Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On December 31, 2019, Earnhardt Company's work in process inventory account had an ending balance of $80,000. During 2019, direct materials costing $240,000

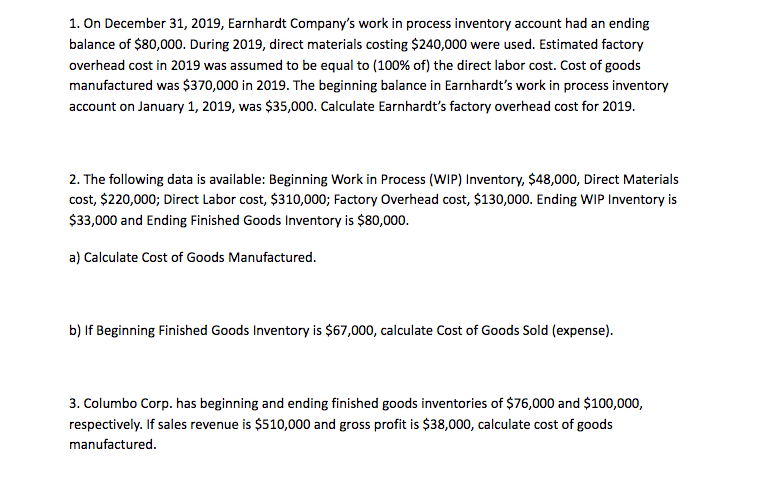

1. On December 31, 2019, Earnhardt Company's work in process inventory account had an ending balance of $80,000. During 2019, direct materials costing $240,000 were used. Estimated factory overhead cost in 2019 was assumed to be equal to (100% of) the direct labor cost. Cost of goods manufactured was $370,000 in 2019. The beginning balance in Earnhardt's work in process inventory account on January 1, 2019, was $35,000. Calculate Earnhardt's factory overhead cost for 2019. 2. The following data is available: Beginning Work in Process (WIP) Inventory, $48,000, Direct Materials cost, $220,000; Direct Labor cost, $310,000; Factory Overhead cost, $130,000. Ending WIP Inventory is $33,000 and Ending Finished Goods Inventory is $80,000. a) Calculate Cost of Goods Manufactured. b) If Beginning Finished Goods Inventory is $67,000, calculate Cost of Goods Sold (expense). 3. Columbo Corp. has beginning and ending finished goods inventories of $76,000 and $100,000, respectively. If sales revenue is $510,000 and gross profit is $38,000, calculate cost of goods manufactured.

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Total factory Overhead Cost of goods manufactured Beginning ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started