, Alejandro received a refund from his state department of revenue for the amount of state taxes that he overpaid in 2018. He

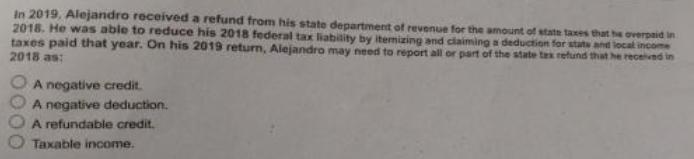

In 2019, Alejandro received a refund from his state department of revenue for the amount of state taxes that he overpaid in 2018. He was able to reduce his 2018 federal tax liability by itemizing and claiming a deduction for stats and local income taxes paid that year. On his 2019 return, Alejandro may need to report all or part of the state tax refund that he received in 2018 as: A negative credit. A negative deduction. A refundable credit. Taxable income.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer to the question Option 4 is correct ie Taxable Income Since Alej...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

3rd edition

1118845897, 978-1118845899

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App